Asian equities were poised for a cautious open Tuesday as White House and Republican congressional leaders stepped up lobbying to ensure Congress passes a debt-accord to head off a US default.

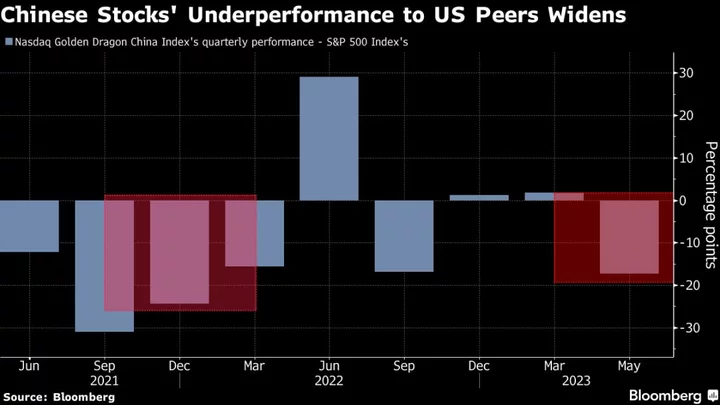

Futures for Japan and Australia pointed to the slimmest of moves when those two markets open, while contracts for Hong Kong suggest more declines. A key gauge of Chinese shares is within a whisker of a bear market as a wobbling economic recovery, intensifying geopolitical tensions and a weaker yuan kept investors away.

Contracts on the S&P 500 and Nasdaq 100 rose 0.3% and 0.5%, respectively, as they opened in Asia after each making small gains Monday in holiday-thinned trading. US markets were closed for Memorial Day. European stocks wavered in muted holiday-affected trading Monday.

The dollar, which has benefited from angst around the statutory borrowing limit, was little changed early Tuesday. Treasury futures linked to the 10- to 30-year part of the US government bond market rallied on light volume Monday.

A rebound for Chinese equity benchmarks would require a monetary catalyst or improving ties between Beijing and Washington, in addition to rosier macro data, said Hebe Chen, market analyst for IG. “It’s probably safe to say this reopening has lost its steam,” she said.

Environmentalists, defense hawks and conservative hard-liners have condemned concessions made by President Joe Biden and Republican House Speaker Kevin McCarthy to reach an accord. on the debt ceiling. Biden has been personally calling lawmakers to support the bill, which is due to be voted on by the House on Wednesday.

Key events this week:

- Eurozone economic confidence, consumer confidence, Tuesday

- US consumer confidence, Tuesday

- Richmond Fed President Thomas Barkin interviewed by NABE as part of monetary policy webinar series, Tuesday

- China manufacturing PMI, non-manufacturing PMI, Wednesday

- US job openings, Wednesday

- Fed issues Beige Book economic survey, Wednesday

- Philadelphia Fed President Patrick Harker has fireside chat on the global macro-economy and monetary conditions, Wednesday

- Boston Fed President Susan Collins and Fed Governor Michelle Bowman speak in Boston, Wednesday.

- ECB issues financial stability review, Wednesday

- China Caixin manufacturing PMI, Thursday

- Eurozone HCOB Eurozone Manufacturing PMI, CPI, unemployment, Thursday

- US construction spending, initial jobless claims, ISM Manufacturing, light vehicle sales, Thursday

- ECB issues report its May 3-4 monetary policy meeting. ECB President Christine Lagarde speaks at German savings banks conference, Thursday

- Philadelphia Fed President Patrick Harker speaks on economic outlook at NABE’s webinar, Thursday

- US unemployment, nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 7:28 a.m. Tokyo time.

- Nasdaq 100 futures rose 0.5%

- Nikkei 225 futures were little changed

- Australia’s S&P/ASX 200 Index fell 0.2%

- Hang Seng futures fell 0.9%

Currencies

- The euro was little changed at $1.0709

- The Japanese yen was unchanged at 140.45 per dollar

- The offshore yuan was little changed at 7.0857 per dollar

- The Australian dollar was little changed at $0.6541

Cryptocurrencies

- Bitcoin fell 0.4% to $27,591.63

- Ether fell 0.3% to $1,888.11

Commodities

- West Texas Intermediate crude rose 0.5% to $73.03 a barrel

This story was produced with the assistance of Bloomberg Automation.