Even after a record slump that wiped out €21 billion ($23 billion) in value, some investors think Adyen NV still looks too expensive, especially compared to rivals like PayPal Holdings Inc.

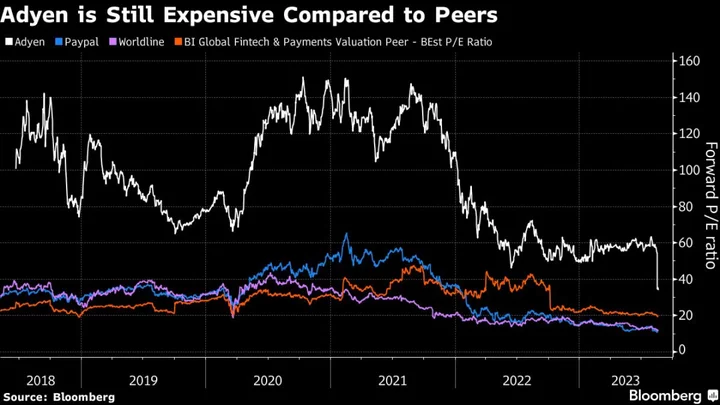

Shares in the European payments processing firm have fallen 46% since it reported a sales slowdown last week, including a record one-day drop. Despite that, Adyen trades at 33 times forward earnings, well above the 19 times average among payments companies in a Bloomberg Intelligence index. PayPal and Worldline SA both have valuations below 12 times.

That’s left many investors and analysts wary about buying the stock anytime soon.

“I am not sure it is a good time to buy Adyen right now, even if the correction has been extreme,” said Cedric Ozazman, head of investments at Mirabaud & Cie SA. “I believe the stock is a ‘dead money investment’ over the next couple of months.” He recommends waiting for the company’s next results to see if there’s a good opportunity to buy the shares.

Analysts — many of whom were caught off guard by the deceleration in sales growth in the first half — have been rushing to reset their expectations. At least five have downgraded the stock, while Citigroup Inc.’s Pavan Daswani — one of the few to hold a sell rating prior to the results — sees more downside amid aggressive competition in the payments sector and high spending by Adyen on new hires and other investments.

Daswani said investors had priced Adyen for perfection. “I don’t think you’re going to get back to the sort of high multiples that the name had” during the past few years, he said on Friday.

The former fintech darling’s extreme valuation helped set the groundwork for last week’s shocking slump. Before the results, Adyen was priced at about 54 times projected profits, and was among the ten most expensive stocks in the whole of Europe’s benchmark Stoxx 600.

“Absolute valuation was completely overstretched over the last couple of years, with a premium vs the Stoxx 600 close to 10 times. Vs European peers such as Wordline, it was also extreme,” said Mirabaud’s Ozazman.

But some are staying positive, and think that Adyen’s premium is justified.

Jim Tehupuring, director at Dutch wealth management company 1Vermogensbeheer, said that the current stock price is “very attractive,” though it may take several years for the shares to recover from the recent report as Adyen needs to rebuild trust with investors. 1Vermogensbeheer holds a position in Adyen.

“Adyen is still growing at an impressive speed and has lots of opportunities ahead,” he said in an email, adding that the company’s investments in personnel will ultimately pay off.

One thing that bulls and bears agree on is that Adyen needs to do better in its communication with investors. It only reports on a half-year basis, while many rivals report quarterly, leaving analysts to rely on merchant data and commentary from other payments companies for clues.

Limited financial communication is partly what caused expectations to go so high, according to Citi’s Daswani. And Tehupuring said Adyen’s management should work on improving investor relations with more trading updates or quarterly results and more guidance.

Tech Chart of the Day

Nvidia Corp. shares have been on tear this year, surging more than 220% because of excitement around its artificial intelligence products. However, analysts still think the stock has room to run, raising their price targets ahead of results scheduled for Wednesday. The current average target among analysts tracked by Bloomberg implies upside of about 11%.

Top Tech Stories

- Microsoft Corp.’s $69 billion Activision Blizzard Inc. acquisition got a new chance at winning approval from UK regulators after the tech giant submitted a substantially different deal to the country’s antitrust watchdog.

- Microsoft said it will give Ubisoft Entertainment SA the cloud streaming rights for all of Activision Blizzard’s console games released in the next 15 years in order to placate regulators reviewing its $69 billion deal for the Call of Duty maker.

- SoftBank Group Corp.’s Arm Holdings Ltd. took a step toward what’s set to become the biggest US initial public offering of the year, a bet that the once-obscure designer of phone chips can flourish in the era of artificial intelligence computing.

- As it seeks to pull off what could the largest initial public offering of the year, Arm Holdings spent more than 3,500 words explaining the risks it faces in China, a critical market that accounts for about a quarter of its revenue.

- Amazon.com Inc. illegally called the police on employees, restricted discussions about organizing, and terminated an activist in the lead-up to a vote on unionization last year, US labor board prosecutors alleged in a complaint.

Earnings Due Tuesday

- Premarket

- GDS Holdings

- Kingsoft Cloud

- IQiyi

- Baidu

- Postmarket

- N/A