Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: a strategic account manager working who makes $210,000 per year and spends some of her money this week on orange Adidas Gazelles.

Content Warning: This Money Diary mentions an eating disorder.

Occupation: Strategic account manager

Industry: Technology

Age: 34

Location: San Francisco, CA

Salary: $210,000 ($140,000 base, $70,000 bonus).

Net Worth: $523,000 (401(k): $316,000; company equity: $80,000; brokerage account: $50,000; savings: $77,000). My partner and I live together and opened a joint checking account and a joint credit card. We put enough in there (proportional to what we make) to cover our expenses; for now that means I cover 65% of costs and he covers 35% of costs. All grocery, subscription, and travel spending happens on our credit card and we budget to save $500 a month in our joint savings account for rainy day activities.

Debt: $0

Paycheck Amount (2x/month): $3,500

Pronouns: She/her

Monthly Expenses

Rent: $3,700 (I pay $2,500 and my partner pays $1,200; this includes internet).

Joint Account:

Utilities: $120

YouTube TV: $73

Apple TV+: $9

Personal Expenses:

Netflix: $17

Spotify: $13

Cell Phone: $110

Coffee Subscription: $74 every six to eight weeks

NYT Games: $3

NYT Cooking: $4

Savings: I get my bonus quarterly and put a few thousand dollars into savings every time I get a bonus payout.

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes, college was always the goal. My parents went to their local state university. I was a bright student so the assumption was that I would go somewhere away from home. I wasn’t a natural athlete, musician, or a legacy anywhere, so to get into a good school, I was going to have to get great grades. When it came time to choose a college, we didn’t get much in the way of financial aid, falling into that terrible gray zone of earning too much for aid, but not enough to conceivably pay for college. My grandparents had been gifting my parents money for education for me and my sister since we were babies, which allowed me to choose the best school for what I wanted to study and not worry about much else but my grades. My dad asked me to take loans out to help pay for college, but when I got a job just after graduation, he used what was left in my college fund to pay them off (a way to make sure I had skin in the game without holding me back financially).

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

We had SO many conversations about money growing up. Almost too many. I was babysitting from 12 years old and got working papers at 14 from the local library, even though no local businesses would hire someone so young. Every summer there was an expectation that I would make my own pocket money for things I wanted to do. My parents rarely, if ever, gave us lunch money; we always packed lunch. Money was earned and taken very seriously. My grandparents seemed to be the exception to the rule, however, giving us money for birthdays and Christmas, buying big-ticket items such as Nintendos and American Girl dolls, sending us on vacations as a family to Disney World or on a cruise. When I graduated college and started my first job, I was officially financially independent from my parents and thankfully haven’t had to look back since. My dad was adamant about my contributions to my 401(k) and bumping them up with each raise. He was a total hard-ass who I resented in my early 20s but now have come to deeply admire. Shavings make a pile and he instilled this in me.

What was your first job and why did you get it?

My first job was at a stationery store. I got it because it was truly the only place in town that would hire me and I was desperate for money. I needed money for anything done outside of school with friends. I went to high school with wealthier kids and I felt so much pressure to fit in wearing Abercrombie and Uggs (which were NOT cheap back then).

Did you worry about money growing up?

Not as a child, no. As soon as I hit 16, I worried about it constantly. It’s strange to look back on it now and know what my parents were going through. They worked really hard to keep us out of their worries and focus on our school work. I always assumed we had more money than we actually did. My mom stayed at home to take care of us and my dad commuted two hours each way to his job. I credit that structure for how I did so well academically and the opportunities that opened for me down the line.

Do you worry about money now?

Yes, I still worry frequently about money and am fearful of being broke. Managing my money as a single person for years, all through my 20s, I worked through most of that and felt just fine. Since getting serious with my partner (who comes from a very different financial upbringing), and considering children, my anxieties have re-emerged. He makes less than me and as a result, I feel pressure to either learn to live with less or keep working at this level to maintain my lifestyle. A privileged place to be, truly, but a fear nonetheless.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I was financially independent at 21 when I moved out of my parents’ house (yes, they took me off their phone plan and everything). I have built up my own safety net as a means of hopefully never relying on someone else for money again in my life. That said, if there was an emergency, I could definitely rely on my family for help.

Do you or have you ever received passive or inherited income? If yes, please explain.

None.

