Home ownership in the UK is about to move further out of reach, even for the nation’s wealthiest age group.

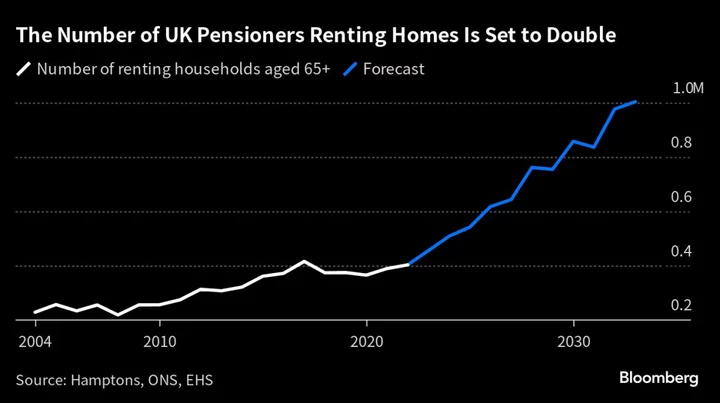

The share of Britons over the age of 65 renting a home in England will more than double within a decade to 11.5% as higher borrowing costs deter them from buying a property, according to a report from broker Hamptons International. That’s set to increase the amount of money pensioners spend on rent each year to £12.7 billion ($16.7 billion) by 2033 from £5.1 billion this year, even when calculated using the current average rent rates.

“The recent rise in mortgage rates will make it harder to buy later in life,” said Aneisha Beveridge, head of research at Hamptons. This “has the potential to bear significant social, economic and political consequences down the line,” she added.

UK households are facing an avalanche of pressures triggered by rising interest rates and the worst cost-of-living crisis in a generation. Meanwhile, tenants are bearing the brunt of the turmoil as landlords — whose interest-only mortgages are particularly exposed to rate hikes — push up rents to deal with extra costs.

This budget squeeze — paired with an acute housing shortage driven by a lack of funding in planning departments — has trapped Britain’s renters in a lettings market where the average monthly rate has risen almost 10% in a year to a record £1,273 in June. These pressures are set to translate quickly into the over-65s, Hamptons said, draining the finances of an age group with some of the highest home ownership rates in history.

What’s more, pensioners with a mortgage currently pay about £1.8 billion in annual repayments, which is less than half of what gets handed over in rent. This spells pain for the nation’s rapidly aging population, which grew up when a policy of home ownership for everyday Britons was a winning political strategy for the Conservative Party.

Still, it’s important to note that the number of people aged 65 or above is set to rise to almost a quarter of the population in England and Wales by 2043, according to government estimates. This means there is bound to be more elderly renters than there are now, especially as attitudes toward retirement living begin to evolve.

However, predictions of a higher proportion of older tenants highlights the barriers to home ownership looming in the form of low housing stock, expensive debt and rising rental costs. This could spur further bets in Britain’s £56 billion build-to-rent market, which has seen supply more than triple in the last five years, according to a Knight Frank report published in December.

Read more: Barratt Turns to UK Rental Sales Amid First-Time Buyer Slump

“High mortgage rates, which have priced out would-be first-time buyers, are stoking rental demand,” Hamptons’ Beveridge added. “With interest rates set to stay higher for longer and few new landlords buying, these pressures seem likely to continue.”