An elite Massachusetts prep school is tapping the municipal bond market next week in order to renovate its dining hall.

The Massachusetts Development Finance Agency is selling the $88.5 million revenue bond issue for Deerfield Academy, a deal that will double the school’s debt load. The new dining facility “supports the Academy’s traditional sit-down meal experience, which is unique in this day and age,” according to the bond offering documents.

Deerfield, located about 120 miles west of Boston, was founded in 1797 and boasts alumni like billionaire David H. Koch and numerous members of the Rockefeller family. The school covers grades 9 through 12, while also offering a postgraduate year and has a total enrollment of 652 for the 2023-2024 school year.

It’s also exceptionally wealthy for a high school, with an endowment of $791 million as of June 30, 2022. That would rank it among the top 100 richest US colleges if measured against institutions of higher education, according to endowment data compiled by Bloomberg.

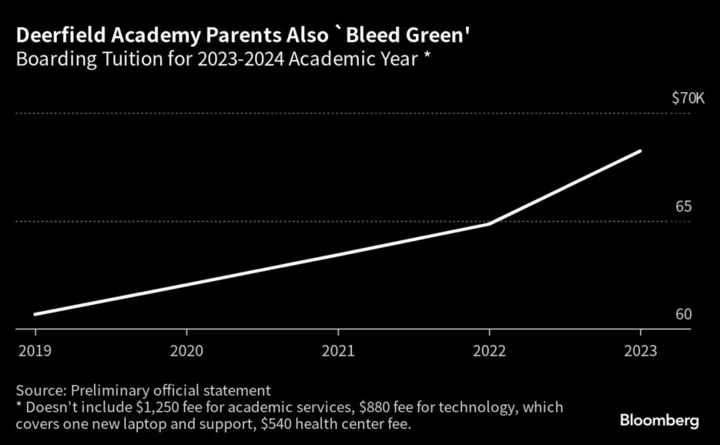

Tuition for boarding students is more than $68,000 per academic year while commuter students pay $48,950. Deerfield says that during the last five years it has “maintained and strengthened its position as a first-choice school,” and that the acceptance rate for 2023-2024 was 12%, according to the bond offering documents.

The $68,230 price tag to attend Deerfield puts it about in the middle of the competition, with New Hampshire’s Phillips Exeter Academy at $64,789 and The Lawrenceville School in New Jersey at $76,080. Deerfield boasts that nearly one-quarter of its seniors were admitted to an Ivy League college or university, and that this number has averaged 20% in the last five academic years.

The school is serious about those sit-down meals and explains on its website that “the Academy believes that sit-down meals provide an important opportunity for enhancing the community. For this reason, family style meals are served seven times per week. Boarding students attend all sit-down meals. Day students attend all sit-down lunches and are encouraged to stay for the evening meal.”

Students are assigned to a different table every three weeks, “which allows them to get better acquainted with different peers and faculty members in a relaxed setting.” Students take turns waiting on tables and “performing other kitchen duties.”

Elite prep schools borrow in the municipal bond market to upgrade their facilities, the same as most school districts, except they have no taxing power. What they have instead is strong demand, high credit ratings, big endowments and loyal alumni who respond to fundraising campaigns. Annual giving to Deerfield for the past five years averaged $48 million annually, according to the bond offering documents.

Proceeds of the new bond issue will be used to renovate the existing dining facility to accommodate more students and modernize the kitchen, serving and storage spaces. Money raised in the deal will also build a temporary dining facility and a multisport athletic complex to support activities displaced by the construction, as well as to make enhancements to the tennis pavilion.

Even so, the school regards the bond deal as “bridge funding pending the expected receipt of campaign contributions for these projects.”

Despite the material increase in the school debt load, S&P Global Ratings says the uptick is “manageable” given its strong fundraising history, and “stellar market position.”

S&P also cited the new deal’s “rapid amortization.” The transaction is scheduled to include tranches that mature each year from 2027 to 2033.

The underwriter of the Deerfield bonds, Citigroup Inc., declined to comment on the new deal. Jessica Day, Deerfield’s director of communications, said the school had no comment on the new transaction.