China’s economic recovery is losing a step after an initial burst in consumer and business activity early in the year, prompting calls for more policy stimulus to bolster growth.

In neighboring Japan, the economy grew faster than expected, bolstered by consumer and business spending. Eastern European countries are staging a slow rebound, restrained by the war in Ukraine and persistent inflation.

And in the US, recession calls keep getting pushed back further amid a tight job market, resilient household spending and some stabilization in housing. But even a “mild” downturn would come with a steep price in job losses.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Asia

China’s industrial output, retail sales and fixed investment grew at a much slower pace than expected in April. A major worry was the jump in the unemployment rate for young people to a record high of 20.4%, a sign that the post-pandemic recovery isn’t strong enough to absorb the millions of new entrants to the labor market.

Japan’s economy expanded at a faster pace than expected as a further easing of pandemic regulations boosted consumption, an outcome that will likely keep speculation simmering of a possible early election and potential central bank policy change.

A cash crunch is persisting in India, pushing short-term borrowing costs above a key policy interest rate and posing risks to an economy that needs cheaper funding to sustain its recovery. After a surge in recent weeks, the weighted average call rate which Reserve Bank of India closely monitors, has shot above its policy rate ceiling of 6.75%.

China’s record high youth unemployment rate may climb further in the months to come, a warning sign that will pressure policymakers to take action. The jobless rate for 16-to-24 year olds hit 20.4% last month, nearly four times the national rate. Pressures will probably only grow this summer, when an estimated 11.58 million graduates are expected to flood the market.

Europe

The European Commission raised its euro-zone inflation outlook and warned of “persistent challenges” even as it acknowledged the resilience of the region’s economy.

Auto sales in Europe rose in April for a ninth month as supply chains improved and carmakers worked through backlogs of orders. Carmakers across the volume, premium and luxury segments have continued to post strong results even as inflation remains elevated and concerns about the economic outlook deepen.

The war in Ukraine and lingering high inflation weighed on economies in the European Union’s east in the first quarter, though data pointed to a gradual rebound.

US

The small group of economists who’ve been maintaining that the US can avoid a recession, despite the most aggressive Federal Reserve tightening in decades, is starting to breathe easier. Many of their peers had expected surging interest rates would’ve put a more material dent in hiring and personal consumption by now. Instead, the unemployment rate is hovering at a more-than-five-decade low, consumers are still spending, and the housing market is beginning to stabilize.

Forecasting if and when a recession will begin — and how high unemployment may rise as a result — is notoriously difficult. Among economists who expect a downturn, the average of 15 predictions suggests that the US economy will shed some 1.7 million jobs over the next year-and-a-bit — roughly 120,000 a month.

Emerging Markets

A bedrock of Thailand’s economy before the pandemic, tourism is reclaiming its key role as investors are waiting and watching days after a national vote on Sunday. Still, any escalation in political uncertainly could hamper the influx of visitors that’s getting closer to returning to the 40 million count in 2019, supported by China’s reopening late last year.

World

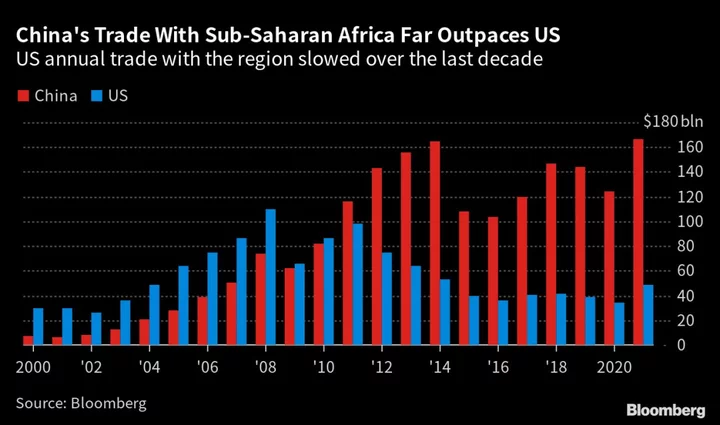

The tussle for global influence is about to intensify, as China, Russia, the US and its allies step up efforts to win over governments in a deepening competition for hearts and minds in strategic third countries.

If you want to join Monaco’s richest 1%, you’ll need an eight-figure fortune. Switzerland and Australia have the next highest entry points to the 1%, requiring net worth of $6.6 million and $5.5 million, respectively.

Mexico’s central bank said it expects to hold its interest rate at 11.25% for an extended period, after halting its steepest-ever series of interest rate increases. Egypt and the Philippines also left rates unchanged, while Zambia hiked.

--With assistance from Jan Bratanic, Enda Curran, Jill Disis, Yujing Liu, James Mayger, Yoshiaki Nohara, Reade Pickert, Monica Raymunt, Anup Roy, Zoe Schneeweiss, Subhadip Sircar, Craig Stirling, Ben Stupples, Alex Tanzi, Andra Timu, Fran Wang, Erica Yokoyama and Suttinee Yuvejwattana.