Australian retail sales rebounded surprisingly strongly in July, suggesting the nation’s heavily indebted households retain spending power even after the Reserve Bank’s 12 interest-rate increases.

Sales advanced 0.5% from a month earlier, when they declined 0.8% and compared with estimates for a 0.3% rise, Australian Bureau of Statistics data showed Monday. The jump was driven by non-food industries.

“The rise in July was boosted by additional spending at catering and takeaway food outlets linked to the 2023 FIFA Women’s World Cup and school holidays,” said Ben Dorber, ABS head of retail statistics.

The strength in household spending jars with downbeat consumer sentiment and raises questions over whether the RBA needs to do more to curb demand and cool prices. Policymakers will now turn their attention to monthly inflation data on Wednesday to further inform their thinking ahead of next week’s September rate meeting.

The Australian dollar and the yield on policy-sensitive three-year government bonds held earlier gains after the data, with the currency trading as high as 64.40 US cents.

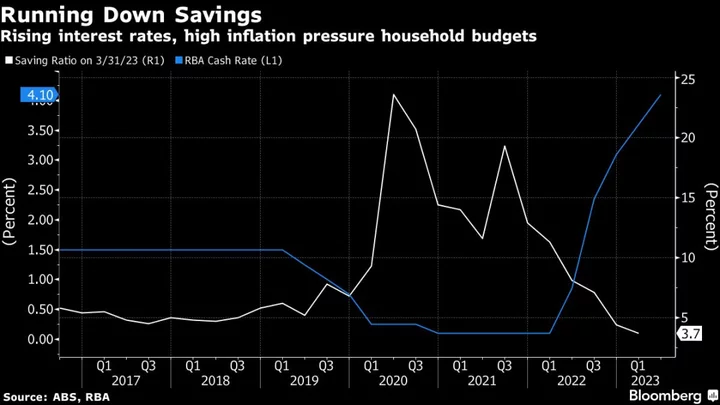

The RBA left the cash rate at 4.1% earlier this month to assess the impact of its rapid-fire hikes that began in May 2022, while keeping the door ajar to further tightening. Retail sales are an important factor in rate decisions given that consumption accounts for roughly 60% of gross domestic product.

A potential headwind to spending is the large number of mortgages that were fixed for three years at record low rates during the pandemic and are being switched to higher floating rates, with the majority due in September.

Commonwealth Bank of Australia, the nation’s largest lender, estimates that only two-thirds of the RBA’s 4 percentage points of hikes have so far passed through to its borrowers.

Economist Stephen Wu said CBA lending data showed A$52 billion ($33 billion) of fixed-rate loans are due to expire in the second half of the year following the maturity of A$34 billion in the six months to June.

Today’s retail report showed:

- Department stores advanced 3.6%, recording the largest rise, followed by clothing, footwear and personal accessories at 2%

- Cafes, restaurants and takeaway food services rose 1.3%

- Household goods retailing recorded a second consecutive fall, declining 0.2%

Bloomberg Economics expects weakness through the rest of 2023 as the full impact of policy tightening flows through to household budgets. Economist James McIntyre said the outlook for retail sales remains challenging despite strong employment, rising wages, increasing population growth and house prices climbing once more.

--With assistance from Tomoko Sato and Matthew Burgess.

(Adds further details from report.)