The Bank of Korea held its benchmark interest rate steady and retained its hawkish bias as it seeks to rein in inflation while also avoiding adding pressure on an economy that faces headwinds ranging from risks of a debt crisis to slumping exports.

The central bank kept its seven-day repurchase rate at 3.5% on Thursday as forecast by all 18 economists surveyed by Bloomberg, and reiterated a pledge to stay restrictive for “a considerable time.” The BOK has stood pat since last raising the rate in January, and Governor Rhee Chang-yong will likely provide details of the board’s discussion when he speaks to the media shortly.

The BOK largely kept its economic forecasts intact, although it nudged up its 2023 estimate for core consumer inflation. The won held on to earlier gains versus the dollar after the decision.

“The status quo is the best way to go for the time being,” said Kim Sung-soo, a fixed-income analyst at Hanwha Investment & Securities Co. “We could be seeing a hold continuing at least through the first quarter of next year.”

In its post-decision statement, the BOK flagged uncertainties to the growth outlook, particularly with regards to China, while also maintaining that credit risks pertaining to non-financial companies have receded somewhat, and a slump in consumption and exports will likely ease.

The BOK decision to hold reflects a sense of caution among board members after more than a year of policy tightening spurred a correction in the property market, leading to higher delinquency rates related to project financing at some lower-tier lenders. Although authorities have taken steps to stabilize the sector, pockets of vulnerability remain.

Household debt is also picking up again, adding to challenges for policymakers who fear heavily indebted consumers will have to cut back on spending. In its statement, the central bank cited growth in household debt as among the factors influencing future decisions.

“One of the key things to watch during the press conference will be Rhee’s comments on household debt,” said Cho Yong-gu, a fixed-income strategist at Shinyoung Securities. Any indication the BOK intends to keep rates elevated for a sustained period to cool household debt could move local bond yields higher, he said.

The trade-reliant economy has also been hit by weak overseas demand for South Korean products, particularly in China, where property-market woes are among a host of challenges undermining economic activity. South Korea’s exports to China fell 25.1% in July, outpacing the 16.5% decline in overall shipments.

After the meeting, the central bank released inflation and growth forecasts for the current year that were unchanged from previous estimates, saying it still expects the economy to expand by 1.4% and consumer prices to rise by 3.5%. It raised its core CPI forecast for 2023 to 3.4% and trimmed its 2024 GDP growth forecast to 2.2%.

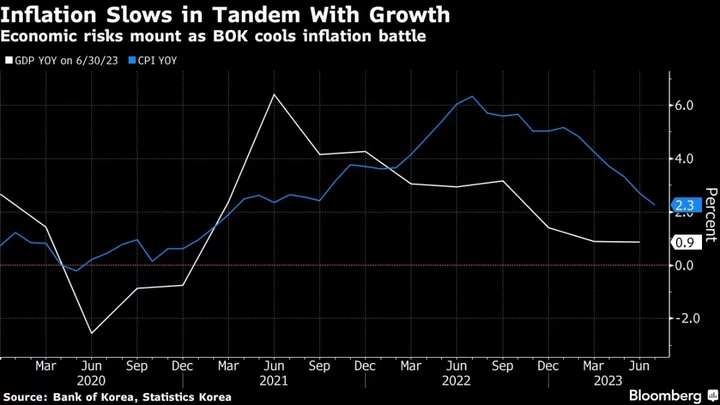

Even as risks to the growth outlook persist, the BOK has been steadfast in its battle to cool price pressure as a top priority. Consumer inflation slowed to 2.3% in July, but monetary authorities expect it will accelerate back to the 3% level toward the end of the year.

What Bloomberg Economics Says...

“A pivot to a looser stance is unlikely until the Federal Reserve changes course.”

— Kwon Hyosung, economist

For the full report, click here

Adding to the risks for the BOK is the possibility the Federal Reserve may keep its policy rate elevated for longer as the US economy chugs along with more momentum than previously expected. That’s giving the BOK another reason to keep its policy restrictive as the widest-on-record rate differential with the US weighs on the won, making imports more expensive. Fed Chairman Jerome Powell is set to deliver a keynote address at the annual Fed event in Jackson Hole on Friday.

The won has been among the weakest performers in Asia this month. Its deterioration against the dollar was a key reason the BOK raised the rate at a faster-than-usual pace in the second half of last year.

The BOK’s vow to stay restrictive comes amid increasing indications that the tightening cycles in many developed nations are nearing a peak if not already there. While many Fed officials see upside risks to inflation, two were open to taking a pause in July. The swaps market is pricing in no more increases.

In Europe, worse-than-expected numbers Wednesday from Germany and France prompted market bets to shift toward a pause in ECB hikes next month.

Rhee will disclose whether there were any dissenters to the latest decision at a press conference starting later Thursday morning in Seoul.

Markets will be interested in knowing how many board members favored leaving the door open to another hike by 25 basis points. At the previous meeting, all board members said they were willing to increase the rate to 3.75% if deemed necessary, in a reminder that the battle against inflation remains at the top of their agenda.

(Adds details from central bank’s statement)