Asian equities were headed for gains after US stocks rallied on signs of optimism from debt-ceiling talks, allowing investors to refocus on the path for interest rates and the health of the banking system.

Futures contracts for Japanese and Hong Kong stocks advanced more than 1%, while those for Australian shares also rose. US futures were muted in early Asian trading after the S&P 500 and the Nasdaq 100 closed near highs of the day, up over 1%.

President Joe Biden expressed confidence there will be no default, and House Speaker Kevin McCarthy said reaching an agreement this week is “doable.” JPMorgan Chase & Co. chief Jamie Dimon said the US government “probably” will not default on its debts after he and other bank leaders met in Washington to discuss the debt limit.

Australian and New Zealand bond yields climbed following a slide in Treasuries. The yield on the two-year US note rose seven basis points, and the 10-year rate added three basis points to 3.56%. The Bloomberg dollar index was steady after rising 0.2% Wednesday to close at the highest level since March.

Australian employment data due later today are expected to show fewer jobs were created in April than March with unemployment remaining at 3.5%. The Philippines is forecast to hold interest rates at 6.25%. New Zealand’s finance minister will deliver the country’s budget Thursday, with economists expecting a return to surplus in 2026, a year later than predicted in the December fiscal update.

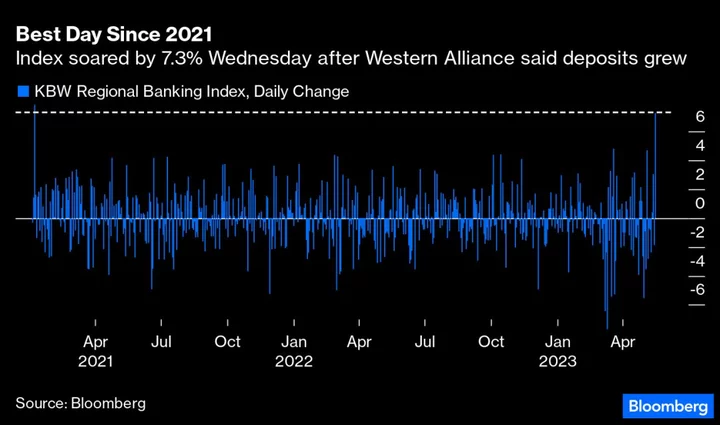

A rally in regional banks after Western Alliance Bancorp reported growth in deposits boosted sentiment and eased worries about the health of the industry. All members of the KBW Regional Banking index advanced, pushing the benchmark 7.3% higher for its best day since January 2021.

In late trading, Cisco Systems Inc. dropped after the networking company reported its third-quarter results and gave an outlook. While the report was better than expected overall, Vital Knowledge noted some weakness in underlying numbers.

Alibaba Group Holding Ltd. results are due later today after Tencent Holdings Ltd. posted its fastest revenue growth in more than a year. Walmart Inc. will report on Thursday in the US.

European Central Bank Vice President Luis de Guindos said the ECB has completed most of its tightening but there is still “a way to go.”

Key events this week:

- US initial jobless claims, Conference Board leading index, existing home sales, Thursday

- Japan CPI, Friday

- ECB President Christine Lagarde participates in panel at Brazil central bank conference, Friday

- New York Fed’s John Williams speaks at monetary policy research conference in Washington; Fed Chair Jerome Powell and former chair Ben Bernanke to take part in panel discussion, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:24 a.m. Tokyo time. The S&P 500 rose 1.2%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 1.2%

- Nikkei 225 futures rose 1.5%

- Hang Seng futures rose 1%

- S&P/ASX 200 futures rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0838

- The yen was little changed at 137.55 per dollar

- The offshore yuan was little changed at 7.0108 per dollar

Cryptocurrencies

- Bitcoin rose 0.3% to $27,425.92

- Ether fell 0.2% to $1,823.58

Bonds

- The yield on 10-year Treasuries advanced three basis points to 3.56%

- Australia’s 10-year yield advanced five basis points to 3.48%

Commodities

- West Texas Intermediate crude fell 0.2% to $72.70 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.