Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an unemployed consultant who spends some of her money this week on a new pair of glasses.

Occupation: Senior Consultant (before I quit my job).

Industry: Consulting

Age: 38

Location: Jersey City, NJ

Salary: $0

Net Worth: -$146,900 ($17,075.66 in a HYSA and $2,520 in my checking. No 401(k), no retirement savings, no real estate, no assets, minus debt).

Debt: $165,534 ($134,634 in federal student loans, $17,338 in credit card debt and a consolidation loan of $13,562).

Paycheck Amount: $0 as I am currently unemployed.

Pronouns: She/her

Monthly Expenses

Rent: $2,900 for a two-bedroom/one-bath “luxe” apartment that is walkable to everything. I live by myself.

Student Loans: still deferred.

Consolidation Loan: $490

Utilities: $166

Cell Phone: $37.32 for my personal phone and $0 for my business phone due to a COVID discount I got in 2020.

Subscriptions: $288 (streaming services, Patreon, YouTube Premium, Adobe, Coursera, LinkedIn, Canva, job boards and online resume services).

Medications: $160 (I have to pay full price because I no longer have health insurance).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes and no. My father is college-educated and has his bachelor’s and my mother went to college but never finished. There was sort of an expectation that I would go to college but I was never really prepared to go. During my senior year in high school, I only applied to one college and that college offered me a full-ride scholarship. But because it was out of state, my parents did not want me to go. So I took a gap year between high school and college and worked full-time at the mall to keep myself busy. I went to the same college my father went to before transferring to a private college later on. I took out Pell grants, subsidized and unsubsidized federal loans, private student loans and even had my job at the time help me out with tuition. It took me almost 11 years to finish my bachelor’s degree and my master’s degree. By the time I finished college, I was estranged from my parents so they really have no knowledge of whether I finished school or not. I am currently the only one of my siblings to graduate college.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Money brought in a lot of friction and stress in my family. My father was responsible for taking care of three families: us, his family in his native country and my mother’s family in her native country. I would have anxiety just asking my dad for lunch money, bookstore money, field trip money, even bus fare. I got my first job at 14 at my high school, making $5.50 an hour, and my parents would literally take my whole check and leave me with about $10. During my junior and senior year of high school, I had two jobs that my parents did not know about, at a grocery store and at a bank. I had to hide money from them because they would guilt-trip me in the worst way. I moved out at the age of 19 to live on campus and from there I never moved back in with my family. They resented me for that.

What was your first job and why did you get it?

My first job was working at my high school for two and a half hours a day as a peer leader for younger students. I got it because there was a program in my school district that my guidance counselor signed me up for. I loved it because I was part of a diverse community where I saw so many talented young students who just needed some guidance. As someone who is on the spectrum, it also helped me feel seen.

Did you worry about money growing up?

All the time. My father was a civil servant so the pay was low and my mother would have temp jobs. There was barely any money to have the basics, like a new backpack or a pair of comfy sneakers. My parents would always get late-night phone calls from their native country because there was always an emergency; either someone was sick or needed money for food and housing. Going to Western Union every week was dreadful because, at the time, I never understood why my parents had to be responsible for other people. Now that I am older, I understand.

Do you worry about money now?

Currently I do. I am unemployed, have very little savings, have no retirement savings, no pension, high debt and my monthly expenses are higher than ever. I know I can make a good salary in the field that I am in but I am struggling with choosing money over mental health. I had to quit my job that paid me $140,000 a year because my mental health was in shambles. Now I am back in the job market, competing with hundreds of qualified candidates for jobs that pay half of what I made. Being unemployed has made my mental health even worse.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At age 19. I paid for my books, my basic necessities and my school application fees. I had a work-study job, worked at a department store and also relied on the refund checks that I would get as an EOF student at the time. At this time, I don’t really have a financial safety net. Once I tackle my credit card debt and student loan debt, I will probably feel more secure.

Do you or have you ever received passive or inherited income? If yes, please explain.

Nope.

Day One

7 a.m. — I find it oddly suspicious how my body can magically wake up before 7 a.m. every day since I have been unemployed. I lie in bed nonetheless. I have made it a habit to check my checking account first thing in the morning to see what transactions were processed. I see that one of my credit card minimum payments is currently pending for $31. Seeing my checking account balance go down every day gives me great anxiety but there is really nothing much I can do. As I’m going through my transactions, I see an email from a job I applied to; a lovely rejection email on a Sunday morning. Love that for me.

