Bitcoin has quickly settled into a narrow trading range after reaching a fresh one-year high, leaving reinvigorated enthusiasts wondering whether last week’s momentum will last.

The largest digital currency, which accounts for about half of the crypto sector’s $1.2 trillion market value, was about 1.7% higher to $30,600 on Thursday, even after Fidelity joined the list of firms to file for a Bitcoin ETF. The token has traded in a range of around $1,500 since hitting $31,410 last Friday.

Still, the breach of the previous June high may prove significant in the long run, especially after the series of industry scandals and bankruptcies that rocked the sector at the end of last year. The move marked the end of the coin’s longest-ever streak without a new 52-week high in data going back to late 2014, according to data from Bespoke Investment Group.

“It’s particularly significant that BTC and crypto have rallied during a period where just about everything negative one could imagine for the space has happened,” said Stephane Ouellette, chief executive of FRNT Financial Inc, an institutional platform focused on digital assets. “For it to rally during such a difficult period for sentiment, it is encouraging to think what will happen if a string of positive announcements happens in the space.”

Bitcoin, began the year trading at around $16,000 and has outpaced major stock indexes to start the year — by a big margin. The 85% gain has been a remarkable display of force for an asset that many had written off as being on its last legs. Partly, the rally can be chalked up to other risky assets, including US stocks, also advancing as the bulk of Federal-Reserve tightening seems to have already happened.

“We’re getting closer to the end of the Fed tightening cycle,” Alex Coffey, TD Ameritrade senior trading strategist, said in an interview. “The acceleration of monetary policy is probably over,” which “can be seen as beneficial for Bitcoin.”

But crypto fans have also become excited about the prospect of staid Wall Street institutions showing signs of embracing the space, with BlackRock Inc., the largest asset manager, stirring up buzz after it filed for a spot-Bitcoin ETF. Although such a product does not currently exist in the US, the potential approval of one by regulators is a thrilling prospect for crypto fans as it could mean that the market opens up to a bigger investor cohort.

“Several institutional projects were put on hold after 2022,” wrote K33’s Bendik Schei and Vetle Lunde in a note. “The recent announcements flag that well-renowned major institutions are comfortable offering crypto services, changing the perceived risk of participating in crypto markets from other institutional investors and financial conglomerates.” The pair cite the Bitcoin CME futures premium surging to 20-month highs and CME’s Bitcoin-denominated open interest approaching all-time peaks as evidence of institutional involvement.

To be sure, a spot-Bitcoin ETF has never before gotten a green light from US regulators and it’s not a sure fact that one will get approved this time around.

While BlackRock’s filing was credited by observers for helping to push the price of Bitcoin to a one-year high last week, the market reaction to the Fidelity refiling was fairly muted Thursday.

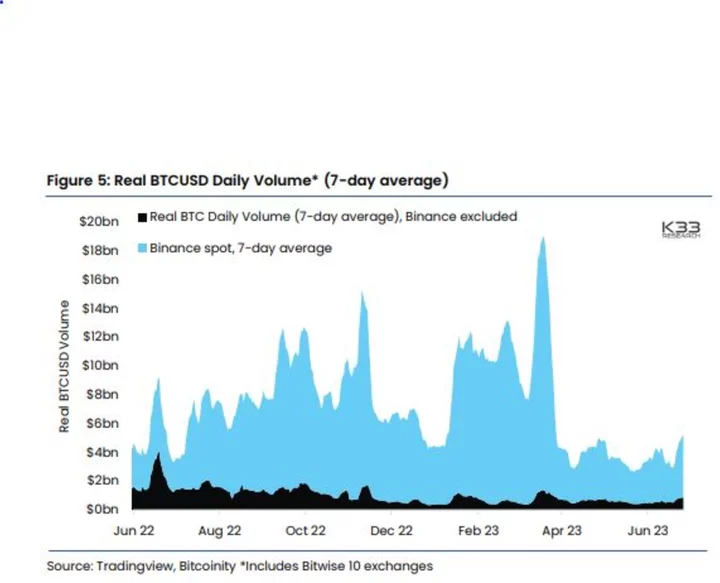

The token’s recent strength has also incentivized some investors to wade back in, according to K33. Volumes, though they’re down significantly from previous highs, have climbed in recent days, a positive development for an industry that had suffered a mass exodus of participants following last year’s numerous fallouts.

“I think of it as a good risk-on, risk-off indicator for the market. When there’s excess money floating around in the system looking for highly risky bets in the market, Bitcoin tends to do really well,” said Kara Murphy, CIO at Kestra Investment Management. “When people are in risk-off mode, money is more scarce,” she said. “ It is a highly levered play on a macro environment.”