The European Central Bank raised interest rates this week and trimmed growth estimates as President Christine Lagarde signaled a shift that could mean borrowing costs have peaked.

US core inflation came in a bit firmer than expected, keeping open the possibility that the Federal Reserve will hike later this year after an expected pause next week.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Europe

The ECB rate hike was the 10th straight and brought the deposit rate to 4%. The new outlook shows markedly softer annual economic expansion through 2025, while inflation will weaken to average 3.2% in 2024 and then 2.1% in the final year of that outlook.

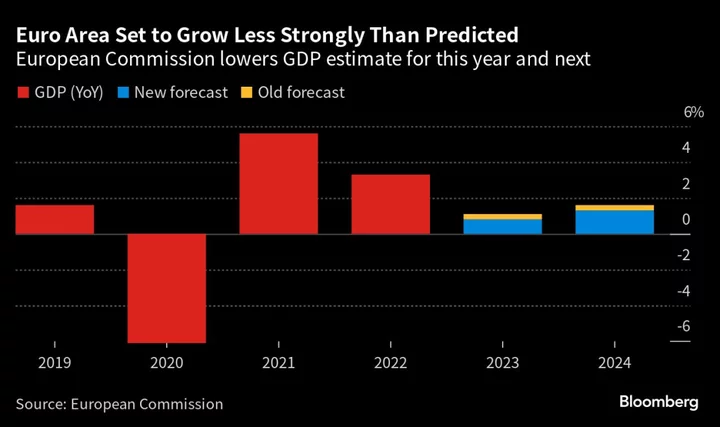

The European Commission cut its outlook for the euro-area economy, predicting it will be dragged down this year by a contraction in Germany. Output in the 20-nation currency bloc will rise by 0.8% in 2023, compared with an earlier forecast for 1.1% growth, according to updated projections by the European Union’s executive arm.

The UK economy shrank at the fastest pace in seven months in July as strikes and wet weather hit activity harder than expected, reviving fears that a recession may be under way.

US

Underlying US inflation ran at a faster-than-expected monthly pace in August, leaving the door open for additional interest-rate hikes from the Federal Reserve. The figures reinforce the financial stress that American families have been dealing with for over a year.

The United Auto Workers began a strike Friday against all three of the legacy Detroit carmakers, an unprecedented move that could launch a costly and protracted showdown over wages and job security. General Motors Co. offered 20% raises over four years, cost-of-living allowances and boosts to existing pensioners.

Consumers are growing more concerned about their ability to tap credit, with the share of households saying it is either much harder or somewhat harder to access credit now compared with a year ago rising to the highest level since the New York Fed survey started in June 2013. More people also said they expect it will be harder to acquire credit in the coming year.

US inflation-adjusted household income fell in 2022 by the most in over a decade, highlighting the toll of a higher cost of living and the expiration of pandemic-era programs. The 2.3% drop in incomes — which was the most since 2010 — marked the third-straight annual decline, which has been a feature of past recessions like the global financial crisis, the dotcom bubble and the downturn in the early 1990s.

Asia

August’s stronger-than-expected credit suggests China’s monetary and fiscal stimulus may be starting to gain traction. But declines in long-term borrowing by business and households show private-sector demand has yet to rebound, despite signs of bottoming in purchasing managers surveys and trade. Continued falls in mortgage loans indicate the housing slump is far from over.

A spurt of home sales in China’s biggest cities is losing momentum less than two weeks after authorities loosened mortgage restrictions, raising doubts over whether the steps are enough to revive the market before a crucial busy season.

Emerging Markets

Brazil’s annual inflation accelerated less than expected in August as central bankers prepare to extend interest rate cuts at next week’s policy meeting. Still, annual inflation has now accelerated for two straight months as the economy delivers surprisingly strong growth and President Luiz Inacio Lula da Silva rejiggers energy costs.

Nigeria’s inflation rate jumped to a more than 18-year high on rising energy and food prices, increasing the odds of a rate hike this month. Consumer prices climbed 25.8% in August from a year ago.

World

In addition to the ECB, Denmark and Russia also raised rates. Pakistan unexpectedly left its discount rate unchanged, while Angola held steady as well. Ukraine, Peru and Georgia cut.

--With assistance from Eric Zhu (Economist), Philip Aldrick, Emma Dong, James Hirai, Andrew Langley, Jonnelle Marte, Ruth Olurounbi, Anthony Osae-Brown, Reade Pickert, Jana Randow, Andrew Rosati, Zoe Schneeweiss, Alex Tanzi, Alexander Weber, Lucy White and Charlie Zhu.