Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Are you single and/or living alone? We want to read your Money Diary! Submit your diary here and email moneydiary@refinery29.com with any questions you may have.

Today: a materials manager who makes $104,000 per year and spends some of her money this week on bride and groom hangers.

Occupation: Materials Manager

Industry: Manufacturing

Age: 25

Location: Charlotte, NC

Salary: $104,000 (full-time job), $18,000 (rental property income)

Net Worth: $123,957 (401(k): $63,540, Roth IRA: $24,847, savings: $9,238, rental savings account: $1,758, rental property value: $190,000, primary home value: $389,000, minus debt. I am engaged and my fiancé and I live together and split all bills evenly. We have a joint credit card for bills, but we are not combining finances until after the wedding. Our joint debt currently includes the primary mortgage and a car loan).

Debt: $554,426 (primary mortgage: $346,208, rental mortgage: $154,691, car loan: $21,327, student loans: $32,200).

Paycheck Amount (1x/month): $5,100

Pronouns: She/her

Monthly Expenses

Mortgage: $1,056 (my half of the mortgage. My fiancé and I bought our house a year ago. I bought my rental property before we were engaged and am responsible for paying that mortgage ($850) from my rental income).

Electric: $78

Private Student Loans: $350

Car Loan: $202

401(k): $1,300

Roth IRA: $500

Wedding Fund: $300

Emergency Fund: $300

Rental Emergency Fund: $250

Rental Property HOA: $250

YMCA Membership: $56

Umbrella Insurance: $44

Lululemon Studio Membership: $40

Soccer Season Tickets: $25

Cell Phone Upgrade Plan: $15

Donation: $15

Hulu, ESPN+, Disney+, Spotify Bundle: $12 (my half).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, both of my parents attended law school and they stressed the importance of doing well in school to get into a good college. They both followed very traditional paths and wanted us to follow in their footsteps. I went to a small private school in the midwest for undergraduate that cost about $80,000/year. To pay for college, I got a lot of scholarships and grants, my grandmother had a small 529 account she gave me ($8,000), and I took out student loans for the remaining $56,000 for all four years. My mom did pay my rent once I moved off campus and my grandfather would come visit and buy my groceries once a month.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My dad wasn’t in the picture a lot growing up and my mom did the best she could to raise four kids on a single income. Things were tight for a couple of years while she was building her career and she gave a lot of good advice about cash envelopes and budgeting. When I turned 16 and got my first job, my mom’s partner talked to me about starting a 401(k) and putting a percentage of my salary into the account to build good habits.

What was your first job and why did you get it?

My first job was bagging groceries. My mom told me once I turned 16 I could either pay for my car insurance or my gas if I wanted to drive. I chose car insurance and got a job a week later. It also allowed me to have spending money to go and hang out with my friends.

Did you worry about money growing up?

Yes, when my dad stopped paying child support and my mom had to get a job. We were extremely poor while she worked to build her career. We are very fortunate she had her JD and was able to get a good job relatively quickly, but she had a lot of expenses my dad burdened her with that were hard to keep up. At one point, our house was in foreclosure because she couldn’t make the mortgage payments. Now she is doing very well and is one of my biggest role models, but it was rocky for a couple of years and she was open about it.

Do you worry about money now?

More than I should, I know I am very fortunate to be in the financial position I am in at 25, but there is still the worry that I might lose it all. Right now there is a lot of stress with paying for the wedding and getting ready to move, both of which are big financial drains. Hopefully, once we settle down in the next couple of months, a lot of the stress will come off and I can enjoy my new job.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I became financially responsible for myself when I graduated from college. My mom still pays for my phone plan and my health insurance, but it is no additional cost to her from the way it is set up. I know that if I ever really needed help financially she could help me out. My grandfather would also do the same, he still pays for little things for me like my Costco membership and Sirius XM, and would be able to help me out in a pinch. I am extremely grateful for the help they provide me with every year since I know they don’t have to do that and not everyone is in the same situation.

Do you or have you ever received passive or inherited income? If yes, please explain.

