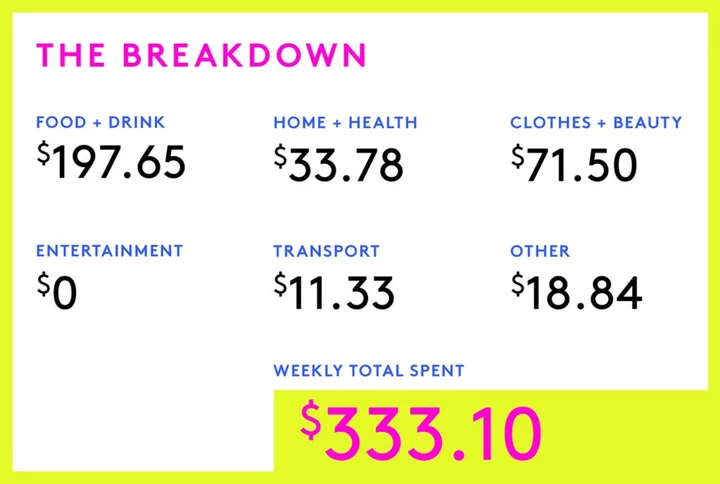

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a ticketing manager working in entertainment who makes $40,745 per year and spends some of her money this week on Sweet Enough: A Dessert Cookbook by Alison Roman.

Totals have been converted to USD.

Occupation: Ticketing Manager

Industry: Entertainment

Age: 27

Location: Alberta, Canada

Salary: $40,745

Net Worth: -$4,675 (savings: $895, RRSP: $3,434, minus my share of debt, which is on my partner, M.’s, credit line. We use it for joint purchases like our car, the deposit for the apartment we live in, and upcoming wedding expenses. We will be opening a joint savings account when we get married but otherwise we’ll be keeping finances separate. We split most things right down the middle using e-transfer: groceries, rent, utilities, our car and transportation, treats and entertainment. We track everything on a spreadsheet and have a categorized budget we try to meet. It has room for going out and spontaneous expenses, and I buy nice gifts for my partner when I can because I make a little more than him and gift giving is one of his love languages. Otherwise, we are pretty committed to paying down debt and building savings so we try to spend a little less when we can).

Debt: $9,004 (credit card: $647, my half of M.’s line of credit line: $8,357).

Paycheck Amount (2x/month): $1,177 (after tax deductions).

Pronouns: She/her

Monthly Expenses

Rent: $500 (my half for a beautiful apartment in a popular downtown neighbourhood. This includes water, heat and power. It’s a steal of a deal).

Car Insurance: $54 (my half).

Internet: $24 (my half).

Health & Dental Benefits: $0 (paid for by my job).

Spotify: $5.15 (my half).

Crave: $10.30 (my half).

Netflix: $6.50 (my half).

PrettyLitter: $15 (my half).

Cat Fund: $15 (we contribute monthly to pet savings instead of paying for pet insurance).

The New York Times: $4.75

Spin Membership: $71

Line of Credit: $150 (if not more).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

My parents both work in the arts and they were supportive of whatever I chose to do after high school. I took a year off, tried a few different things and finally settled into the degree I have now in my 20s. They had savings to pay for undergrad degrees for me and my twin sister, and they let us know that things were a little tight paying for both of us to get six-year, double-major degrees. My sister ended up taking out a student loan to cover additional costs and that was pretty smart. My credit card balance was high from college expenses and a residency abroad. I just recently paid it down after graduating, which feels great. If I could go back in time, I would probably take out a student loan to cover what my parents couldn’t. They paid for class tuition but I paid for all my living expenses and everything else, so I always worked two jobs.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents didn’t talk about money unless they were fighting. My dad was absolutely terrified of debt and both my parents tended to moralize it (i.e. if you acquire debt, you’re irresponsible). I definitely internalized guilt when I started acquiring credit card debt and felt like a bad person. There was also a shroud of mystery around whatever money conversations we did have, because emotions were too fraught. I used to pay my parents directly for car insurance and my phone because I was still on their plans and we couldn’t communicate well about what was actually due. They never gave me an actual number so I would come up with a huge sum of a few thousand dollars every year, which was really stressful as a teenager, and often they would end up giving a little back if the company “quoted less” or something. As an adult, I know that is absolutely not how things work. Still, I have to give my parents credit and grace for keeping me on their plans and handling the money. It was complicated but they did their best and always took care of me.

