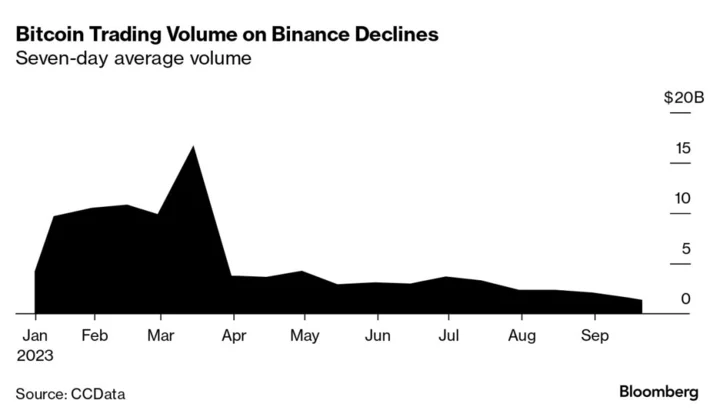

This month’s steep decline in Bitcoin trading volume on Binance is likely tied in part to the end of another zero-fee promotion by the world’s largest cryptocurrency exchange.

The seven-day average volume has dropped by 26% since the start of September, according to researcher CCData. On Sept. 7, the exchange halted an incentive that allowed customers to trade between Bitcoin and the TrueUSD stablecoin without a fee. The seven-day average volume for that so-called trading pair has dropped 89% since the inducement expired.

This is not the first time when the end of a promotion has led to volume and market-share declines on Binance. In one week in March, for example, Binance’s share of all spot trading shrank to 58.8% from 65% after it ended a zero-fee campaign for trading in Bitcoin cryptocurrency pairs.

Binance’s trading dominance has been undermined in part by lawsuits filed this year by the US Commodity Futures Trading Commission and the Securities and Exchange Commission, which alleged that the platform didn’t register with US regulators. Binance, Changpeng Zhao, the founder and head of the exchange, and its American operations, are fighting the charges in court.

“The ending of zero-fee trading isn’t the sole reason behind low trading volumes,” said Jacob Joseph, a research analyst at CCData. “The current regulatory concerns around the exchange might have driven users to other platforms. Binance’s trading volumes have steadily been declining since it stopped its zero-fee trading promotion for USDT pairs in March.”

A Binance spokesperson didn’t immediately return a request for comment.

Binance saw outflows of about 12,230 Bitcoin, worth around $330 million, since the beginning of August, according to CCData. It also saw outflows of about 198,200 Ether, worth around $323 million, per the researcher. Bitcoin accounts for about half the value of the estimated $1 trillion crypto market. Ether is the second largest cryptocurrency at around 20%.

Binance’s spot market share has declined to 33.9% from 56.9% in March, according to CCData. Binance.US’s market share has been melting as well. The firm also operates the world’s largest crypto derivatives platform.