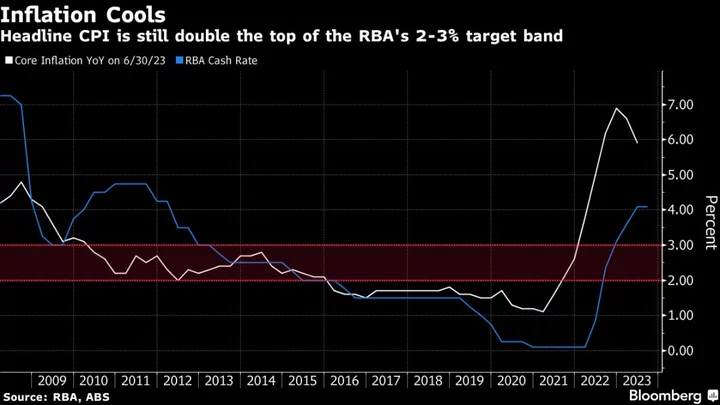

Australia’s central bank kept its key interest rate unchanged on Tuesday following a cooling of inflation pressures and weaker household spending, while keeping the door ajar to future hikes.

The Reserve Bank left its cash rate at 4.1% for a second straight meeting, wrongfooting a majority of economists but in line with market expectations. The second-straight pause suggests the RBA may be approaching the end of its tightening cycle.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks,” Governor Philip Lowe said in his post-meeting statement.

The Australian dollar slipped to 66.71 US cents at 2:32 pm in Sydney while the rate-sensitive three-year government bond yield dropped to 3.82%.

The decision highlights the RBA’s more cautious approach to policy compared with the Federal Reserve, which last week raised by a quarter-point to take its cumulative rate increases to 5.25 percentage points.

That’s well ahead of 4 percentage points in Australia and partly reflects the rapid pass-through of hikes to the nation’s borrowers, who are mainly on floating-rate mortgages whereas most in the US are on 30-year fixed rates.

Lowe has put the central bank into data-dependent mode, monitoring consumer spending, labor costs, business surveys and inflation for guidance. Figures last week showed a slowing in CPI and a surprising fall in retail sales, while data from Equifax indicated a rising trend of missed mortgage payments.

Tuesday’s hold also reflects the governor’s efforts to maintain some of the job gains made during the pandemic as he brings down inflation.

The long and variable lags associated with monetary policy are another reason the RBA is moving cautiously. The ongoing expiry of a batch of home loans fixed at record low rates during the pandemic remains a cloud on the horizon.

Economists expect the RBA will need to increase borrowing costs at least one more time to 4.35%, pointing to the nation’s ultra-low unemployment of 3.5% and core inflation still around 6%, double the top of the target.

Lowe has acknowledged the path to a soft landing is “narrow,” while reiterating that the bank will do what it takes to bring inflation back to target.

--With assistance from Tomoko Sato and Edward Johnson.