Yes, my grandfather gave me a car when I graduated college and I was extremely grateful. He also gave me an allowance (~$500/month) during college to pay for all my gas, insurance, groceries, and travel. My mom also let me live at home for nine months rent-free when I was moving for work, which let me save up enough for my first house. Every now and again my dad will resurface in my life and pay $1,000 (~$3,000 total paid by him) on my student loans to try to feel less guilty, but that hasn’t happened since he found out he wasn’t invited to my wedding. Currently, my mom and my fiancé’s family are paying for half our wedding (~$20,000) and we are extremely appreciative they are helping us out since weddings are so expensive.

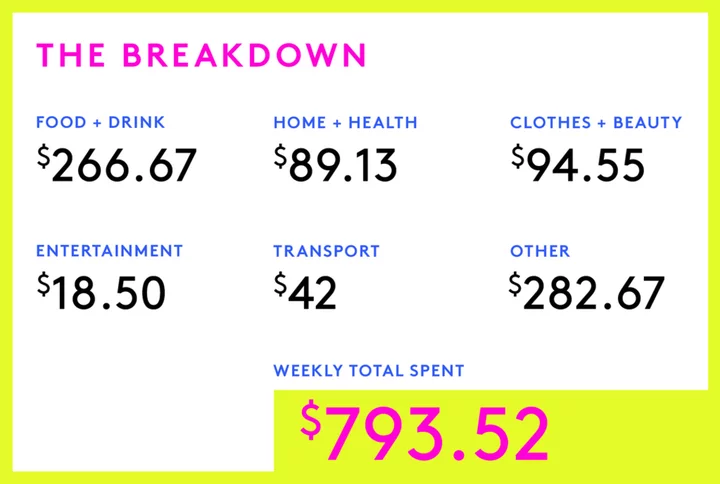

Day One

7 a.m. — My friends and I are currently in Costa Rica for my bachelorette trip and booked a tour to go see the hanging bridges and the thermal hot springs. We have to wake up at 7 for the driver to pick us up from the Airbnb since it is a four-hour drive from the coast to the mountains. I paid for my portion ($130) when we booked.

10:30 a.m. — We stop and get a buffet breakfast of eggs, beans, rice, and coffee. They have a Caribbean salsa that is the best salsa I have ever eaten in my life. $12

12 p.m. — We finally arrive at the hanging bridges. We have to pay $2.50 for entry into the park. The hanging bridge tour is a two-mile round trip walk over suspension bridges through the rainforest. We get some amazing pictures that make it look like we are floating in the rainforest. $2.50

2:30 p.m. — We get to the resort and swim in the hot springs until lunch. After lunch, we each get a drink at one of the swim-up bars. I get a piña colada and we continue to swim for another hour and a half before starting the drive home. $15

7:30 p.m. — When we get back to the Airbnb we tip the drivers $12 each and go inside to get ready for dinner. We hired a private chef for dinner since we didn’t think we would want to cook after being in the car all day. My mom and her friend stayed behind to drink by the pool instead of coming on the tour so we greet them. $12

10:30 p.m. — The chef makes us an amazing spread of chicken and rice, beans, salad, veggies, and cake for dessert. While the chef is cooking we make margaritas and hang out in the pool. We get the bill at the end of the night for $604 which includes a $320 chef service for today and tomorrow and $284 in groceries. We split the price and tip between all eight of us and thank the chef. $74

11 p.m. — After the chef leaves, we are all extremely tired and go to bed. My maid of honor and I are sharing a room so we stay up talking for a little while before falling asleep.

Daily Total: $115.50

Day Two

9:30 a.m. — My maid of honor wakes me up with coffee in bed. She knows I will sleep the entire day if I don’t get woken up. We walk out into the kitchen and the chef has already started preparing a breakfast spread with coffee, rice, beans, fresh fruit, eggs, and salsa. We already paid for the chef service and groceries last night so we aren’t charged anything this morning. We tell the chef to come back at 2:30 for lunch.

