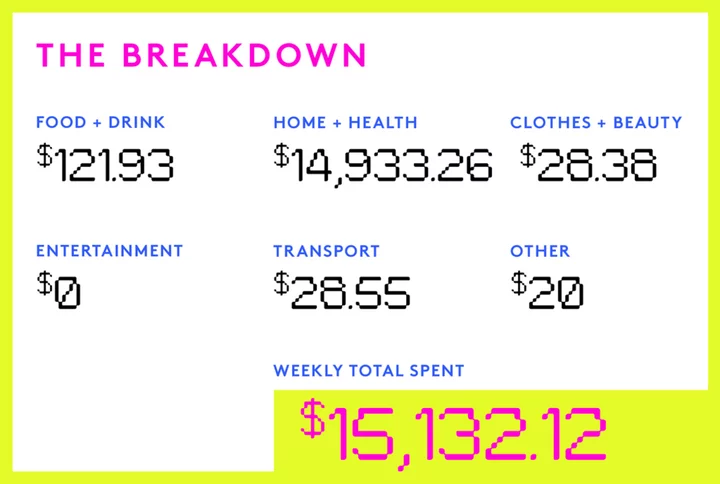

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a research associate who makes $89,000 per year and spends some of their money this week on a washer/dryer.

Occupation: Research Associate

Industry: Government

Age: 25

Location: East Tennessee

Salary: $89,000

Net Worth: $44,835 (checking: $12,416, HYSA: $43,160, Roth IRA: $9,930, 401(k): $14,963, investments: $76 (just getting started), minus debt. I also have a pension but have no idea how much is in it. My partner, N., and I do not share finances and split everything evenly).

Debt: Car: $9,109, student loans: $26,601.

Paycheck Amount (1x/month): $5,325.16

Pronouns: They/she

Monthly Expenses

Rent: $1,029.25 (my half).

Car Payment: $275

Student Loans: $400 (my student loans are currently on pause so I’m putting this into a HYSA for now).

401(k): $445.76 (taken from paycheck).

Pension: $148.59 (taken from paycheck).

Internet: $32.97 (my half).

Utilities: $50-$80 (my half).

Renter’s Insurance: $11.25 (my half).

Subscriptions: $21.88

Roth IRA: $500

Nest Egg: $500

Car Insurance: $96

House Savings: $900

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

I went to a prep-style high school so college was really the only option. I had grand plans of working in political science but I spent one summer campaigning door-to-door and hated it. I fell into my current field of work and just sort of stuck with it since the pay was great and the work suited me. I paid for school through scholarships and student loans. Occasionally my parents would send me money for food but for the most part I was on my own.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We hardly ever talked about money. I learned most of what I know about money from the internet.

What was your first job and why did you get it?

I was an assistant middle school track coach in my senior year of high school. I mainly did it to spend more time with my little sister before I went to college and to save up for college moving expenses.

Did you worry about money growing up?

All the time. My dad lost his job in 2008 and was periodically out of work when I was growing up. Looking back, I can tell that we were doing just fine, but my parents always made it sound like we were destitute. I never liked to ask for anything because I felt guilty about spending money. I still don’t know their financial situation but they pay for my sister’s school and recently went on an overseas vacation so part of me feels a little resentful for having to worry so much.

Do you worry about money now?

Yes. My partner and I have great, stable jobs but we are currently buying a house and it is stressing me out so much. Realistically we will be fine, and we are financially privileged to even be buying a house at this age, but all the costs and expenses coming up are freaking me out. I also want to get married soon and know that will be another huge financial cost. I know I can always elope but I’ve always wanted a nice wedding with my friends and family, so sacrifices will have to be made.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I’d say I just recently became financially responsible for myself with this home purchase coming up. My parents do still pay my phone bill and I’m on their insurance for a few more months but those are things I could pay for myself when necessary. I mean, it’s called a family plan and aren’t we family? I have a decent emergency fund and I could always rely on my partner as well. If it came down to it, we could stay with either of our families, but it would have to be dire.

Do you or have you ever received passive or inherited income? If yes, please explain.

Nope.

Day One

5 a.m. — I wake up and do my morning routine, skincare (CeraVe face wash, snail mucin, vitamin C, moisturizer and sunscreen), have my morning coffee and do my daily tarot card pull/meditation/journal. I do this every morning now and it’s been incredibly helpful to start my day with good intentions. I head to work.

6:30 a.m. — I usually get to my desk around 6:30 a.m. I spend the morning reading emails, checking my schedule for the week and reviewing a paper I am working on. I am heavily encouraged to publish at my job and this would be my first published paper if it gets accepted.

