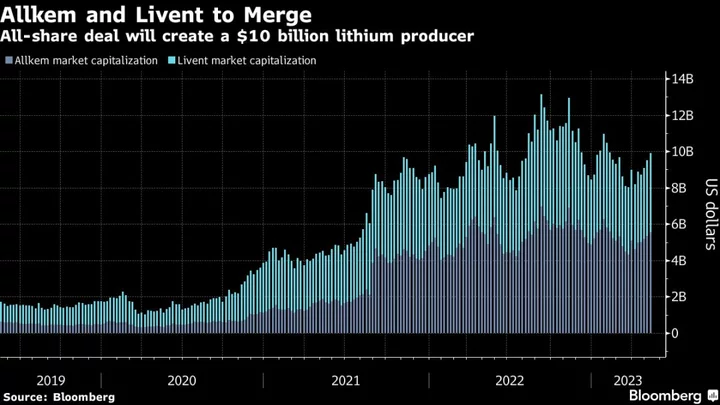

Allkem Ltd. will combine with fellow lithium producer Livent Corp. to create a company with a valuation of $10.6 billion, the latest deal in a sector that’s benefiting from surging EV demand.

The all-share merger will create the world’s third-biggest lithium producer in terms of future estimated capacity, the companies said on Wednesday. It will be listed in New York.

A slump in prices of lithium carbonate, a processed form of the metal that’s a key ingredient in EV batteries, is fueling a surge of M&A activity. The drop in share valuations for some miners is making them more attractive to buyers who want to grab a slice of a market that’s a major part of the transition to cleaner energy.

READ: Lithium Takeover Blitz Looms, But Rio Tinto Says Buyers Beware

Livent Chief Executive Officer Paul Graves will lead the new company, while Allkem director and former Woodside Energy Ltd. head Peter Coleman will be chairman. The deal, which would see Allkem shareholders take 56% of the company and Livent shareholders 44%, was a “merger of equals,” the companies said. No role was announced for Allkem’s CEO Martín Pérez de Solay.

“As a combined company, we will have the enhanced scale, product range, geographic coverage, and execution capabilities to meet our customers’ rapidly growing demand for lithium chemicals,” Graves said in the statement.

Allkem has operations in Australia, Argentina and Canada and was rumored to be a potential takeover target of Rio Tinto Group. Livent has brine production in Argentina, a hard-rock based lithium project in Quebec, and lithium refineries in the US and China. The company also has a supply agreement with automaker BMW AG.

The tie-up may have been partially driven by the Inflation Reduction Act, which specifies a certain percentage of minerals in the EV battery have to be extracted from or processed in countries that have free-trade deals with the US. That’s prompting the industry to search for supplies from countries that could benefit from the tax credit, which would include Canada. It’s possible that Washington may do a critical minerals deal with Argentina at some point.

The merger will strengthen their position in Argentina and Canada “and consolidate global sales at a time when the lithium market is correcting from last year’s dramatic upturns,” said Susan Zou, an analyst at Rystad Energy. She likened the deal to the 2021 merger of Galaxy Resources Ltd. and Orocobre Ltd. that created Allkem.

Shareholders in Allkem, listed in Sydney, will receive the rights to one share in the new company per share held, while shareholders in US-based Livent will receive 2.4 shares, the companies said. The transaction is expected to close by the end of 2023, they said.

The Australian Financial Review newspaper reported the deal earlier.

--With assistance from Rob Verdonck and Mark Burton.

(Updates with more details from official statement throughout)