11 a.m. — We quickly find we are out of tequila and decide to walk to the convenience store down the street. I lost my sunglasses on the hanging bridges yesterday so I want to get a new pair of sunglasses to hang out by the pool. My maid of honor gets two bottles of tequila and some supplies for our game night tonight. I get two bottles of Caribbean salsa, a swim cap, condoms for our games later, and new sunglasses. While we are at the convenience store, we got a text that the masseuses have gotten to the Airbnb so we hurry back for the pool and massages. $36

1 p.m. — Once we get back to the Airbnb we all change into our swimsuits and start making margaritas before getting in the pool. We have two masseuses come to the house to give us all massages. Once it is my turn, I ask the masseuse for a deep tissue massage and she delivers. Massages in Costa Rica are significantly cheaper than the US ($60/hour), and I make sure to tip 20%. I am definitely going to be sore tomorrow from how hard she dug into my muscles. After the massage, I make another drink and get back into the pool with the rest of the group. $73

4 p.m. — The chef finishes preparing lunch. He made a wonderful chicken dish with a mushroom sauce, salad, veggies, rice, beans, and guacamole. Since it is so late in the day we ask the chef to come back at 8 but only prepare snacks and dessert. After the chef leaves we all change into our themed outfits for the night and start playing the games we had planned.

9 p.m. — The chef comes back and prepares an amazing spread of salsas, guacamole, and a fruit and ice cream dessert. We are all still so full from lunch and drinks that we barely eat half. After dinner, the chef gives us our remaining bill for additional groceries. We are a little frustrated because they told us yesterday that we had paid our grocery bill for all meals, so we are confused when we are presented with a bill for $200. At the end of the day, they did a great job so we pay for the groceries and tip them for their service. We split it eight ways. After dinner, we all go to bed early since we have to get up at 6:45 a.m. for our catamaran tour. $30

Daily Total: $139

Day Three

6:45 a.m. — We get up for the drivers to pick us up at 7. We are going on a catamaran tour. The entire tour costs $170 but includes drivers, breakfast, lunch, and all drinks while on the island. I paid for it when I booked it.

7:45 a.m. — We get to the boat and they inform us it’s probably a 45-minute ride to the island. We get fruit cups, carrot cake muffins, and coffee as our breakfast for the day. Once the boat starts moving, we see a whale and her calf breaching on the surface!

11:30 a.m. — After spending the morning drinking, swimming, and snorkeling, it is time for lunch. They have a buffet on the island that has chicken, rice, beans, salad, coleslaw, chips, and different salsas. The food is delicious and over lunch they give me a Bloody Mary shot as a congratulation for getting married. After lunch, we have all had a little too much to drink at this point and decide to go banana boating. We end up flipping twice and all of our drinks end up in the ocean, but it is a blast.

6:30 p.m. — After we get back to the dock, we decide to go get dinner at a restaurant close to our Airbnb. I get a raw shrimp appetizer, a seafood salad, four piña coladas, and a strawberry daiquiri. The restaurant is on the beach so we are able to go into the water for sunset while eating dinner. $65

10:30 p.m. — Once we get back to the Airbnb we all start packing for our flights the next morning. We have a cab picking us up at 2 a.m. to take us to the airport.

Daily Total: $65

Day Four

2 a.m. — Morning comes way too soon and we all pile into the van hungover for the trip to the airport. Since I am a little worse for wear, I grab a seat in the front row. Luckily, there is no traffic and instead of two and a half hours the drive only takes an hour and a half. Once we get there we split the $150 fee and a $30 tip for the driver. $30

5:30 a.m. — Once we get through security, I get an iced coffee from Starbucks, a water bottle, and a toasted bagel with cream cheese. We all start to get worried that our flights are going to get canceled because of the hurricane, but we keep our fingers crossed for good luck. $15

9:30 a.m. — While on the plane I give in and pay for Wi-Fi ($12) and a New York Times Subscription ($4) so I can track the hurricane. I see our flight from Miami to Charlotte has been delayed an hour and at the same time my airport lounge vouchers are delivered. I signed up for this new subscription a couple of weeks ago called VacayDelay. It was $29 for an entire year and every time your flight is delayed by more than an hour, you get a lounge pass for a lounge in that airport. It has already paid for itself since I have used it twice. $16

11 a.m. — Once we land in Miami, I have Global Entry so I leave my friends to go through customs and go buy a water bottle. I am still feeling hungover so I grab a water bottle from an airport shop and mix a Liquid IV into it. Once my friends get through security, we go to the lounge to get some lunch while our flight is delayed. Of course, we have to try one of everything since it’s free, this lounge even has a self-serve espresso machine and bar. $4

7 p.m. — We finally land in Charlotte a couple of hours later than originally expected. My fiancé comes to the airport to pick us all up and we fill him in on our travel woes. I am excited to see him after five days apart, but sad that he is leaving for his bachelor trip in the morning. We would’ve scheduled them at the same time, but we didn’t want to board our dog since he gets anxious.

