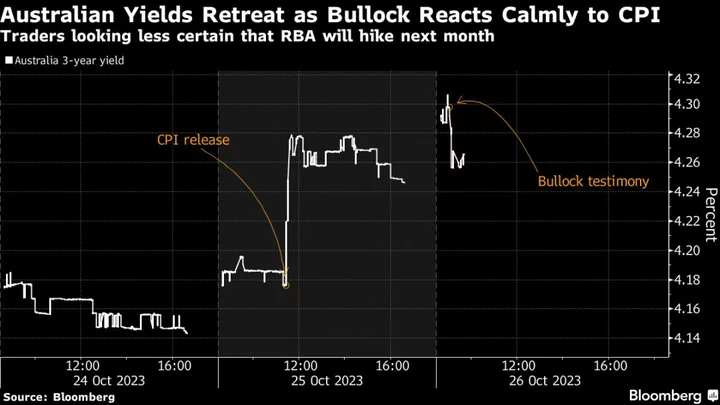

Australia’s third-quarter inflation report came in “pretty much where we thought,” Reserve Bank Governor Michele Bullock said Thursday, sending government bond yields and the currency sliding.

Bullock said the figures released on Wednesday were higher than the RBA’s August forecasts, but based on information since then, including the monthly CPI indicator, “we thought it was going to be about where it came out.”

Bullock was speaking during testimony to a parliamentary panel in her first remarks since hotter-than-expected inflation prompted money markets and some economists to call a 25-basis-points hike next month. That would lift the cash rate to 4.35% — a level not seen since November 2011.

Her comments Thursday pushed the Australia dollar down to the lowest level since November 2022 and saw the policy-sensitive three-year government bond yield pare its opening advance. Money market bets also eased, now implying a 60% chance of a Nov. 7 rate hike, down from 80% on Wednesday.

Despite that, Westpac Banking Corp. Chief Economist Luci Ellis said she now anticipates a rate hike next month, a reversal of the bank’s previous expectation of a fifth straight pause at 4.1%. That now means all four major Australian lenders expect a hike on Nov. 7.

“We do not take any signal from the governor’s parliamentary testimony this morning on the interpretation of the CPI data,” Ellis, previously an assistant governor at the RBA, said in a research note.

“Having spelled out so clearly that a material surprise to the outlook would warrant a rate increase, she simply had to be equivocal to avoid front-running the board’s decision, which is still more than a week away,” Ellis said of Bullock’s comments.

Earlier this week, Bullock said the RBA “will not hesitate” to raise interest rates further if there’s a material upgrade to its inflation outlook. The central bank’s current forecasts show headline prices will only fall back within the 2-3% target in late 2025.

Questioned on how she would assess the current inflation picture, Bullock agreed with a senator’s characterization that the bank remains “wary.”

The board doesn’t “know if the job is done yet” on inflation, she said. “We may need to go again” on interest rates.

Bullock on Thursday was also confronted with the RBA’s frequent pushing back of its timing for inflation falling back within the target. While acknowledging this, she said policymakers are yet to make a judgment on how long CPI can stay outside the target band.

When asked if the latest inflation report would spur a “material change” to the RBA’s economic forecasts, Bullock demurred. “We’re still thinking about that. I wouldn’t say one way or another,” she said.

The RBA has paused at its past four meetings after raising rates by 4 percentage points between May 2022 and June this year. The board is assessing the impact of its tightening to date and will be presented with the RBA staff’s updated quarterly economic forecasts at the Nov. 7 meeting.

The economic picture so far remains mixed - consumers are downbeat while corporate confidence is holding up.

Retail sales show household spending is close to stagnating while a small, yet growing number of Australians are in the early stages of financial stress.

On the flip side, the labor market persists in defying the RBA’s rate hikes with hiring staying strong and the jobless rate surprisingly sliding to 3.6% last month. The housing market has also staged a surprising rebound.

--With assistance from Garfield Reynolds.

(Adds former assistant governor’s reaction in fifth-seventh paragraphs.)