Alex Mashinsky claimed he was different.

The 57-year-old was the affable, approachable adult of crypto. He boasted that he was an entrepreneur with a track record of success, even before launching digital currency lending platform Celsius Network.

He called his customers “Celsians” and said he was on their side. With Celsius, they could stick it to the greedy banks and help the less fortunate. When he told them they could earn yields of as much as 18% with little risk, they believed him.

Many even stuck with him in May 2022, when the crypto rout was roiling the industry and tanking the platform’s proprietary token.

“We all have our money in the same platform,” he told them. “I have millions of dollars of my money on the platform as well. And obviously we are in it together, all right? We are going to make it through this.”

It turns out it was all a lie, according to US prosecutors.

Days after they unsealed a 46-page indictment, details are emerging of a man who, not unlike other disgraced crypto titans, used his ability to gain the trust of investors, only to allegedly dupe them and enrich himself.

As Mashinsky was telling his followers to hold fast, he was pulling millions of dollars worth of crypto from his Celsius accounts, well aware that the company he billed as a modern-day bank (but was in fact little more than a speculative investment fund) was about to fail, the Department of Justice claims. About two weeks later, Celsius — which at its peak managed about $25 billion in assets — stopped customer withdrawals. By mid-July, it was bankrupt.

“Alex deserves everything he is getting,” said David Silver, a lawyer who specializes in investment fraud, with a focus on cryptocurrency litigation. “As a master marketer, he took advantage of hundreds of thousands of people and separated them from their life savings, permanently.”

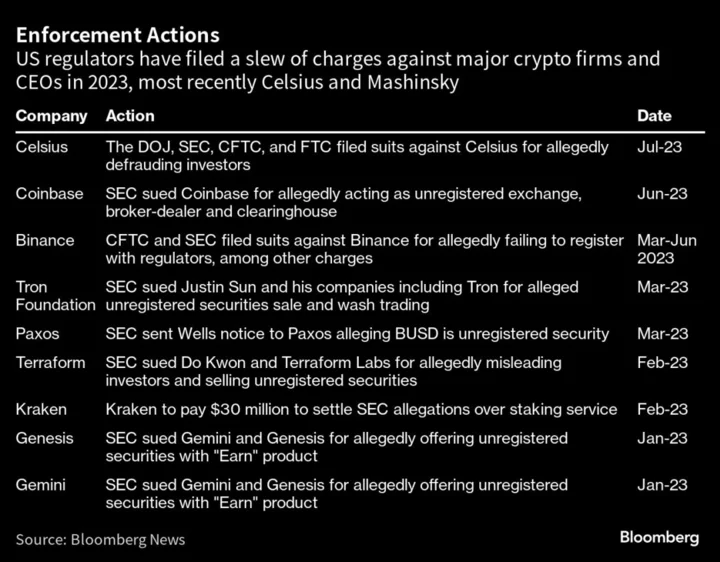

Mashinsky was arrested and charged with wire fraud and other crimes last week, the same day the indictment was unsealed. He pleaded not guilty at a hearing in New York. The Securities and Exchange Commission, the Commodity Futures Trading Commission and the Federal Trade Commission also filed lawsuits against him.

Mashinsky and his lawyer Jonathan Ohring didn’t respond to requests seeking comment. Ohring said in a July 13 statement that Mashinsky “looks forward to vigorously defending himself in court against these baseless charges.”

The falsehoods alleged in the indictment are numerous, and can be traced to the firm’s very beginning.

After Celsius’s initial coin offering roughly five years ago, Mashinsky claimed the company raised $50 million by selling all of its native digital currency made available. In reality, it only raised $32 million, failing to sell more than a third of the tokens it offered, the DOJ alleges.

The way Celsius deployed customer assets also bore little resemblance to Mashinsky’s statements, government enforcers allege. He claimed that Celsius used a market-neutral strategy, and wasn’t making so-called directional bets — taking short or long positions in various coins. In fact, the company “was regularly using customer coins to take risky bets on the future value of various crypto assets, often at Mashinsky’s express direction.”

Certain bets resulted in “significant losses” of customer assets, the indictment said.

Mashinsky also claimed that all loans extended by Celsius were fully or partially collateralized. In reality, uncollateralized loans made up a significant part of its portfolio, the DOJ alleges.

And while Mashinsky said the company was profitable, it was, in appears, highly unprofitable. In early May 2022, an internal presentation to Celsius’s board said that the company had suffered a pretax loss of approximately $800 million in 2021. It was also not profitable in 2022, according to the indictment.

Mashinsky was, in many ways, an easy person to root for — an underdog who seemingly came from nothing and made it through sheer force of will.

When he was 7, his family moved from what was then the Soviet Union to Israel. The Russian border patrol took his only toy, he’s recounted in podcasts.

After living in Israel for 16 years and briefly studying economics, he started trading commodities, like sugar and fertilizer, he told the Vincent Everts podcast.

He made his way to the US about 30 years ago. His website claims he’s known for inventing VoIP, or voice over internet protocol, though early pioneers in the industry have refuted that.

Still, he was involved in the space as founder of Arbinet, an online exchange where companies could buy and sell network capacity. It went public in 2004, and peaked at a valuation of about $800 million. But by then Mashinsky had long since been replaced as chief executive.

Prior to getting involved in crypto, he founded Q-Wireless, which was one of four companies that made up Transit Wireless, a joint venture that won a contract in 2007 to install wireless service in New York City subway stations.

He helped start Celsius in 2017, raising funds through an initial coin offering and eventually growing it into multibillion-dollar business.

Crypto is starved of people with seemingly “legitimate backgrounds who have built successful companies, raised billions of dollars of capital, and had profitable exits,” said Rayne Steinberg, CEO at Arca, which specializes in digital assets. “This factor, combined with Alex being very promotional, served as a powerful combination to persuade so many people to invest in Celsius.”

It was his power of self-promotion that allowed Mashinsky to allegedly con so many out of so much.

One of his calling cards were weekly “ask-Mashinsky-anything” video chats, where he would preach the virtues of Celsius, promote the robust risk-management practices of the company, and sprinkle in everyday life lessons and philosophical musings that allowed him to connect with ordinary investors.

A recurring theme was that the traditional banking system had failed people, and that Celsius was different.

But the roughly hour-long videos (Mashinsky recorded almost 200 of them) were often so riddled with half-truths and outright lies that company employees regularly had to edit them, according to the indictment.

Desperate Pleas

Since Celsius filed for bankruptcy, hundreds of letters from people pleading for help recovering their life savings have been filed with the court.

“I write to you to let you know the devastating impact that Celsius is having on my life,” wrote one distraught alleged victim. “We did so much research and thought Alex (CEO) was trustworthy, having a family of his own.”

Several people said they contemplated suicide after investing everything they had with Celsius.

“There was a mystique and an aura that drew people in,” said Toby Lewis, chief executive officer of crypto analytics company Novum Insights, who met Mashinsky at an industry event. “He was a good communicator.

“Once they got to scale very few people questioned” him, Lewis added.

--With assistance from Zeke Faux and Ava Benny-Morrison.