What was your first job and why did you get it?

I babysat from the time I was 12 and I taught ballet as a volunteer to kids with autism and cerebral palsy, starting when I was 14. I met lots of babysitting clients at those classes so I took care of kids with additional needs and their siblings. I also had a paper route and painted sets and houses for the local film industry. I took all the gigs I could for pocket money. Later, I saved up to pay for insurance on the car I inherited from my grandpa in high school. I didn’t have a savings account until my first job with paychecks as a barista, and that’s how I paid for things like car insurance and travel while I lived with my parents.

Did you worry about money growing up?

Yes and no. My parents experienced money insecurity right when we were born. It’s hard to fund twins because you’re buying two of everything. I remember my dad took a lot of jobs when we were young and our family thrifted most things. I think they were more secure as we grew up but were definitely always frugal. Even while my dad was saving money, he didn’t like to talk about it, and we definitely had to justify every purchase. But they always made sure my sister and I had everything we really needed and were safe and cared for. We also had extracurricular activities and trips to the coast to visit family so we definitely had treats. My parents were really generous that way. I was more worried and nervous about them judging me or thinking I was bad with money. I tended to keep my spending habits secret just because that’s how our family was.

Do you worry about money now?

Yes, definitely. I still have debt stigma even though it’s basically impossible for millennials to escape it in this economy. My partner and I worry that we haven’t been able to build decent savings for my grad school year, which will require moving and taking out loans for tuition. But I recently advocated for a raise at work and I am working on feeling more secure. It’s important to me that my partner and I have a budget and sit down at least once a week to talk about money.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I moved out permanently when I was 20 and paid for all my living expenses. When I started my degree, my parents paid all my tuition. I felt independent and financially responsible as soon as I moved out but I graduated at 26, so that’s really when I stopped receiving support from my parents. I’m also part of a family phone plan my mom pays for, and she bought my sister and me phones for our birthday. Part of the present was paying for our plans until the phones are paid off, which is really kind. Both my parents are generous now with money because they have a great dual income and love giving gifts. One or both of them will often send me an e-transfer for a treat or to make my life easier when an unexpected expense comes up. I would never move back in with them if I fell on hard times, even though I know they would welcome me. I struggle to take that kind of help from parents so I would likely sooner move in with my sister and get financial help elsewhere.

Do you or have you ever received passive or inherited income? If yes, please explain.

My degree was in English and writing, and I won a few writing awards that totaled about $2,265 and funded things like my writing residency so I’m lucky to have had that extra income. My parents gave me $1,887 when I turned 25, which I put into savings. It really helped us for our big move downtown. For our wedding, my partner’s parents sent us $3,775 and my dad sent us $1,360, which we used for wedding expenses and car repairs. We are definitely not without help and privilege, and I have a lot of gratitude for our parents.

Day One

9 a.m. — My partner, M., wakes me up like he does every morning. He’s a super dedicated designer and always up earlier than me. I work at a concert venue and don’t clock in until later so we lie in bed for a bit with the coffee he brought. I catch up on texts I missed from my friends and sister, then shower and do my morning routine while M. makes a breakfast of bacon, eggs, toast and tomatoes. We play records and have a chill morning.

12 p.m. — I go into the office. I usually walk but it’ll be a later night and I don’t like walking home by myself so I drive our car and pay for parking. $11.33

2 p.m. — At work, I chat with my coworker about shoes and end up purchasing a pair of Reeboks online. I need a comfy pair of tennis shoes because I’ve been walking everywhere. Things are slow so I make it through my to-do list a little early. $71.50

4 p.m. — I take a break to clear my head before the concert. I haven’t eaten since breakfast and I’m peckish even though I know M. will have dinner ready tonight. I walk to a Vietnamese place and order salad rolls ($11.10 with tip). The place is empty so I sit and read my book for a while. The food and the walk back to work are really good for me. I set up the concert and wait for my team to arrive. $11.10

5 p.m. — Time for the concert. Tonight is a celebration of Indigenous composers and it’s a short but phenomenal program. There’s a very grounded, community-based vibe to the event. Since there’s no intermission, I can dip out earlier than usual. In my rush to get home, I drive all the way back before realizing I forgot my computer at work. I’m exasperated but M. keeps me company on the drive back and waits in the car while I grab my computer and some paperwork.