Day One

7 a.m. — Wake up just before my alarm goes off and roll over to see that my partner, Q., is also awake — a rarity. We chat and he begs me to stay home with him. My company is enforcing its return-to-office policy pretty sternly and I am a rule follower, so into the office I will go. I do a quick makeup routine benefiting from last night’s shower and skincare: bareMinerals Complexion Rescue, Ilia Beauty Multi-Stick, and Lancôme Hypnôse Drama (GOAT mascara, IMO). I blend myself a smoothie of spinach, frozen berries, vanilla protein, almond butter, chia seeds, and almond milk. Make a coffee before heading to catch the Muni to the office. $2.50

12 p.m. — My office has a ridiculous cafeteria with a million kinds of food. I get a buffalo chicken quesadilla and a salad on the side. Even better, they let you take to-go boxes home for dinner. I grab a burger and fries for Q. (his favorite) and head back to my desk for afternoon meetings.

3 p.m. — Take a protein shake and a Diet Coke out of the office fridge and head into my final meeting today: a session for women employees looking to learn how to be more assertive in the workplace about their accomplishments. It is interesting and amazing to meet other women at my company and hear what they are working on and dealing with. I was managing a team through this summer but got moved back to an individual contributor role due to staff reductions, which took a massive toll on my ego and self-confidence at work.

5 p.m. — Head home intending to meet Q. for some afternoon pickleball — our new and very basic obsession. I once heard someone say being basic means you’ll have something in common with a lot of people, so I wear my basic-ness with pride. No free courts in Buena Vista Park, so we end up hiking to the top. The hills of SF are no joke.

7 p.m. — We reheat the food I brought home from my office cafeteria for dinner. We try to do this once or twice a week when I go into the office, to save some money.

9 p.m. — Watch a movie, read funny tweets, and resist the urge to buy new sneakers after browsing StockX mindlessly. Off to bed.

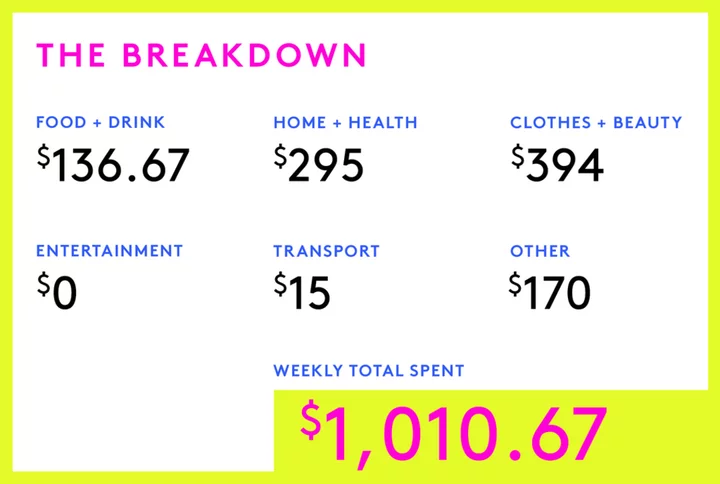

Daily Total: $2.50

Day Two

7 a.m. — Get up and toy with the idea of doing yoga before work but decide to work out later. I body shower and put on some makeup while listening to Jake Johnson on Armchair Expert. I feed my sourdough starter. I grab a Better Bagel and a cup of coffee. I head out for work via the Muni. $2.50

9 a.m. — Realize Q. locked our front door and our cleaner won’t be able to get in. I hop off the bus, return home, unlock the door, get back on the bus, and wonder what the purpose of men on this planet is. $5

10:30 a.m. — Hardly any meetings today which means I can catch up on personal and work projects that I have on my list. Q.’s birthday is soon and I am looking for a wetsuit for him. Since we moved to SF he’s been swimming in the bay and I want him to be able to keep doing that as the weather cools. Find a perfect one and place the order. $170

12 p.m. — Lunch today is Japanese-style chicken legs and roasted veg with a white chocolate macadamia nut cookie for dessert. My stint as a manager was really stressful and it affected my eating habits. Now that I am feeling better about my work-life balance I am trying to get back to feeling good in my body. I have a long history with an eating disorder and found recovery a couple of years ago. I am really protective of that now. As a result, balance is of the utmost importance for my mental and bodily health.

