China’s credit demand weakened in May as the economy’s recovery lost steam, adding to reasons for the central bank to boost stimulus to spur growth.

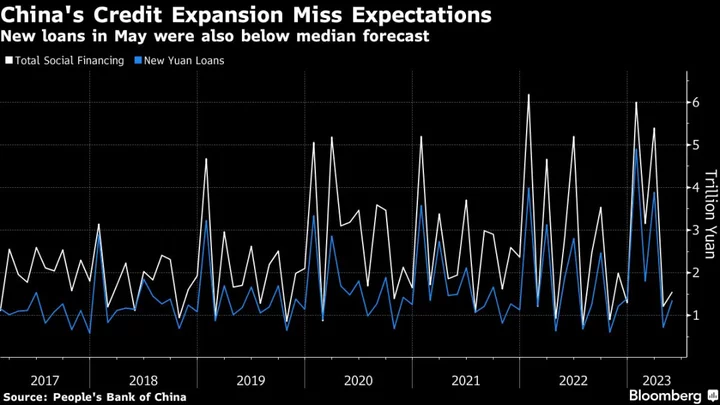

Aggregate financing, a broad measure of credit, was 1.6 trillion yuan ($224 billion) in May, the People’s Bank of China said Tuesday, lower than the median estimate of 1.9 trillion yuan in a Bloomberg survey of economists.

Financial institutions offered 1.4 trillion yuan worth of new loans in the month, also missing economists’ forecasts of 1.6 trillion yuan. Both of the figures declined compared with the same month a year ago.

A string of economic reports show China’s economic recovery lost momentum in May: inflation remained close to zero, manufacturing activity contracted, exports shrank for the first time in three months and a rebound in home sales has slowed. Private investment stagnated in the first four months of the year despite a rapid expansion in money supply.

The data came after the the PBOC surprised markets Tuesday morning with a cut to its short-term policy interest rate, a sign that officials are increasingly concerned about faltering growth. Speculation about further monetary easing rose following the move.

The disappointing figures shows that “the PBOC was using the 10-basis point rate cut to comfort the markets ahead of the data,” said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc. “The demand and dynamism among companies and households is sluggish.”

Growth of M2, the broadest measure of money supply, moderated to 11.6%, the slowest level in almost year. The stock of credit also expanded at a weaker rate than in April at 9.5%.

Net corporate bond issuance turned negative in May, while government bond issuance nearly halved from a year ago, weighing on credit growth. New household mid and long-term loans, a proxy for mortgages, improved from the contraction in April but was still far below the level prior to the property downturn in 2022.

Authorities are also considering a broad package of stimulus measures to boost the economy and the State Council may consider the proposal this week, according to people familiar with the matter.

PBOC Governor Yi Gang last week hinted at more flexibility in monetary policy, referring to “counter-cyclical adjustments” to support the economy, a shift in language that some analysts said signaled more easing. Major state banks have also lowered rates on a range of deposit products, which will help preserve profit margins at banks if lending rates decline.

(Updates with additional details throughout.)