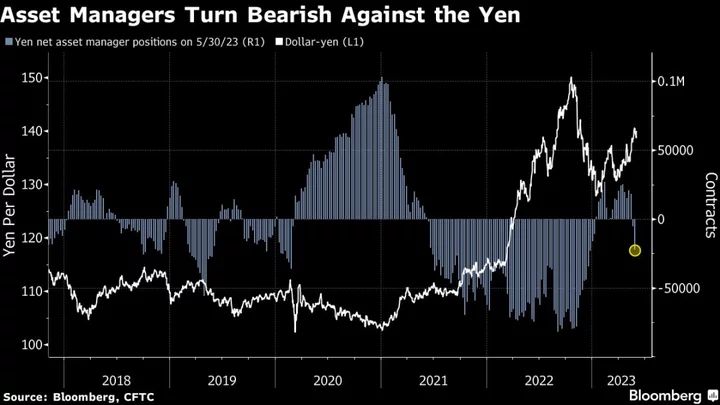

Asset managers joined hedge funds in increasing yen-bearish positions amid speculation the Bank of Japan isn’t likely to rush to adjust its ultra-easy monetary policy.

A week after leveraged funds increased net shorts on the yen to the most in almost a year, asset managers boosted such positions to the biggest so far for 2023 in the five days through May 30, Commodity Futures Trading Commission data show. The managers were net sellers for two straight weeks after being net buyers for 11 consecutive weeks.

The Japanese currency lost 4.7% in the two months through May against the dollar, the second-worst performer among its major currency peers, and reached a six-month low of 140.93 on May 30.

“There’s reassurance about selling the yen as the BOJ will likely keep its negative interest rate policy, while other global central banks have raised their policy rates,” said Kengo Suzuki, senior market strategist at Mizuho Bank Ltd. in Tokyo. Still, yen weakness may be “limited because of factors from the US side such as concerns about an economic slowdown and a potential pause of Federal Reserve’s tightening, which will then turn to a rate cut eventually.”

There appears to be underlying concern that Japan’s Ministry of Finance will order intervention, and speculation on that may deepen should the yen fall beyond 145 per dollar, limiting declines in the local currency. The BOJ, MOF and Financial Services Agency held a meeting on May 30 for the first time since March, and top currency official Masato Kanda said afterward that the government would take action if needed.

“The dollar-yen weakened just by holding the three-way meeting which indicates market’s concern,” Suzuki said. “However, with the US tightening nearing its peak or some economic slowdown risk in the US, the pair is unlikely to reach 145 where the real threat of intervention will likely emerge.”

The US currency’s gain may be limited to around 142 yen and then move toward 130 by year-end, he said.