Alibaba Group Holding Ltd. shares jumped in Hong Kong trading after Reuters reported that China is likely to announce a fine of more than 8 billion yuan ($1.1 billion) on its fintech affiliate, drawing a line under the probe into the firm founded by Jack Ma.

China’s central bank is expected to disclose the fine against Ant Group Co. as soon as Friday, Reuters said, citing people with knowledge of the matter. That will allow Ant to seek a financial holding company license, revive growth and eventually resurrect plans for an initial public offering, it added.

Alibaba’s shares surged as much as 6.4% in Hong Kong, the most in about a month.

“The market likes it because scrutiny looks likely to be over and the fine, though big in absolute terms, is very manageable for such a big company,” said Vey-Sern Ling, managing director at Union Bancaire Privee. An 8 billion yuan fine would be less than the estimated 9.6 billion yuan profit that Ant generated in the December quarter.

The probe into Ant marked the symbolic start of a withering crackdown on the broader Chinese internet industry, which wiped hundreds of billions of dollars off the value of sector leaders from Alibaba to Tencent Holdings Ltd. Allowing the fintech giant to resume business growth would kindle hopes that Beijing will finally unfetter its giant private sector, part of a nationwide effort to resuscitate a flagging economy.

Ant Group didn’t immediately respond to a Bloomberg request for comment.

Regulators killed Ant’s IPO in 2020 after Ma angered Beijing with a public critique of financial regulators. The government began a clampdown on the private tech sphere shortly after, accusing Alibaba of monopolistic behavior before levying a record fine for the alleged violations.

Even if Beijing lifts the clamps on Ant, the years of relentless scrutiny have reduced the billionaire’s empire to a shadow of its former self.

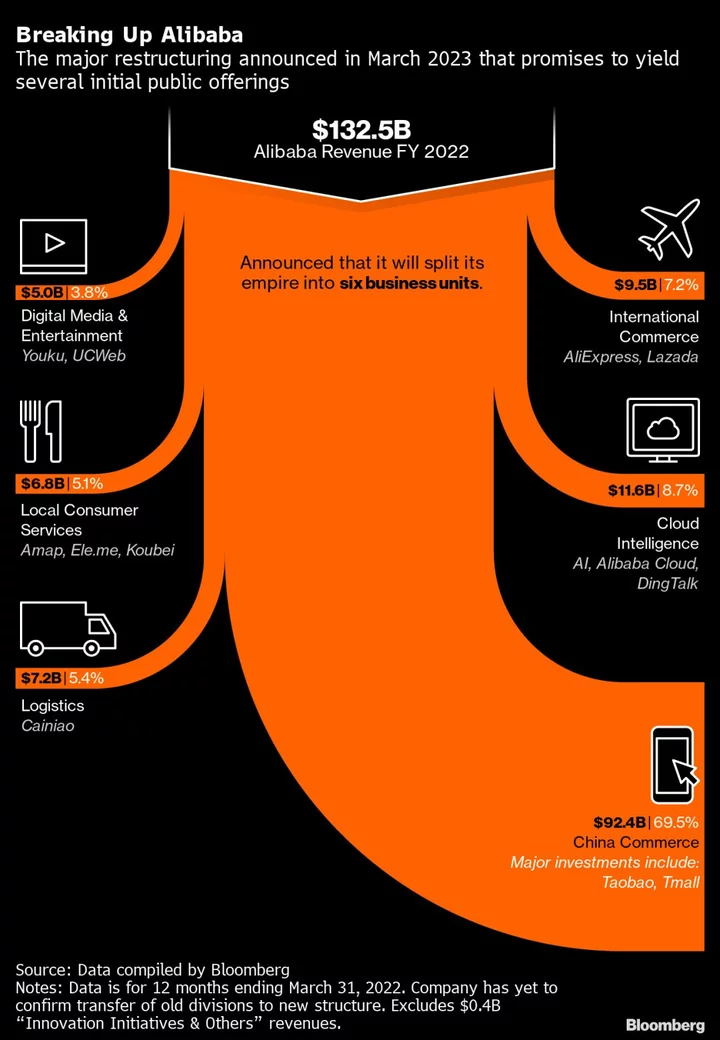

Ant’s bottom line has eroded since the days it was preparing for the world’s largest IPO in 2020, while Alibaba is in the process of splitting into six main businesses from cloud services to meal delivery and logistics. While investors initially cheered the potential creation of value, Alibaba’s shares have come off their 2023 highs and have shed more than $600 billion of their value since the Ant episode began.

The central bank ordered Ant to fold all financial units into a holding company in 2021. It also told the firm to open up its payments app to competitors and sever improper linking of payments with other products including its lending services.

Market watchers had since been awaiting the conclusion of the probe to gauge Beijing’s stance on China’s sprawling internet sector. Authorities had pledged to unwind crackdowns that ensnared private sectors from technology to online education, at a time when the world’s second-largest economy is struggling to get back on its feet.

While the latest development may signal Beijing’s efforts to follow through on its pledges to support the sector, more solid actions may be required to stabilize investor confidence. Ant is still awaiting a regulatory greenlight to start reviewing its application for setting up the financial holding company and resume its IPO in the longer run.

“Ant is a very different company from before with all the restrictions in place and its valuation should be much smaller,” Ling said.

While Ant fetched a valuation of $280 billion pre-IPO, the myriad regulations imposed over the past two-plus years mean it’s now worth a fraction of that, as it’s now more “fin” than “tech.”

Ma gave up his controlling rights of Ant earlier this year, complicating its prospects for an IPO anytime soon.

Companies can’t list domestically on the country’s so-called A-share market if they have had a change in control in the past three years — or in the past two years if listing on Shanghai’s STAR market, which is geared toward new technology companies. For Hong Kong’s stock exchange, this waiting period is one year.

--With assistance from Edwin Chan, Zheng Li and Charlotte Yang.