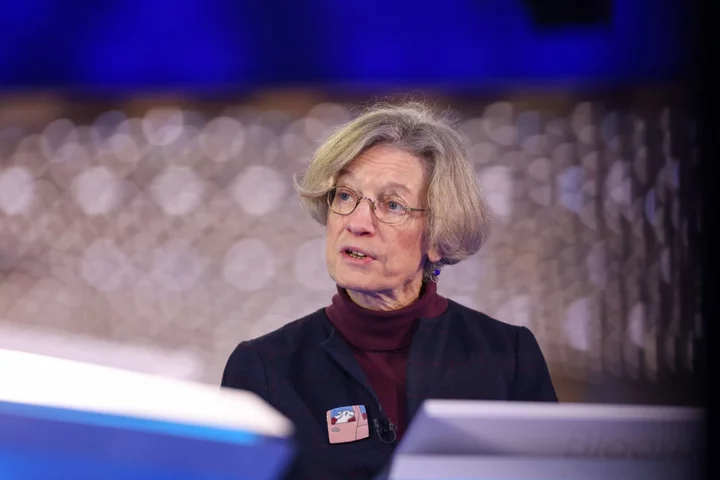

Both climate change and the path to net zero will cause higher, more persistent and more volatile inflation that central banks will have to respond to, Bank of England rate setter Catherine Mann said.

Speaking at the University of Oxford, Mann said monetary policymakers will face challenges either from the transition to net zero as carbon pricing leads to “persistence in inflation” or from the “physical impacts” of climate change.

The impact of carbon pricing, or carbon taxes, would not be the same as an oil price shock as it would be long-lasting with wider effects on the economy, she added.

“The research here points to increased inflation, increased inflation persistence, and increased inflation volatility associated with climate shocks, policies, and spillovers,” Mann said.

“Not only is it within my remit to respond to the macroeconomic effects of climate change, but my remit requires me to do so.”

She said far more research is needed to understand the impact of climate change on the macroeconomy and “central banks should raise awareness of climate issues,” particularly in the UK where the commitment to net zero by 2050 has been made.