10 a.m. — I eat the lunch I brought from home at my desk (fried rice) and reapply my sunscreen. I accidentally got a mineral sunscreen stick and it leaves a white cast and rubs off all my blush so that’s fun.

12 p.m. — I take my afternoon walk and see several birds and turtles hanging around the pond. My workplace is situated in a large nature preserve of sorts and it’s not uncommon to see bobcats, wild turkeys and even coyotes wandering around.

3:45 p.m. — I leave work around 3pm and drive home. When I get home, I do a quick lower body exercise while watching Derry Girls and take a 10-minute break to tear up at the series finale. I do some chores around the house and wait for my partner, N., to come home.

6 p.m. — N. makes dinner (salmon and asparagus) and we go out for ice cream after (my treat). $14.20

7 p.m. — After ice cream, I make the biggest purchase I have ever made and we wire the down payment for our new house to the title agency. Just my half alone makes me nauseous. Afterward, I rewatch some Skins UK while doing a sudoku puzzle to calm down and am in bed by 9:30. My nighttime skincare is usually a cleanser, retinol and moisturizer. $14,387.25

Daily Total: $14,401.45

Day Two

5 a.m. — Same morning routine, bright and early. Today’s tarot card of the day is nine of cups and I take it as a message to relax about all the new house purchases.

10 a.m. — Today’s lunch is ramen that I made last night. I call my renter’s insurance plan to make sure my policy cancels on the day we move out of our apartment and pay the remaining balance. $8.42

1:30 p.m. — After our team meeting, I take my afternoon walk (I try to walk most days, weather permitting). This work week has been slow. Sometimes it feels like a slow work week is more stressful than a busy one but that’s government work for you.

3:45 p.m. — Home again. I do upper body today and check my mail. I see that my car registration tags still haven’t come in. I’m gonna have to call the city tomorrow, it’s been over 20 days. N. wants to go on a walk when he gets home so we enjoy the spring sunshine and then he makes a spinach gnocchi dinner.

9 p.m. — I spend the rest of the night coloring and watching some more Skins UK. It makes me feel oddly nostalgic despite having none of the same experiences and also not being British. Skincare and lights out at 9:30.

Daily Total: $8.42

Day Three

5 a.m. — Today’s tarot card is the four of swords. Sounds like I need to rest a little before all the craziness of moving into our new house. I stop and buy gas on the way to work. $28.55

6:30 a.m. — I get to work and see I got paid! I pay my car payment and transfer the amounts listed above into my Roth IRA and my HYSA. Normally I would transfer $900 to my down payment savings but since I just paid that I keep it in my checking account to help offset some of the upcoming moving costs. Our new house doesn’t have a washer/dryer or fridge and we are going to have to buy a lawn mower.

10 a.m. — Today’s lunch is a leftover burrito bowl from dinner two days ago. I add some extra cheese and heat it up in the microwave. It’s rainy and unnaturally cold for late April so I skip my afternoon walk.

12:30 p.m. — It’s admin appreciation day and my coworker brought in goodies for them. I throw in some cash along with other coworkers to pay her back. I continue editing my paper and submit it to my group lead for review. I also call the county clerk’s office as my new car tags never came in the mail. I’m told I’ll have to go into the office, bummer. $20

4 p.m. — We have our final walkthrough for our new house. It looks normal to us, nothing out of the ordinary. Very nervous and excited to close tomorrow and have to deal with this new responsibility. The house has a huge yard and I plan to make the fairy garden of my dreams.

7 p.m. — N. makes us dinner of bratwurst and parmesan-crusted green beans. It’s delicious but I’m craving something sweet. That would mean putting on shoes, getting my car out of the parking garage, driving to the store, walking around and coming all the way back. Too much work. I stopped drinking 119 days ago to “reassess my relationship with alcohol” and I’ve been relying on candy a lot to get through the cravings. Unfortunately, now I’m craving candy AND alcohol. I color and watch the new John Mulaney special to distract myself. How fitting. Bed at 9:30.

Daily Total: $48.55

Day Four

6 a.m. — Sleep in an hour later since I am working from home today. I work from the couch while N. sleeps. In our new home, we will have a dedicated office room and I am very excited to have a space to work that isn’t a desk in a bedroom.

