Citigroup Inc. strategist Scott Chronert says the first-wave of artificial-intelligence breakthroughs lifted the stocks of companies like Nvidia Corp. that are at the center of it all. The second will elevate the market at large.

It’s a familiar pattern for technological innovation, from nineteenth-century railroads to the development of the Internet. But when it comes to AI, Chronert sees it happening with relatively rapid speed: He says it may become ingrained in the operations of a wide range of businesses in as little as two years, boosting earnings with cost savings and productivity gains.

“What we think happens more broadly is an acceleration of a trend already underway, where the bulk of Corporate America is utilizing the technology as a way of better managing their business on a real-time basis, which actually means less earnings volatility and probably even less cyclical volatility,” Chronert said in an interview.

“It gives the market in general a new growth thing, and we haven’t really had a new growth thing for some time,” he said.

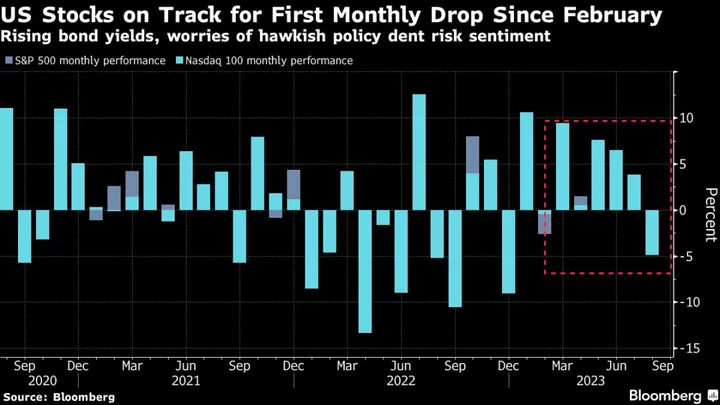

The excitement about artificial intelligence was a key pillar of the stock market’s rally this year, turning Nvidia into the best-performing stock in the S&P 500 Index as the share price tripled on the back of sales of its high-powered computer chips to companies investing in the technology. While the market’s gains stalled on concern about the scale of the run-up and further rate hikes from the Federal Reserve, the tech-heavy Nasdaq 100 Stock Index is still up some 37% this year.

And on Monday, the S&P 500 was headed toward its first back-to-back gain this month, with Nvidia among the top drivers of the advance.

Wall Street banks remain optimistic about AI’s potential applications and are busy gaming out which corners of the stock market stand to benefit. Strategists at Goldman Sachs Group Inc., for example, foresee a large jump in the earnings per-share of the companies it’s tracking that may gain most from the new technology.

According to Chronert, the release of first-quarter earnings prompted a rush into anything AI related after revealing how a handful of the biggest companies, like Microsoft Corp. and Amazon.com Inc., were planning to deploy it. In the second quarter, however, the attention shifted to how the impact will be felt more broadly — setting the stage for it to start cropping up in a wider array of stock prices.

Chronert upgraded his year-end target on the S&P 500 to 4,600 from 4,000 earlier this summer on expectations for earnings growth next year and rising optimism that the Fed can engineer a soft landing for the economy, while admitting that the bank failed to foresee the surge in tech stocks. The S&P 500 closed at a little over 4,400 Friday.

Chronert said Citigroup’s target incorporates expectations that the market will be buffeted by further volatility.

“You reign in expectations and you don’t set yourself up for disappointment as much going forward,” he said. “When we raised our target, we were very clear, we want be more aggressive on pullbacks to give us a little bit better opportunity in the end of the year.”