(Bloomberg) --

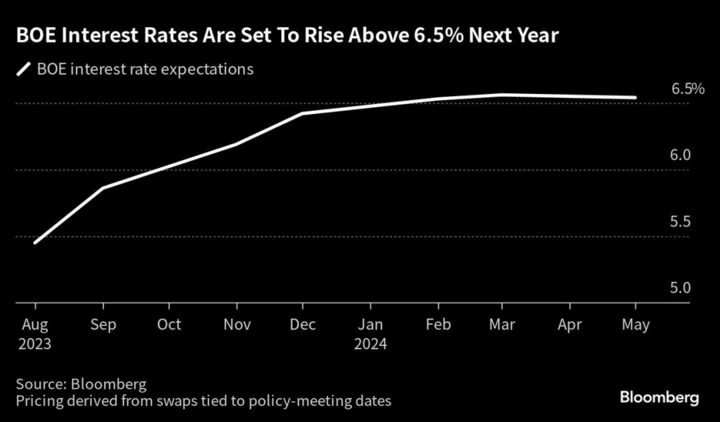

On the same day that UK interest-rate expectations hit the highest since 1998, Bank of England Governor Andrew Bailey was explaining inflation to children.

Sitting down to an interview on CBBC’s Newsround, a TV show aimed at kids as young as seven, Bailey was lamenting how families now faced “very difficult choices” because of rising mortgage costs. In London, newspapers put warnings about interest rates and bright red lines pointing skyward on the front page.

While Britain’s cost-of-living crisis has been brewing for months, this was a week that the fear over interest rates seemed to escalate on its own. There was no political drama to unsettle markets, no big economic surprise — only the sense that the country is dealing with out-of-control inflation and inevitably interest rates have to keep increasing.

And the question still on everyone’s mind: how much higher can interest rates and bond yields go? On London’s trading floors, there’s a mix of answers. Some argue that the UK economy is bound to weaken so quickly that the BOE won’t need to raise rates to 7% to bring inflation down. Others point to the resilience in consumer spending as a reason why borrowing costs will continue to rise.

“We expect the wheels to come off before the BOE delivers the tightening that the market is bracing for,” said Richard McGuire, a rates strategst at Rabobank.

While bond yields have surged globally, the UK has seen some of the sharpest moves because of its persistent inflation. The BOE has already delivered 13 hikes since late 2021, yet inflation at 8.7% has beaten estimates four months running and still remains well above the 2% target.

For investors, it was a tough week. The benchmark 10-year rate reached as high as 4.7%. The other instances of yields that high were in October, when the nation was grips of Prime Minister Liz Truss’s budget chaos, and the 2008 global financial crisis. The blue-chip FTSE 100 Index sank 3.7%, the biggest weekly selloff since March.

At one point during the week, traders priced a one-in-three chance of the key rate rising to 6.75%, a level last seen when the Spice Girls and Oasis topped British music charts. That compares with wagers on a 5% peak just a couple of months ago.

“Absolutely, rates could go to 7% if data continues to surprise to the upside,” said Ales Koutny, head of international rates at Vanguard. “We have seen a very strong shift on BOE rhetoric. Before, it was trying to find a way to not hike rates anymore. Once we got to 4% and kept getting better economic data, it felt like the BOE finally decided to do what it takes.”The housing market shows the strain. UK house prices are falling at their fastest annual pace since 2011, according to a report from mortgage lender Halifax. And there’s a worry that as rate hikes work their way through the financial system, other vulnerable parts of the economy will come under pressure.

“The risk of something breaking, and breaking badly, is getting bigger the more that rates go up,” said Mike Riddell, a macro portfolio manager at Allianz Global Investors.

Among investors, there are divisions over whether UK bonds are a good opportunity to lock in juicy yields or on the verge of another selloff as rate expectations keep climbing.

In the bull camp, Riddell said central banks have already tightened rates too much, and gilts are a bargain too cheap to pass up. Samuel Zief, head of global FX strategy and markets at JPMorgan Private Bank, likes short-dated gilts because they offer high yields and provide a buffer against further shocks.

“We moved bullish gilts a couple of weeks ago, as we think gilt valuations are now looking very interesting,” said Riddell. “They just got more interesting.”

One of reasons that the UK bond market is so volatile is that liquidity has dried up, said Koutny of Vanguard. He says many investors stepped away from the market after mini-budget crisis last year and are watching the data for stronger evidence that a pause could be in sight.

The problem, in the view of some markets watchers, is that investors have been burned over and over again trying to predict UK interest rates. Evelyne Gomez-Liechti, a rates strategist at Mizuho, says investors will be less willing to own gilts given the backdrop of uncertainty and volatilty.

Or in the words of Imogen Bachra, head of UK rates strategy at NatWest Markets, “Gilts are a falling knife that no one wants to catch.”