10 a.m. — We sign all the documents at the title company and now we are officially homeowners! It is very anticlimactic but now it’s all ours! So scary and fun! N. takes the rest of the day off to go change out the locks and do some minor immediate improvements (put in a mailbox). He will send me the cost of those later. The title agency is near Ulta so I pop in quickly to pick up some pimple patches. For some reason over the past five months, I’ve had nonstop breakouts on my forehead and recently they have been appearing on my jawline. Eventually I’ll go to a dermatologist but I’m baffled since I’ve never had this problem before. $28.38

12 p.m. — I’m just about to walk over to the county clerk’s office to ask about my new car tags when I see they’re in my mailbox. Two good things in one day! I save myself the walk and make some fried rice for lunch instead. I look over the edits my boss gave me on my paper.

3 p.m. — I hop offline and do a quick lower body workout while watching The Great on Hulu. I am forever in love with Nicholas Hoult and Elle Fanning. The realtor gave us a pack of local beers and a $50 Home Depot gift card to celebrate our closing. The margarita sour one is calling my name and I’m slightly irritated at myself for having this “no drinking” rule thing going on. To put off the craving, I grab some candy and a non-alcoholic mojito kombucha from the store. $9.76

6 p.m. — I go over to the house to help N. pick up sticks and trash from the yard (we find a lot of interesting things in the overgrown shed including a maggot-covered mattress, a mysterious groundhog hole and various broken tools). Luckily the main house is much cleaner. At 6, I hop on Zoom for my teletherapy session. We talk about my recent alcohol cravings and make a plan for a beach trip with my family I have coming up. $40

8 p.m. — N. makes us a chicken and rice dish and I watch the new episode of Farmer Wants A Wife. I color a bit and drink my mojito kombucha, which is so incredibly refreshing. In bed and lights off by 10.

Daily Total: $78.14

Day Five

6 a.m. — Working from home again today to let the cleaners in. It’s very peaceful getting to work in my living room in the morning. I make myself a pot of coffee and do my skincare and daily tarot journal. Today two cards fall out: queen of swords and the sun. I get the first card a lot. She likes to follow me.

10:30 a.m. — After my group meeting, I run over to our new house to let the cleaners in. I splurged on a move-in deep-cleaning service and I’m very excited to see how it turns out. While there, I see a spider chilling on the ceiling and instantly feel ill. I have a severe fear of bugs, which is not ideal for buying an older home, but we have the pest control service coming on Monday. I don’t care if it takes five years off my life, I want them to spray the shit out of this house so I never have to see a bug if I can help it. I prepaid for this but it was $433.22.

12 p.m. — Attend more meetings, write a to-do list for the next week and make myself some fried rice. I love fried rice.

3 p.m. — Done with work for the week. It was a light one but usually my week consists of meetings, emails, writing, reading and working on requests for sponsors. I finish up with the cleaners and admire my clean house. I get myself a little treat from the store (cayenne kombucha and jelly beans). $8.24

7 p.m. — Upper body workout day, call my dad and fill 50 gyoza wrappings with the pork filling N. made. Same deal of coloring, kombucha, candy and Skins. We go to bed early at 10 since N. has a test tomorrow for his work license.

Daily Total: $8.24

Day Six

7 a.m. — N. leaves for his test and I enjoy a lazy Saturday morning, sipping coffee and listening to the new Lana Del Rey. I also pay the utility activation fee for the new house. Today’s tarot card is judgement, so ominous. $17.50

12 p.m. — I go for a walk and call my sister at college. N. texts to tell me he passed his test. Yay! This will be a huge stress lifted off him.

8 p.m. — It’s been a lazy Saturday. N. buys me some candy from the store and we eat leftover gyoza and watch Crazy Rich Asians. In bed by 10.

Daily Total: $17.50

Day Seven

9 a.m. — Up early to go to the grocery store with N. We are out of paper towels and toilet paper so today’s bill is a little higher. $70

10:30 a.m. — I finally bite the bullet and buy a washer/dryer for our house. We obviously need one but the large expense makes me anxious. My mom very, very, very graciously volunteers to pay for half as a housewarming present but I still feel awkward Venmo-requesting her the amount. The total cost is $1,656. With her half and then N. and I splitting, I only end up paying around $414. $414

11 a.m. — Another trip to Home Depot. This time we get a ladder, drain extenders and some gloves. We spend a few hours at the house, cleaning the gutters and finishing putting in new locks. $66.09

6 p.m. — N. and I meet up with some friends at a local brewery to catch up. We’ve been so busy lately, it’s been hard to make time. N. has an IPA and I have a kombucha, on me. Most of the breweries in town have non-alcoholic beers or kombucha so my social life hasn’t been too hammered by this sobriety thing. $19.73

9 p.m. — Finally have time to do my tarot card pull and journal. Same card as yesterday, judgement. I guess it really wants to prove a point. I finish my journal, do my skincare and am in bed by 10.

Daily Total: $569.82

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.