2:30 p.m. — Slow afternoon; a friend in the office walks by wearing Birkenstock Bostons. I have been sliding easily and quickly into SF’s casual wear, and these feel like a perfect addition to my fall wardrobe. I snag them with a 20% off coupon at Bloomies. $135

4 p.m. — Our cleaner messages me that she’s done and I Venmo her from our joint account ($144). Get on the Muni (for the fourth time today, $2.50) to head home. I bought tickets a while ago for Q. and me to go see a show in SF tonight (I bought the tickets a couple of weeks ago when they went on sale). I make myself some Fiber Gourmet Mac & Cheese with turkey bacon before the show at home and grab my weed gummies to enhance our experience. $146.50

10 p.m. — Home from the show — it was amazing! On the walk home, we pick up a seasonal pint [of ice-cream] from Salt & Straw: Beecher’s Cheese With Apple Pie Cinnamon Rolls. I grew up eating apple pie with hunks of cheddar cheese so I loved it. $13

Daily Total: $472

Day Three

7:30 a.m. — Wake up early to get a jump on my first attempt at sourdough. I make the levain (offshoot of my starter for the loaf) and lay out my materials meticulously. I was an A student most of my life and a project like this allows my particularness to shine.

9 a.m. — Home after a quick but typically grueling hike up Buena Vista Park. Make my normal smoothie, check my emails, and hop in for a body shower.

12 p.m. — Prepare my autolyse (fancy word for dough) and run over to the grocery store to pick up a couple of last things I need for the sourdough: fine sea salt and rice flour. Grab high-protein wraps, oat milk, and some deli turkey while I’m there. Make a quick lunch of a turkey and cheese wrap when I get home before I sit back down to bang out some client work. $21.67

3:30 p.m. — Nearing the end of this day and move my office to the couch to catch up on Real Housewives. Nothing soothes me quite like a Bravo session. Make myself some popcorn with salt, garlic powder, and nutritional yeast which is my GOAT popcorn topping. Finish up work for the day and discuss dinner options with Q.

6 p.m. — We decide on burritos and walk to a local spot we both love. Q. gets a steak burrito California style and I get a chicken super burrito. He puts it on the joint account. Love a cheap and cheerful Friday night treat. $35

9 p.m. — I decide to pull out some cookie dough balls from the freezer. Even though I’m in recovery, intrusive food thoughts emerge and I feel like I need to justify eating dessert. It sucks and I remind myself to do what feels good for my body — and tonight that’s a big old chocolate chip cookie. Q. and I start watching Reservation Dogs and mow through a couple of episodes before heading to bed.

Daily Total: $56.67

Day Four

7:30 a.m. — Wake up abruptly to the news that Q.’s mom’s dog passed away. They just put down their other last week, so this is a big blow. I didn’t grow up with pets so relatability here is low but I realize we need to make sure today goes at a slow and easy pace for Q., as he’s shaken up by the news. Get out of bed after some snuggles and put my sourdough in the oven.

10 a.m. — We have eggs and smoked salmon on the fresh sourdough. I love to bake, and taking something out of the oven that I made never gets old for me. For my first attempt, I am thrilled with the result. Hard crust, light and fluffy inside. It is so satisfying to spread on some fancy French butter that TikTok convinced me I needed. After digesting for a bit, we head to the farmers’ market.

12 p.m. — Quick stop at the ATM to make the farmers’ market as easy as possible. We Revel to this market as it’s in a neighborhood that’s not that easy to get to (and we freaking love Reveling places). We pick up corn, the last of this season’s heirloom tomatoes, garlic, Japanese yams, a spaghetti squash, shishito peppers, and blackberries ($45… But I took $100 out of the ATM so girl math says $100 total, right? everything else I buy with this cash is FREE). $45

3 p.m. — We decide to try the tennis courts at Dolores Park to see if we can get some pickleball in. Lucky for us, multiple courts are empty and we get an hour of play. Q.’s feeling better and we decide to use barely anything we bought at the farmers’ market for dinner and stop at Whole Foods on the way home. Sometimes it just be like that. We settle on shrimp and linguini in a white wine sauce and pick up shrimp, fresh pasta, and herbs. $17

6 p.m. — Q. makes blistered shishito peppers from the farmers’ market for a snack while I bake the second loaf of sourdough that I’ll likely give away. We feel proud of ourselves for eating one fresh thing we bought today. I’m taking some time off from drinking but am craving a seasonal pumpkin beer or a glass of red badly tonight. I hold strong.

8 p.m. — I make the pasta and we both agree this comfort food was a great call. We pay for YouTube TV and as a result, we occasionally get sucked into a movie being shown on cable like the olden days. Tonight we watch The Mummy on Bravo.

Daily Total: $62

Day Five

9:45 a.m. — Wake up late and am shocked I slept so long — I guess I was tired! Text my best friend to see if I can drop off my second loaf of sourdough and she asks if I want to go for a walk. It’s beautiful out so I eat a banana and have some water before heading to her place with the bread.