1 p.m. — I’ve finally decided to get up from my bed after endless hours of scrolling through TikTok. I take a nice warm shower, make some coffee, take my Adderall and my vitamins, and hop back on Linkedin. Honestly, I am going through job search fatigue, it is so tiring. After submitting six Easy Apply applications, I’ve decided to prepare for my interview tomorrow, which will be with a panel of four people. I already have a decent summary of my skills and experience typed up but I’ve decided to utilize ChatGPT for a little razzle-dazzle.

6:30 p.m. — Holy guacamole! Why is the company that I will be interviewing with tomorrow announcing layoffs? Now I’m debating if I want to even go through with this interview. I really don’t want to waste any time or energy. While I am debating, I order Five Guys through Uber Eats. I order the bacon burger with grilled onions, peppers, mushrooms, jalapeños, ketchup and regular fries. I spontaneously burst into tears because internally I feel so close to giving up. Sometimes I wish I was normal and had a support system. After my crying session, I wash my face, throw in a load of laundry, eat half of my burger and watch Couples Therapy until 1 a.m. $30.57

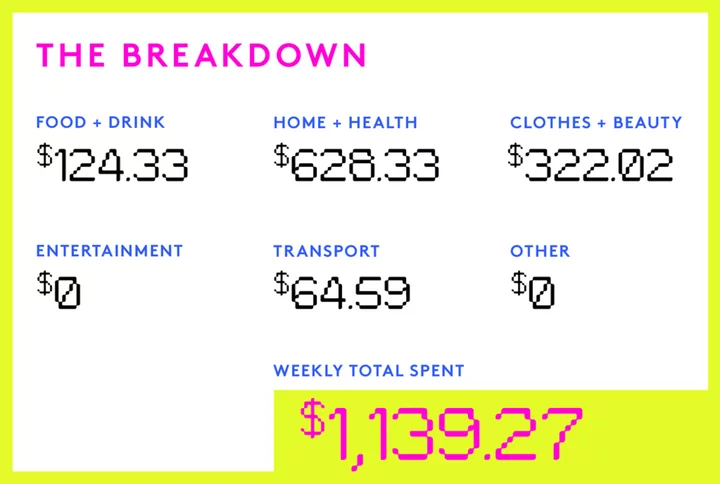

Daily Total: $30.57

Day Two

6:20 a.m. — I abruptly wake up to the sound of a freight train. I also wake up to my whole body drenched in sweat. I know I am 38 but am I having some sort of perimenopausal symptoms? I gulp down some cold water, brew some coffee and take a quick shower to wash away the sweat. After I’ve cooled down, I change my sheets and throw my comforter into the washer. I see that I am running low on detergent and other items so I place an order on Amazon Fresh. I order more hazelnut coffee creamer, a bag of onions, a large bottle of detergent and laundry sanitizer, a box of tampons, spinach, coffee grounds, frozen waffles, two cases of bottled water, a loaf of bread and three cans of chicken noodle soup. $79.20

12:30 p.m. — I have my interview in 30 minutes and I am extremely nervous. I prepped as much as I could but you never know with these panel interviewers. I move my laptop into my “office”, which is my second bedroom. While I am playing the waiting game, I book my hair appointment for this month and another one for September. I like booking ahead of time because it is easier to get weekend appointments. I pay $100 in total for the deposits for both appointments. $100

4:30 p.m. — That interview lasted almost two hours! I am drained and my anxiety is really bad. I pop an anti-anxiety med to calm me while I reflect on the interview and the role itself. I prepare for a phone screening for another role at 5. Looking for a new job is a full-time job in itself. I’m lucky that I am at least getting interviews; it’s getting an offer that has been a miss. After the phone screening, I heat up the other half of my burger, shower, then scroll TikTok for the night.

Daily Total: $179.20

Day Three

8:20 a.m. — I wake up to a text from a former coworker sending me some jobs to look into. She is so sweet! I look at the roles and they are senior level. Even though I have all of the skills, experience and expertise to be in management, I just cannot see myself in such roles. I wish I had the desire but I have to be realistic and understand that I have some limitations. I get up and get dressed to head over to LensCrafters to get myself a new pair of glasses. My current pair is holding on for dear life.