Daily Total: $65

Day Five

7 a.m. — My fiancé, S., wakes me up as he is leaving for the airport and I can’t go back to sleep. Instead, I pull the trigger on some items in my Etsy cart, earrings for my bridesmaids to wear on the day of the wedding ($40.54) and hangers for my dress and S.’s suit for pictures ($21.44). We are getting to the point of wedding planning where we get to spend money on the details, which is much more fun than all the vendors. $61.98

10 a.m. — After getting sucked into some Instagram ads, I end up placing an order on SHEIN for matching hangers for my bridesmaids ($15.10), bride earrings for the rehearsal dinner ($2.47), cute gift bags for their earrings ($6.76), and thank you cards ($1.82) to write them all a cute note as well. I also order some clear jelly beads from Amazon ($6.42) for the cocktail hour centerpieces. $32.57

3 p.m. — I realize S. threw away all of our reusable hand soap when trying to refill the containers, so I place an order for a three-pack of hand soap on Amazon ($8.63). My dog’s favorite dental sticks are also on sale so I add them to the order as well ($7.50). $16.13

5:30 p.m. — After work I go to the grocery store and pick up some essentials for the week. I don’t like to cook when S. is out of town so I grab stuff that is quick and easy. I grab strawberries, peaches, celery, a salad kit, two frozen meals, two cans of tuna, a pre-made Korean chicken dish, Laughing Cow cheese, salt and pepper pretzel crisps, and a Diet Dr. Pepper. I figure if I run out of food, I can always go over to my mom’s house for dinner. When I get home, I to have the salad kit for dinner and watch Suits. $38.03

11:00 p.m. — I try to go to bed early since I am starting my new job tomorrow but I am nervous I end up playing on my phone for a couple hours. This will be my first time being a manager so I want to make sure that I am prepared.

Daily Total: $148.71

Day Six

7 a.m. — I wake up early for my first day on a new job. I am doing a hybrid mix of virtual and in-person until we move. I spend the morning answering a few questions and talking to my new boss to get the lay of the land. I am excited to officially go on-site next week.

5 p.m. — I log off work. I FaceTime my maid of honor to order our wedding flowers to make sure they get here in time ($246.67 for my half). We are making the bouquets and centerpieces ourselves in order to save money. $246.67

6 p.m. — After ordering the flowers, my mom comes over to talk about her wedding hairstyle and the food for the after-party. We go to Costco to look at their food platters as an option for the after-party. We make sure to walk through all the aisles and my mom ends up purchasing some groceries and things for her house.

8:30 p.m. — I am still recovering from my bachelorette, so I decide to stay in tonight. I heat up a feta Mediterranean shrimp bowl and settle in to watch Suits with my dog.

Daily Total: $246.67

Day Seven

11 a.m. — I wake up to a text from my friend asking if I want to go to the mall. I have some returns I need to make so I agree on the condition that we can stop at Starbucks. Coffee is my treat since she is one of my bridesmaids and did an amazing job with my bridal shower and bachelorette. $10.72

12 p.m. — We go to Madewell and Lululemon to make some returns. I bought a pair of pants from Lululemon for the bachelorette, but I didn’t like the way they fit me so I exchange them for a pair of their work pants. I am feeling broke from all the wedding stuff I purchased yesterday so I refrain from buying more clothes from Madewell.

7:30 p.m. — A few of us decide to have a girls night and I offer to host. The same friend from earlier picks me up and we go to pick up some Chipotle. I have a free entree reward so I only have to pay for the guacamole that is added. Our two other friends meet us back at the house and we play Super Mario Party. $2.92

1 a.m. — My friends leave and I am exhausted so I start getting ready for bed. It is always great to have a girls night when the boys are out of town.

Daily Total: $13.64

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.