9 p.m. — M. has dinner in the oven. We build delicious plates of rosemary-fennel sausage, roasted cauliflower with anchovy and lemon dressing, and sauerkraut. We’re taking some time off drinking so I make us each a spritz with a virgin liqueur that’s supposed to be like Campari and soda water. Masterpieces all around. We watch Beef on Netflix but M. has more work to do and I’m still feeling wired from the concert so he does some illustrating while I read more in the bath (I use bath oils that smell amazing).

11 p.m. — M. and I go to bed and he falls asleep pretty fast. I read my library book on my phone for a couple hours, then pop a sleeping pill and scroll Twitter until I fall asleep around 2. I know, I’m a blue-light menace.

Daily Total: $93.93

Day Two

9 a.m. — I wake up before M. comes in but he still pounces on me while I answer my morning texts. He leaves shortly after to printmake at a nearby studio. I have coffee. I’m trying to get into the breakfast habit but just don’t feel hungry until lunch. I change into sweats, log onto my computer and get to work taking calls and meetings. I break periodically to play with my cat who is giving me attention-starved eyes.

1 p.m. — I eat a working lunch of leftover cauliflower with a can of tuna and capers while I finish all my paperwork. Then I take a proper break to do a speedy Pilates workout and have a shower. I put together congee to simmer while I work because I’m bringing a big pot to a dinner party tonight. I get back to work and take more calls.

4:30 p.m. — I hit a major afternoon slump and give myself an early weekend. I close out at work and take a few minutes to stretch and have a big glass of water after sitting all day. The congee tastes delicious; I season it and take it off the heat. I do my makeup and pick an outfit for dinner with friends tonight.

6:30 p.m. — M. and I go over to our friends’ new house. I bring the congee and our hosts make bao with char siu filling. They just got a new dog so we let her get comfortable with us. We eat and have a cozy night in.

11 p.m. — It’s sooo cold and windy out. M. and I immediately jump under the duvet when we get home. I have PMS and am feeling crampy. We put on the boygenius album and I share funny tweets with M. Then I roll over to finish my library book but I’m zoning out hard. I put my phone away and fall asleep around 12:30.

Daily Total: $0

Day Three

8 a.m. — M. wakes me up with a kiss and coffee before going for a bike ride with his art friend. I have plans to get coffee with my friend V. We meet up at her place and get in a decent walk on the way to get pastries. We each buy a croissant and cappuccino. I also get a little yogurt cup for a protein boost before my workout later but I don’t finish it because yogurt is gross. We have a nice talk on the long walk back and bump into M. on his bike. V. and I say goodbye until book club tomorrow. $15.94

12 p.m. — Spin class! It’s one of those places with the lights and the music that make it feel like a club. I’m fully aware that it’s a cult and I’m also fully indoctrinated. My sister and I bought passes when she got cleared for exercise postpartum. The classes are definitely an extravagance but I justify the cost because I do therapy monthly instead of weekly now. And bad news: Exercise does help my brain. It’s an intense, fun workout but my period came early (always better than late) so I take it easy, making sure to drink lots of water and take breaks if I’m crampy.

1 p.m. — I’m super-low-energy after spin and wonder if maybe I should avoid classes on the first day of my period from now on. I jump in the shower and feel refreshed. My mood has definitely improved so I’m glad I went. I microwave a bowl of congee and chat with M. about writing.

3 p.m. — We decide to make an early dinner because M. has plans tonight. This requires a HUGE grocery shop that we’ve been putting off for a while. We go every few weeks and supplement with smaller runs to the store to keep fresh produce. We drive to our local Italian market that seemingly hasn’t been hit as hard by inflation. We get tofu, cheese, meat, tons of veggies, pasta, noodles, tea, yogurt, butter, jam, honey, biscuits, chocolate, cat food, garbage bags, dishwasher pods, cleaning supplies and an Italian soda for me. M. and I split groceries down the middle. $79.46

5:30 p.m. — We prepare pizza with prosciutto, arugula, chili flakes and lemon, and I make “Campari” spritzes again. Dinner is so good and satisfies all my salty cravings. M. rushes off to a show across the river; he’s a musician, too, and the band is made up of his friends. He invited me but I am feeling burnt out after a big week of work and social events so I stay in to get some writing done. (I take a few freelance writing gigs a year for between $115 and $225 each. I’ve done some reading and editing assignments for about $450 each, and I have a monthly social media gig that my partner and I collaborate on that pays me $37 a month.)