1 p.m. — It is so good to catch up. I don’t have tons of friends in SF and I’m really close to this one so it feels amazing to chat and get our steps in. When I get home, I am hungry. I make sourdough toast with almond butter and raspberry preserves. It hits the spot. I spend the afternoon cleaning and organizing as Q. is out watching football. I use the blackberries from the market and make a blackberry and lemon ricotta cake for dessert (a recipe from Alison Roman’s recent dessert cookbook).

3:30 p.m. — I take a quick cleaning break to pick at the second half of my burrito from Friday night and play all my NYT games — I’m obsessed with Connections, the Mini crossword, and sudoku right now.

6 p.m. — Q. gets home from watching football and puts on… More football. I make us corn on the cob, teriyaki chicken breast defrosted from the freezer, and Japanese yams for dinner. We have the ricotta cake for dessert.

Daily Total: $0

Day Six

7:30 a.m. — Wake up and share some morning snuggles with Q. We seem to be very silly on Mondays when we WFH together and it’s something I look forward to. Certainly helps us ease into the week. I make my smoothie and coffee and oat milk before logging on to take my morning calls.

11:45 a.m. — My noon call cancels so Q. and I sneak out for a quick hike up Buena Vista Park. With repetition, it’s getting easier and I almost beat him up the hill.

12:45 p.m. — Make myself a wrap for lunch with leftover chicken, arugula, and heirloom tomato. Get back on work calls for the afternoon.

2 p.m. — Break from work for couple’s therapy. Q. and I are nearing two years together and seriously considering marriage and next steps, so decided to start doing this now to help us establish good patterns and behaviors. We’re a few sessions in and so far we’ve felt closer after each one. Afterwards, I take an “everything shower” and wash my hair as well as shave, which is a big event. $250

5 p.m. — I go to a local bakery to pick up my Too Good To Go bag, which is an app that allows you to buy mystery bags of food that would otherwise be thrown away from local eateries. Looks like we scored five croissants for only $5! My dad’s been giving blood for years now and finally inspired me to check out if I can do that as well. I’m pleasantly surprised that my iron levels are good and that they will be able to take my blood. It only takes about 10 minutes and the phlebotomist explains that they are in a bad shortage and really need donations. I’m glad I could help and hope to make this a more regular thing. $5

7 p.m. — I make the spaghetti squash for Q. and me, and add defrosted chili. Simple and so filling. Blackberry lemon cake after, obviously. I’m back on the StockX app and Q. encourages me to pull the trigger on some sick orange Adidas Gazelles, so I do it. As mentioned before, SF styling is a far cry from NYC. We love sneakers. $160

10 p.m. — We watch a few more episodes of Reservation Dogs and head to bed.

Daily Total: $415

Day Seven

7:30 a.m. — Up to shower and head into the office via the Muni. I decide to bring my coffee because my Cometeer coffee obsession is real. I get free breakfast in the cafeteria. On the bus, I listen to Armchair Expert while playing my NYT Games. When I get into the office, I opt for an onion bialy with light cream cheese and some fruit. I head to my desk to get prepped for my morning meetings. $2.50

12 p.m. — The morning flies by. We have several client calls today and tomorrow so between prep meetings and deck work, I have been busy. My boss is in town and we grab lunch together. She’s been an excellent role model and confidante over the last two years and I’m thankful to be reporting to her. People managers really make or break your experience at work and I’m lucky to work for someone who is empathetic and kind. I have a salad with arugula, tomatoes, mozzarella, and chicken.

3 p.m. — I am finally tackling a deck I’ve been procrastinating doing all week. Ten minutes in and I realize it’s not that hard and my anxiety creates problems out of nothing. Love that for me. I have a protein bar at my desk and decide I can leave early because I did such a good job finishing my deck. I get distracted by looking at Airbnbs for Q.’s birthday weekend.

6 p.m. — Home from work and wiped out. Knowing all the meetings we have tomorrow, I will probably head to bed early. I mindlessly scroll TikTok and pull out all the leftovers we have accumulated for dinner. I make myself a wrap with the chicken, arugula, tomatoes, and this delicious sauce I keep in my fridge made of Greek yogurt, kewpie mayo, sambal oelek, and soy sauce. Q. eats the last of the shrimp pasta and we have the last of the blackberry lemon cake for dessert.

9 p.m. — We watch a documentary on doping in baseball on Netflix which I struggle to pay attention to, then head to bed.

Daily Total: $2.50

If you are struggling with an eating disorder and are in need of support, please call the National Eating Disorders Association Helpline at 1-800-931-2237. For a 24-hour crisis line, text “NEDA” to 741741.

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.