A mishmash of exchange rates for Argentina’s chaotic currency system are hanging in the balance as the nation prepares to choose its next president.

Libertarian candidate Javier Milei has vowed to do away with the peso — and the myriad of exchange rates — by adopting the US dollar. His rival, Economy Minister Sergio Massa, has embraced capital controls and revived a plan to devalue the peso — at a pace of 3% per month.

“Regardless of who wins, a currency devaluation will need to happen,” Jason Tuvey, Deputy Chief Emerging Markets Economist for Capital Economics. “Post-elections, we expect either Massa or Milei to push through a devaluation of the peso, although the speed and scale of that move would vary between the two. Massa would almost certainly take a more gradual approach.”

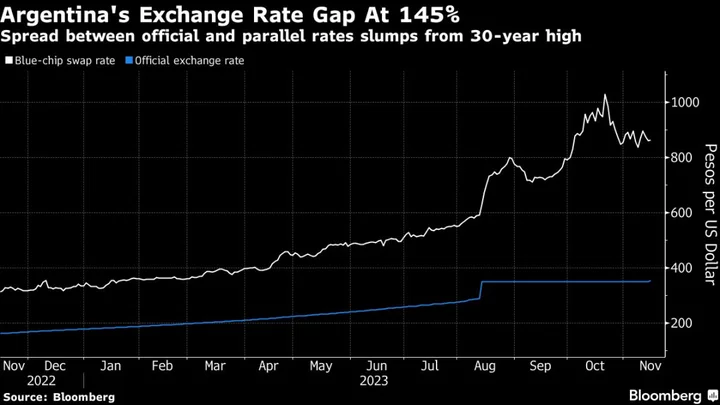

Argentina has, for years, restricted its peso’s daily decline through currency controls and import restrictions. That’s fueled a large gap between the peso’s official and parallel rates.

On official channels, one dollar is worth around 354 pesos, while it goes for about 844 using the so-called blue-chip swap rate — the most commonly used among market watchers, which is derived from buying securities like stocks or bonds locally, and then selling them abroad. The blue-chip is an approximation rather than a clear benchmark, but represents the market’s true value of the peso against the US dollar.

The gap, which surged ahead of the first-round of the elections as Argentines braced for a long-delayed devaluation following the vote, has begun to close. This week, the government instituted a so-called crawling peg, devaluing the peso by 1% on Wednesday and a further 2% distributed during the rest of November.

The crawling peg will likely continue if Massa wins the presidency, though potentially at a different pace, according to Carolina Gialdi, head of international-markets sales and trading at Max Capital.

“I would rule out a larger devaluation in December, though,” she said. “It would be socially undesirable to pull this off, especially during the holidays.”

Ivan Stambulsky, a strategist with Barclays Plc, meanwhile, said that uncertainty remains about currency policy under a Milei administration. While he ran with lofty campaign goals, a weaker-than-expected performance in October’s vote signals that his popularity is relatively limited. That, coupled with strong opposition in congress makes dollarization harder to implement, he said.

Here are some of the most commonly used rates in Argentina:

The Official Rate

Rate: 354 pesos per dollar

Argentina’s official exchange rate is highly restricted. Individuals can only legally exchange pesos at a bank at the official rate for no more than $200 a month and must pay high taxes.

The Blue Chip

Rate: 844 per dollar

Argentina also has free-floating exchange rates for investors who buy stocks and bonds. For local transactions, an exchange rate known as “dolar MEP” is used, while the blue-chip swap rate, or “dolar CCL,” is utilized for operations that finish abroad — providing an approximation rather than a clear benchmark.

The “Blue”

Rate: 900 per dollar

The most-commonly accessed rate among Argentines, the “dollar blue” is a free-floating, all-cash exchange rate you can get in back-rooms of stores, newspaper stands or in inconspicuous offices — or a contact willing to exchange dollars for pesos, sometimes requiring several large shopping bags to carry wads of the local notes.

The Tourist Dollar

Rate: 743 per dollar

Argentines are charged three separate taxes that amount to to 100% on top of the official exchange rate when they use their Argentina-based credit or debit card to make a purchase in a foreign currency, a strategy by the current government to discourage spending abroad.

Luxury Dollar

Rate: 708 per dollar

Wealthier Argentines who buy luxury goods including private jets, sports cars, yachts, watches and top-shelf alcohol need to pay additional levies of nearly 100% on top of the price of the imported goods.

Tech Incentives

Tech companies can retain 30% of the dollars from sales abroad instead of having to exchange them into pesos. The dollars are meant for employees’ salaries.