8 p.m. — My sister texts me that she’s had the “worst day imaginable” and asks me to bring her some treats. I’m ready to wrap my writing night anyway so I put on a coat over my sweats and run to the corner store to get Sour Patch Kids, ice and olives for martinis ($6.34). She only lives a block away so I walk over and play with my nephew for a while. On my way back, I extend my walk along the promenade. It’s early enough when I get home that I do a bit more writing before turning on Yellowjackets. $6.34

11 p.m. — Yellowjackets spooks me so I turn on all the lights and put on the 2006 masterpiece Step Up. M. comes home just in time to watch it with me and we fall asleep around 1:30.

Daily Total: $101.74

Day Four

10 a.m. — Big sleep-in. I’m not that much of a morning person. M. has coffee ready. He loves a good breakfast so we have bacon and egg sandwiches. We were going to take a walk after but I’m too crampy so we drive to our local coffee shop and have a coffee and tea. We get a discount because my brother-in-law is the chef. M. pays.

1 p.m. — My sister asks us to pick up a few things because she’s busy with her baby and wants to bake for book club tonight. We get flour, marshmallows, cereal, brown sugar and baby food pouches. My sister reimburses me right away. We look after my nephew and help my sister bake.

5 p.m. — I take a bath and skim through the book club book, tabbing passages I want to talk about. Then I put together caprese skewers to bring with me and do my makeup. I pick up my sister and V., and we go to our friend’s house with books and our snacks. There’s lots of food there so I make a plate and call it dinner.

9 p.m. — After book club, my sister, V. and I decide to get a beer at a local brewery. I have a nonalcoholic pale ale and we split a plate of hummus and pita ($10.23 with tip). We forget that there’s a playoff game close by and the place is packed with fans in jerseys. When the game ends, we grab our bills and race out to beat the traffic. $10.23

11 p.m. — I do my nighttime routine and crawl into bed with M. I got so many hot book recommendations at book club so I hold them all on my library app and start to read one that’s ready to borrow. I stay up reading until 2 and have vivid dreams about the book.

Daily Total: $10.23

Day Five

10 a.m. — Another sleep-in. I take a mental health day whenever I have therapy now because I’m dealing with some pretty heavy grief counseling. With all the evenings and weekends I work for concerts, I can just take lieu time. I’m pretty depressed gearing up for the appointment so I skip breakfast and lunch. I grab coffee M. made and stay in bed until 11.

1 p.m. — I have a massage appointment, it feels nice to treat myself. My work benefits plan pays for a ton of massages so I try to go regularly. The total is $107 but I submit a claim through my work portal and they’ll reimburse me in a couple days. ($107 expensed)

2:30 p.m. — I know my therapist will have words if I’m not taking good care of myself during a depressive episode so I go to the drugstore and buy a Clif bar and a cherry Coke Zero even though I have no appetite. I also grab a bottle of Tylenol for home and one for work because my period cramps still suck and I mostly work with other people who menstruate. $33.78

3:30 p.m. — I have therapy and we work on my treatment plan. She gives me great coping mechanisms for when I’m depressed like this — I resolve to make a nutritious dinner tonight and spend quality time with M. since we’re both at home. The appointment costs $150 and I’ll submit a claim. This is the last appointment my work will pay for completely since my benefits plan only allocates $566 to mental health support per year. Soon, I will have to pay out of pocket. ($150 expensed)

5 p.m. — M. works at a wine store occasionally and I stop by after therapy to visit him. I want to pick up non-alcoholic spirits to experiment with making fun mocktails. I get stuff for virgin Negronis and the total with M.’s discount is $19.37. M. is ready to come home early so I drive him back to our place. $19.37

6:30 p.m. — I make us a vegetarian stir-fry and M. makes virgin Negronis. I focus on the sensory experience of every bite because I still don’t have an appetite. At least I’m making an effort. After dinner, we take a long sunset walk in the city. It lifts my mood. When we get back, I am affectionate with M. and hungry for dessert. We have mint chip ice cream.

10:30 p.m. — We get ready for bed a bit early because I have to get back to work tomorrow. I read for a few hours and fall asleep around 1.

