It didn’t take Nigerian President Bola Tinubu long to comprehend his situation. With the country’s stash of hard currency dwindling, investors, not policy makers, were in command. So on his second week in office, he gave them what they wanted, sacking the central bank chief and devaluing the currency.

Days earlier, Recep Tayyip Erdogan, the long-standing leader of Turkey, had reluctantly come to the same conclusion. Out went the architects of the economy’s byzantine web of rules and restrictions and in came the Wall Street pros to simplify policy to woo back disgruntled investors. Stocks and bonds surged.

Such is the new dynamic of power in a world of rapidly rising interest rates. Investors are demanding economic orthodoxy and, for the first time in almost two decades, are in a position to make sure their voices are heard. Across the developing world — in Colombia, Egypt and, to a certain degree, even in Argentina, a perennial market pariah — governments are pivoting away from heterodox policies.

When interest rates in G-7 countries were hovering near zero and cash was flowing freely around the globe, there was little angst in policy circles about alienating investors. But when those investors can suddenly rake in 5% or more — stress-free — by parking their cash in US T-bills or blue-chip corporate bonds, policy makers have to work a lot harder to entice them into providing the financing needed to pay teachers, build highways and power economic growth.

That means either dangling astronomically high yields — an unsustainable approach over time — or committing to the sorts of basic policies long favored by the Davos crowd: fiscal austerity, limited government intervention in the economy and simple rules for moving money in and out of the country.

“You have this battle between placating your common person as well as the people that voted for you with maintaining external investors, who obviously help your balance of payments and reserves,” said Mark Hughes, who manages a portion of the $400 billion in assets at Western Asset Management. “Ultimately, when we see politicians or policy makers make difficult decisions, for us that’s a good thing.”

The reform stories are proving to be some of the biggest surprises in a year in which emerging markets have failed to live up to investors’ optimism, as China’s reopening fizzled and central bankers kept raising interest rates.

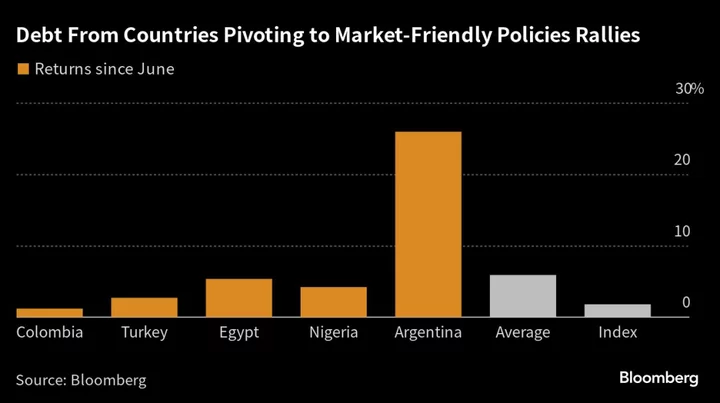

On average, sovereign bonds from five countries — Argentina, Colombia, Egypt, Nigeria and Turkey — handed investors a return of 6% since the start of June, compared to a 1.8% return across government debt from developing nations, according to a Bloomberg index.

The shifts are the latest in a long-standing tug-of-war between government officials and bond vigilantes, as economist Ed Yardeni famously called investors in the 1980s for their ability to mete out punishment when they disapproved of policy decisions.

Their influence waned greatly this century, drowned out by quantitative easing across the developed world, but the key role that the bond market played in taking down the Liz Truss government after just 44 days signaled the balance of power was shifting once again. The UK, of course, isn’t a developing nation — despite the mocking jabs of its harshest critics — and yet, the message was crystal-clear: This is a dangerous time for fiscal experimentation or any policy that is unconventional in nature.

High borrowing costs are forcing corporate CFOs and finance ministers alike to play by the market’s rules or risk being punished. Today, the bonds of 16 emerging countries trade 10 percentage points or more over similar US Treasuries — the threshold considered distressed. Four years ago, it was only three.

“Countries are realizing you can’t go down the Lebanon route, the Venezuela route, the Zimbabwe route back in the day of continuing to do things irresponsibly,” said Charles Robertson, head of macro strategy at Frontier Investment Management Partners. “They’re doing it before they collapse, before the situation breaks.”

Money managers have been quick to reward them when they do change course. They pushed the Colombian peso to a world-beating currency rally after leftist President Gustavo Petro saw his ambitious social agenda scaled back by congress. They scooped up Argentina bonds after the nomination of Sergio Massa as the Peronist party candidate signaled the October election would usher in a more market-friendly administration.

In Egypt, which had lost its standing as an investor favorite, bonds rallied the most in emerging markets following the government’s stepped up efforts to sell state assets. And in Turkey, foreign investors piled into stocks at the fastest pace in more than two years in the wake of a decision by Erdogan’s new economic team to stop using foreign reserves to intervene in the currency market.

What Bloomberg Economics Says:

“Turkey’s much-awaited policy pivot is finally here — and it’s likely take a toll on growth through 2024. The central bank started a slow-burn tightening cycle in June with an initial 650-bp rate hike and partial dialing-back of macroprudential rules — all in line with our earlier calls.”

- Selva Bahar Baziki, economist

-Click here for full report

Few places saw as dramatic a shift as Nigeria, which investors had largely avoided in recent years amid concerns that unorthodox monetary policy was stoking inflation.

Following Tinubu’s changes, the currency immediately lost value against the dollar and global bonds rose to their highest levels of the year.

“Nigeria is the most obvious example where the new measures have really woken up the market and can make a serious fundamental difference,” said Nick Eisinger, a money manager at Vanguard Asset Services who was overweight on the debt in anticipation of Tinubu’s changes. “The situation was so negative earlier and we then had very quick policy initiatives from the new president.”

Rally Limits

Still, there are questions over how long the rally can last. Some Wall Street veterans have warned that reform agendas often have a way of stalling, especially when they cause political fallout.

A broader run up in developing-nation assets has already been held back by the slowness of China’s reopening, which is expected to ultimately drive demand for commodities, and the lack of a clear indication of when the Federal Reserve will stop tightening.

Read more: Emerging-Market ‘Orthodoxy’ Pivots Find Skeptics on Wall Street

For investors like James Johnstone, however, that’s provided an opening to buy. Johnstone, who manages roughly $1 billion in emerging- and frontier-markets funds at London-based Redhweel, said policy shifts in countries like Argentina and Turkey ultimately prime them to outperform once a catalyst hits.

“We have an incredibly exciting cocktail of factors for a return of emerging markets that in some cases sadly haven’t done anything for 15 years,” he said. “The headwinds that faced this set of countries are suddenly becoming tailwinds and now you’re combining that with some political stability and a return to the mainstream.”

--With assistance from Zijia Song and Kathleen Hays.

Author: Ezra Fieser, Selcuk Gokoluk and Maria Elena Vizcaino