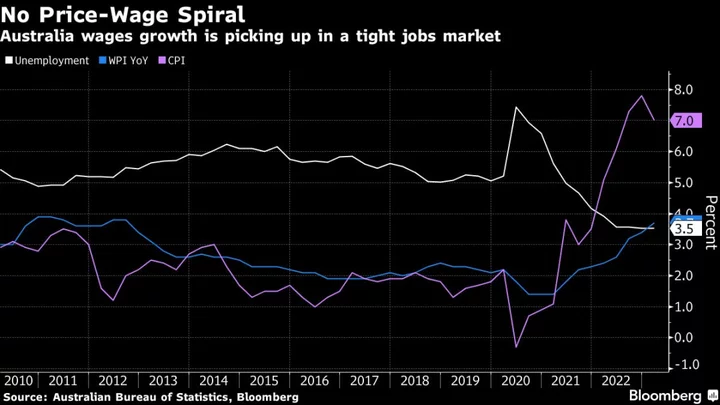

Australian salaries rose at around half the pace of inflation in the first three months of 2023, suggesting the economy will avoid a wage-price spiral and bolstering the case for the central bank to stand pat in June.

The Wage Price Index advanced 3.7% from a year earlier, slightly above economists’ expectations of a 3.6% gain, Australian Bureau of Statistics data showed Wednesday. On a quarterly basis, wages climbed 0.8% versus a forecast 0.9% rise.

The data suggest wage growth is relatively contained compared with global counterparts from Washington to Wellington and remains detached from inflation that’s currently running at 7%. That reinforces expectations the Reserve Bank will keep borrowing costs unchanged at its June 6 meeting and may have reached the peak of its tightening cycle.

“As there is no current wage breakout problem in Australia, there is no urgency for the RBA to lift the cash rate” next month, said Diana Mousina, deputy chief economist at AMP Capital Markets Ltd. “However, the risks to wages growth in the near-term are tilted to the upside, especially if the labor market remains stronger than expected.”

The RBA is closely monitoring labor costs and this week highlighted the risk of a shift in wage-setting behavior if consumer-price growth remains elevated for a prolonged period. The central bank is trying to keep inflation expectations anchored to its 2-3% target.

Worries about upside risks to inflation amid a very tight labor market prompted the central bank to deliver a surprise rate hike this month, minutes of the meeting showed Tuesday. The RBA has boosted borrowing costs by 3.75 percentage points since May last year to take the cash rate to an 11-year high of 3.85%.

The central bank says further tightening may still be needed, but it will depend on how the economy and inflation evolve. Some economists including Goldman Sachs Group Inc. expect the bank to hike by another quarter percentage point.

What Bloomberg Economics Says...

“Australia’s wage growth is likely to peak in 2H23, before a cooling economy and rising unemployment see the pace of pay gains ease back. With runaway wage growth no longer an inflation threat the central bank has elevated concerns about sluggish productivity in order to support its tightening bias.”

— James McIntyre, economist

The RBA’s own forecasts show growth in the Wage Price Index will peak at 4% this year, down from a previous expectation of 4.2%. That comes as the central bank now sees unemployment hitting 4% by December, up from its February forecast of 3.8%.

On Thursday, employment data are forecast to show the jobless rate held near a 50-year low of 3.5% in April even after 11 rate increases.

One of the reasons that economists expect Australia will avoid the sort of wage-price spiral that has erupted in some other developed countries is that immigration is surging, boosting labor supply and reducing the bargaining power of employees.

Policymakers are waiting on the outcome of next month’s annual wage review by Australia’s Fair Work Commission. The current national minimum wage is A$21.38 ($14.23) per hour. Employer groups have argued for a 3.5% rise whereas the labor union is calling for a 7% increase on top of the FWC’s 5.2% rise last year.

--With assistance from Tomoko Sato.

(Adds comments from economists in fourth, eighth paragraphs.)