Daily Total: $53.15

Day Six

9 a.m. — M. wakes me up with coffee. I work from home and take my time getting set up at the desk after changing into sweats. We’re pretty busy in the morning due to a staffing shortage. I take lots of calls and attend a meeting. I put on another pot of congee to simmer while I work.

1 p.m. — I finish the congee and put it away for breakfasts. My snack lunch is cheese and crackers and carrot sticks. Then I put on a Yoga With Adriene video and take a quick shower afterwards. Back to work: I blast Broadway musical soundtracks and blow through a ton of paperwork.

5 p.m. — I close out at work and drive to pick up a package. The tennis shoes I ordered have arrived and I try them on right away. They fit perfectly! M. comes home and takes a Zoom meeting so I read my library book. Then I do my makeup and put on a great outfit: wide-legged blue pants, a sheer white blouse over a black bra, and heeled clogs (tennis shoes in bag for walking). We’re off to the soft opening of a new wine bar tonight.

7:30 p.m. — We get there early so take a walk around the ravine and creek. I change into my heels in the car and we go get seated. Drinks are free tonight and M. and I make an exception to our temporary sobriety to sample lots of delicious wines and amaro. We eat a four-course dinner of anchovies, salad, scallop crudo and steak. I take care of the bill, though M. and I will split it with money transfers. $38.88

9:30 p.m.— We love a fine dining moment but the cliché teeny portions ring very true tonight so we stop at McDonald’s on the way home. M. gets a quarter pounder and I get fries with a bucket of Coke Zero. M. pays.

10 p.m. — We watch some of Bones and All and go to bed around 11. I read until 1:30 and fall asleep around 2.

Daily Total: $38.88

Day Seven

8 a.m. — M. wakes me up while our cat zooms around. Usually, he’s already eaten by the time I get up but this morning he’s a menace. I have coffee and get ready to go into the office. I do light makeup and sunscreen and pack the congee along with all my paperwork. I’m running late (I’m slow in the mornings) so I walk halfway and catch the train. I fill my transit card sparsely but don’t swipe it this morning because I’m in a rush.

9:30 a.m. — I need another coffee so I pop across the street and grab one for me and one for an employee. $4.79

2 p.m. — I have my congee, call M. to talk about some work stuff and read my library book.

5 p.m. — I’m meeting my friend for a drink at my favorite bar. We were supposed to celebrate because they finished their final school project but instead we have conciliatory drinks because their boyfriend just confessed to cheating and dumped them. I just have cranberry seltzers with free refills, which cost $1.51, but I tip $3.77 for the table time and service. $5.28

8 p.m. — I walk home and stop at the bookstore to pick up Alison Roman’s new cookbook, Sweet Enough: A Dessert Cookbook, for my friend’s birthday. I’m splitting the cost with our other friend and she already sent me money for her half so my half comes to $18.84. I also stop at the grocery store to pick up frozen pierogi and green beans for an easy dinner ($6.26). $25.10

9 p.m. — M. and I eat pierogi and garlic sausage with the green beans. We watch the end of Bones and All and then do a little wedding planning. For anyone who is interested in the budget, we’re trying to do the whole thing for about $10,000. We’re eloping and then throwing a party for 50-odd people the next day. Most of our budget is for travel (the party is in another province), food and wine. We’re very lucky to have been gifted the venue by generous family members and we’re not spending money on things like a photographer (M. has art school friends who will shoot a few rolls on film for us) or hair and makeup. We’ve also saved money by thrifting decorations, plates, cutlery, etc. and by buying M.’s suit from a consignment store. I’m very lucky that my mom is making my dress — another very generous gift. M. and I are also cooking everything for the party, not to save money but because it’s our favorite thing to do together. Tonight, we spend some time talking about the menu. M. is baking bread and we’ll make steak tartare, a few veggie dishes and salads, charcuterie and cake. Around midnight, M. will start slinging pizzas for late-night dancing fuel. We enter our expected expenses into our wedding spreadsheet (M. is a spreadsheet king).

11 p.m. — M. and I get into bed after our nighttime routines. I read for my usual two hours and finish my library book, then fall asleep around 1:30.

Daily Total: $35.17

If you are experiencing anxiety or depression and need support, please call the National Depressive/Manic-Depressive Association Hotline at 1-800-826-3632 or the Crisis Call Center’s 24-hour hotline at 1-775-784-8090.

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.