Chile’s central bank slashed its key interest rate by a larger-than-expected 100 basis points, spearheading Latin America’s shift toward looser monetary policy and signaling more big reductions to come.

Board members led by Rosanna Costa voted unanimously to reduce borrowing costs to 10.25% on Friday, as expected by only four of 26 analysts in a Bloomberg survey. All others foresaw a cut of either 50 or 75 basis points.

In a statement, policymakers wrote that rates were set to fall more than forecast in the short-term, as anticipated by the market. The most recent traders survey, conducted by the bank, put the key rate at 7.75% in December.

“The board estimates that, in the short term, the MPR will accumulate a somewhat stronger reduction than was considered in the Monetary Policy Report’s central scenario, in line with the results of the surveys conducted prior to this meeting,” they wrote, also pointing out that both headline and core inflation have fallen faster than they expected.

Chile’s jumbo cut sends a powerful message that rates will dive from an over two-decade high after the government forecast growth near zero and traders cut inflation forecasts to near the 3% target in just 12 months. More broadly, it’s the strongest sign that most of Latin America is now benefiting from early and aggressive rate hikes during the pandemic as price pressures wane.

Read more: Chile’s Prices Unexpectedly Fall, Paving Way for Rate Cut

Brazil is seen cutting borrowing costs starting next week, with Peru and Mexico following suit by year’s end and Colombia close behind. By contrast, monetary authorities in developed economies including the US Federal Reserve and European Central Bank tightened policy again this week.

“While the most important central banks in the world are still raising rates, we have already begun a process of normalization,” said Nathan Pincheira, chief economist at Fynsa in Santiago. “There are issues that are affecting all of Latin America. There’s also weakness in the data that’s come out of Chile and also other countries.”

Limited Impulse

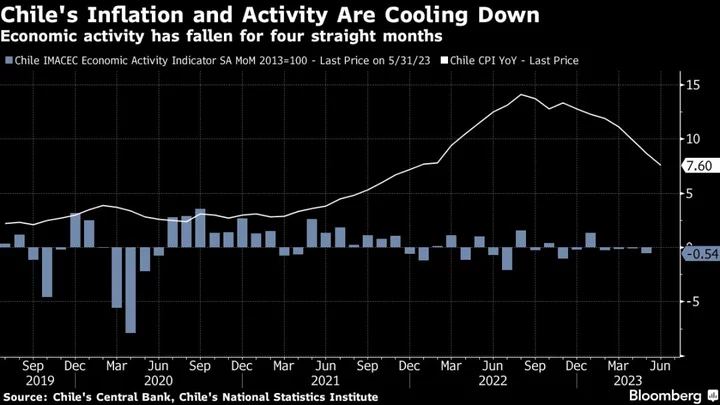

In Chile, headline annual inflation stands at 7.6%, down from a recent peak of 14.1% in August of last year. A price gauge excluding volatile items that’s closely-watched by the central bank has eased to 9.1% on an annual basis.

Meanwhile, the central bank’s main measure of economic activity has posted four straight month-on-month drops, with the most recent reading dragged down by a plunge in mining.

In their statement, policymakers wrote that local consumer and business expectations remain pessimistic, though they have shown some improvement. They noted that the most recent decline in domestic activity was caused by supply factors that affected mining and, to a lesser extent, manufacturing.

Global inflation has continued to decline, with downward surprises in a broad group of economies, central bankers wrote. “The impulse that the Chilean economy will receive from abroad will remain limited, with weak world growth prospects for this year and next,” they wrote.

Future Cuts

Prior to Friday’s announcement, investors had increasingly positioned themselves for a swift monetary easing cycle. Two-year swap rates, an indication of the outlook for borrowing costs, have tumbled 76 basis points to 6.025% since the prior key rate decision on June 19.

In their statement, central bankers reaffirmed their commitment to act with flexibility when implementing policy. They also wrote that “the magnitude and timing of the MPR cuts will take into account the evolution of the macroeconomic scenario and its implications for the trajectory of inflation.”

Still, the overall communication reinforced the view that inflation’s slowdown toward target is being consolidated faster, according to Credicorp Capital economists Samuel Carrasco and Daniel Velandia.

“We expect that the benchmark rate will move to the lower bound of the policy corridor shown in the latest IPoM, implying cuts of 100bps for September, October, and December, respectively, and leading to a rate of 7.25% by the end of the year,” Carrasco and Velandia wrote in a note.

--With assistance from Giovanna Serafim and Rafael Gayol.

(Re-casts story, adds economist comments starting in seventh paragraph)