China’s decision to bar Micron Technology Inc.’s memory chips has escalated tensions with the US, fueling worries over what other technology firms Beijing may target.

Policymakers in the Asian nation, however, have limited scope to find alternatives to US firms in the semiconductor supply chain that ranges widely from chip design, manufacturing, equipment to materials. For now, it’ll be almost impossible for China to replace some key products made by top American companies including Qualcomm Inc., Nvidia Corp., Intel Corp. and Advanced Micro Devices Inc., analysts say.

The spat over semiconductors between the world’s two biggest economies has been hurting investor sentiment since the US in October imposed a sweeping ban on exports of advanced chips and know-how to China. That said, the scale of decoupling between the two nations is likely to be smaller than feared given China’s reliance.

“Head-on against the US in semiconductors is a costly, if not losing move that is not strategically sound for China,” said Redmond Wong, a strategist at Saxo Capital Markets based in Hong Kong. “China is not seeking decoupling nor deglobalization. It is only seeking gradual changes to the global order to be less American dominant.”

Logic Chips

Logic chips are deemed as the “brains” of electronics. This segment includes central processing units (CPUs) that are built for general functionality of equipment, and graphics processing units (GPUs) which are optimized for visual displays and AI computation.

This sub-sector is deemed as one of the most difficult areas for China to ban American components. The US has a more-than 60% market share in the logic chip segment, according to a Goldman Sachs Group Inc. report.

“Mainstream components such as Intel processors and mobile phone processors from Qualcomm are integral to PCs and smartphones. However, it seems unlikely they would be banned at this point, given the lack of viable local alternatives,” said Robert Lea, Bloomberg Intelligence.

Huawei Technologies Co. and other firms have developed their own processors, “though I’m not sure they are as advanced as US products currently, nor are produced in sufficient volume,” said Lea.

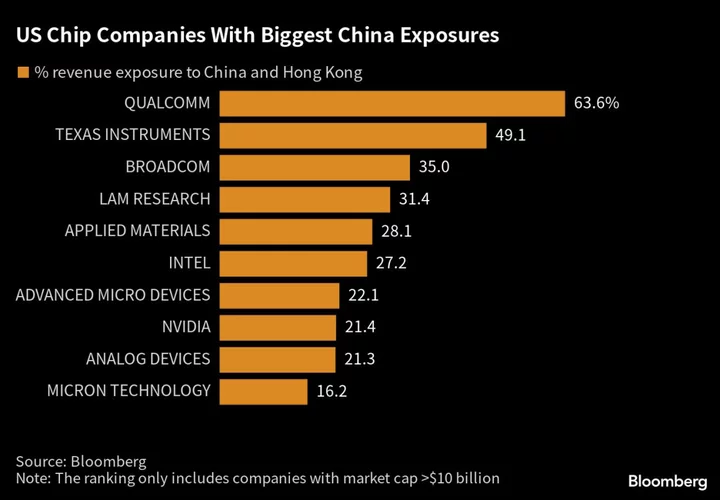

CPU manufacturer Intel generated 27% of its revenue from China and Hong Kong, while the China exposure of GPU maker Qualcomm and Nvidia is 64% and 21%, respectively. The US banned Nvidia from exporting high-end products to China last year, but it’s still selling the country low-end chips. Even for the latter, it’ll be hard to replace, according to Lea.

For Qualcomm, “China has no domestic capability and it still has to rely on Mediatek Inc., which is Taiwanese. So pick your poison,” said Vey-Sern Ling, managing director at Union Bancaire Privee.

Chip Design

“China needs to balance sending a message to the US and hurting its own domestic enterprises,” said Ling. “It has fairly capable domestic memory chipmakers that can step up to replace Micron’s supply, but in other areas like chip design, logic chip manufacturing and semiconductor production equipment, China is not able to ban the US without hurting themselves.”

Another challenging group to replace includes Synopsys Inc. and Cadence Design Systems Inc., which provide software design services for chipmakers. Although they don’t generate revenue directly from China, their customers include Intel and Advanced Micro Devices Inc. that get a big portion of sales from there, Bloomberg-compiled data show.

Shares of Synopsys and Cadence dropped over two sessions following China’s decision to ban Micron. All the three stocks had recouped those losses by Thursday, thanks to a rally spurred by optimism over Nvidia Corp.’s bullish sales forecast.

READ: Asian Chip Stocks Climb Second Day After Nvidia Sparks AI Rally

Manufacturing Equipment

The US banned China from buying advanced chip-making equipment or employing American citizens without a license late last year, causing firms like Applied Materials Inc., KLA Corp. and Lam Research Corp. to withdraw their businesses from China.

The choices left are quite limited for China. Dutch company ASML Holding N.V. is the only manufacturer of extreme ultraviolet machines needed to print every advanced microchip. Japanese companies like Nikon Corp. also make chip-making equipments.

In March, Japan said it will expand restrictions on exports of 23 types of leading-edge chipmaking technology to China, though Japan’s trade minister said the move isn’t in coordination with US and wasn’t a ban. Japanese chip stocks slid earlier this week as the trade ministry said the previously announced chip curbs would take effect July 23.

The Dutch government is seeking a middle ground between the US and China, as it announced plans in March to expand semiconductor export restrictions, though that’s seen to fall short of measures the Biden administration took.

READ: China Chip Firm Seeking to Rival ASML Is Said to Mull IPO Filing

“With the US ban, it’s been quite challenging for China to make breakthroughs in advanced chips below 10 nanometers,” said Dale Dai, Taipei-based analyst at Counterpoint Research. “Even if they obtained the equipment machines, they still lack the designing capacity.”