Banks that underestimate the financial fallout of the climate crisis are exposing themselves to regulatory and investor backlash that includes bigger capital requirements and more lawsuits, according to a senior official at the Bank of France.

Jean Boissinot, deputy director for financial stability at the French central bank, says precedents are now being set that offer a glimpse of the legal risks banks face if they downplay climate change.

“What is clear is that if it stays in a blind spot, there will be a painful wake-up call,” he said in an interview.

Boissinot, who’s also the head of secretariat for the Network for Greening the Financial System (NGFS) — a group of more than 100 central bankers and regulators formulating recommendations to get through the climate crisis — says the impact on bank finances can become “very material.”

“It’s not too late for financial institutions to get on top of the issue and to efficiently monitor and provision for the risks associated with these litigations,” he said.

Ideally, banks should be adapting their businesses to such risks “before it’s translated into capital,” he said. But when a supervisor sees that “there are obvious gaps in the way the institution is approaching these risks, it would be obvious for that consideration to feed into the Pillar 2 assessments,” he said, referring to capital requirements that are specific to an individual lender, rather than the entire industry.

Boissinot said banks need to make sure they have the necessary buffers to cope with the potential legal challenges ahead, as investors increasingly lose patience and explore lawsuits. That’s as bank clients in high-emitting industries such as oil, gas and utilities in some cases may be facing bigger losses than they can cover, triggering potential bankruptcies and even contagion, he said.

It is conceivable that the world lands in a situation in which “the climate physical risks are in fact so huge that the liabilities are beyond one’s ability to shoulder as a single corporate,” Boissinot said.

“If everybody that is affected by, or that will be affected by climate change, is able to claim or call in some liabilities from anyone who has ever emitted CO2, that will be almost an uncapped liability at the global level,” he said. “In that respect we see that as maybe bigger than many other liabilities.”

Ultimately, banks need to be alert to the risk that some of their clients may be exposed to “existential litigations,” Boissinot said.

Capital Requirements

The European Banking Authority is currently looking into whether minimum capital requirements go far enough in preparing banks for the risks ahead, with a report expected within weeks.

Earlier this year, Frank Elderson, a European Central Bank executive board member who’s also vice chair of its supervisory board, said the goal is to “use all measures in our toolkit and, if needed, step up the supervisory escalation to ensure compliance with our expectations. This may include periodic penalty payments as enforcement action or imposing bank-specific capital add-ons.”

The ECB’s 2022 climate stress tests resulted in “a small number of banks” already seeing their Pillar 2 requirements impacted.

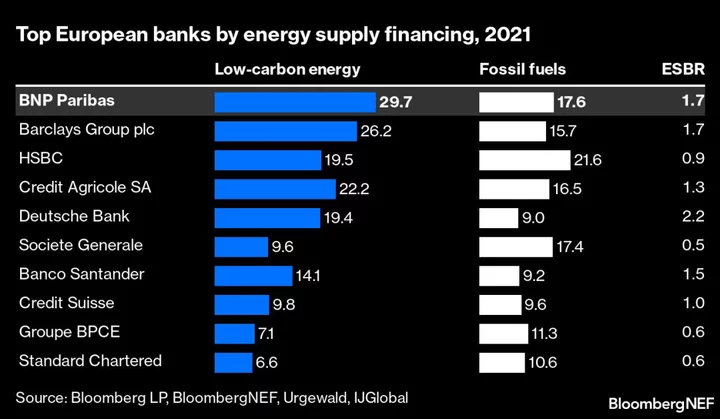

The finance industry is still nowhere near adapting to a model that aligns with limiting global heating to 1.5C, according to an analysis by BloombergNEF. In a study published earlier this year, BNEF analysts found that for every dollar of bank financing provided to fossil fuel activities, only 80 cents goes to green ventures, in aggregate. That ratio needs to be closer to 1:4, BNEF estimates.

The European Union’s biggest bank, BNP Paribas SA, is already fighting a lawsuit that was brought by a group of nonprofits who allege the lender isn’t meeting its climate obligations under France’s duty of vigilance law. Since the suit was filed, BNP has updated its climate strategy to impose tighter restrictions on its fossil fuel clients.

“There is a lot of money going into these litigation cases,” Boissinot said. “And the money brings a lot of expertise and a lot of legal creativity also.”

In a report earlier this month, NGFS warned that lawsuits don’t have to be successful to have an effect.

Created in 2017, NGFS has grown from its eight original members to 127, including the US Federal Reserve, the European Central Bank and the People’s Bank of China. The organization identifies and promotes best practices for supporting the finance industry to meet the Paris Agreement and to manage risks.

(Adds comment on potential client liabilities from seventh paragraph.)