11:30 a.m. — I take an Uber over to the mall ($16.59). My prescription is going to expire soon so now is the best time to get a new pair. With the cost of the frames, lenses and all the other knick-knacks, my total comes out to $628.33. This should last me for another two years. They should be ready in a couple of days. $644.92

1:15 p.m. — I head over to a nice and empty Sephora and pick up some skincare items. I get Caudalie gel cleanser, Caudalie brightening eye cream, Topicals Faded Serum, Summer Fridays Lip Butter Balm and Laneige Cica Sleeping Mask ($167.35). There is nothing like spending money you literally don’t have. Retail therapy activates that dopamine! I see that I have some missed calls from a recruiter so I make a mental note to call them back when I get home. I call an Uber ($15.35). $182.70

4:15 p.m. — I call the recruiter back and am presented with a verbal offer! Even though this is a contract role, it is better than nothing at this time. The pay is lower but it can pay the bills. I cancel a phone screening I have planned for tomorrow. I shower, do my skincare and make dinner.

Daily Total: $827.62

Day Four

10:30 a.m. — I must have been tired because I sleep until 10. I check my bank account and more automated credit card payments have come through. I have a few missed calls and a bunch of paperwork to fill out for the new job. I take my Adderall because I will definitely need it today.

3 p.m. — I get offered an in-person interview with the company that I had a panel interview for a few days ago. I decide to move forward with the second interview since this role is permanent and full-time with really good benefits and the pay is a little bit more than the contract role. So now I have to head over to downtown NYC tomorrow at 1. I haven’t had an in-person interview in years!

7:30 p.m. — I print out copies of my resume and get my old Longchamp work bag ready with all the things I may need (my ID, my proof of vaccine card, masks, hand sanitizer, portable charger, some tampons, Motrin, a protein bar, a small notepad and pepper spray). I spend the remainder of the night reading Glassdoor reviews, showering, making dinner and laying low until I pass out.

Daily Total: $0

Day Five

11:30 a.m. — Riding the trains still makes me nervous. Downtown NYC is not far from me at all but I want to take my time and walk slowly so that I don’t break a sweat. I purchase a new MetroCard and add $21 then get on the train. I arrive about 40 minutes before the interview. I sit outside and people-watch until it’s time. $21

2 p.m. — I can’t believe I came all the way to NYC for a 30-minute interview! This could have been over Zoom! Anyway, the interview went pretty well. We shall see. I am starving so I look for a Hale and Hearty to get a tuna melt and some soup because I haven’t had them in a long time. To my surprise, they no longer exist. I decide to walk back to the subway, take the train to the mall and get Chipotle ($14.56). I then take an Uber home ($11.65) and then take some of my anti-anxiety meds to calm me down. I get overstimulated by sound and light so easily nowadays. I eat my Chipotle when I get home and then lay low for the rest of the day. $26.21

Daily Total: $47.21

Day Six

8 a.m. — Rent for next month is due and I am very conflicted. Should I dip into my emergency fund to pay my rent or should I use my credit card? My fear is seeing my emergency fund decrease and go below a certain amount (I quit my job with $26,000 in savings and now I have $17,000). Currently I have a little over $2,000 in my checking that I can also use. After much internal debate, I decide to pay my rent using my credit card. I know it is frowned upon but at this point I need to do what will put me at ease (at least temporarily). Who would’ve known that paying rent induces anxiety?!

6:15 p.m. — Where do people buy work clothes nowadays? Many of my favorite stores have closed down but I need new clothes if I’m going to go back to an office. Express is a little too pricey for me so I check out Kohl’s. I order a pair of slacks and two blouses for $54.67. Not bad for that price. Hopefully they fit because dressing up as a plus-size woman is very hard. I end the day by watching The Mother on Netflix. $54.67

Daily Total: $54.67

Day Seven

10:30 a.m. — I wake up to the sound of my neighbor’s smoke detector going off. I guess they are burning that bacon again. I also wake up to some painful cramps. I take some prescription-strength ibuprofen because having endometriosis and fibroids is disastrous around this time of the month. I drink two bottles of water, take a long hot shower, make some hibiscus tea and lie on the couch with my heating pad. I put on some YouTube videos and watch vlogs throughout the day.

7:30 p.m. — I decline a FaceTime call from my sister. I am not in the best mood so I’d rather not speak to anyone at this time. Plus, I am not in the mental space for anyone venting to me. It is very easy for me to go weeks without talking to anyone. I want to break out of that cycle but it is extremely hard. I look around the kitchen for something to eat, even though I am not all that hungry. I decide to heat up frozen dumplings from Trader Joe’s and snack on some mandarins. Then I watch TV for the rest of the night.

Daily Total: $0

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.