China’s credit growth held steady in September, with rapid government bond issuance to fund infrastructure projects and stronger mortgage lending offsetting a decline in the value of new bank loans.

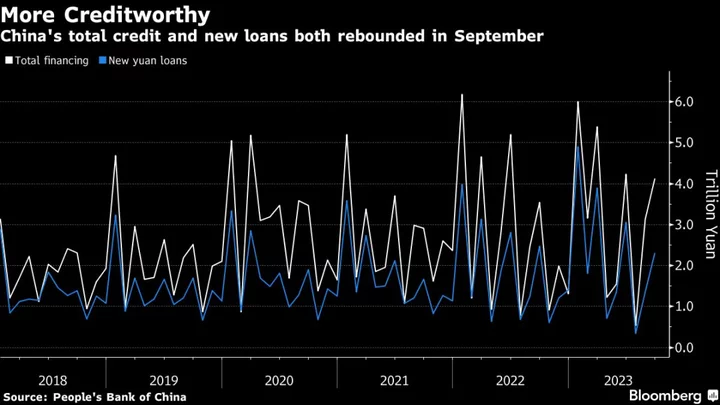

Aggregate financing, a broad measure of the stock of credit in China’s economy, increased by 9% in September from a year earlier, the People’s Bank of China said Friday — the same rate as the previous month. There was 4.1 trillion yuan ($564 billion) in credit extended in September, above the median estimate of 3.7 trillion yuan in a survey of economists and the fastest increase for September in comparable data back to 2017.

Financial institutions offered 2.31 trillion yuan worth of new loans in the month, lower than economists’ forecasts of 2.5 trillion yuan, and compared with 2.5 trillion yuan a year ago.

‘Slower than expected money supply growth suggests that domestic demand and the slow recovery remains fragile, and it signals to authorities that more stimulus is needed,” said Kelvin Lam, China economist at Pantheon Macroeconomics. “For loans, I think the weaker than expected number suggests that authorities still need to work on improving the demand side of the economy.”

Economists have been closely watching for a pick-up in loan demand as a barometer of China’s economic recovery. A housing market slump combined with low corporate confidence in some sectors has led to relatively slow credit expansion in China this year.

Read more: China on Brink of Deflation Again Reveals Still-Fragile Recovery

Outstanding medium and long-term loans to the household sector, a proxy for mortgage lending, increased by 544 billion yuan in September from the previous month. That was the largest increase recorded since March and came after cities across China were allowed to lower mortgage requirements in a bid to stimulate the housing market.

China’s interest rate policy is more targeted and coordinated and credit growth was reasonable, the central bank’s spokesperson Ruan Jianhong said Friday at a press conference. Aggregate financing and credit growth are expected to remain stable in this quarter and the economy will continue to recover, she said.

What Bloomberg Economics Says ...

September’s stronger-than-expected credit growth sends a signal that activity is bottoming out. Both household mortgages and overall corporate funding jumping from August’s level. Policy stimulus was a big driver, especially the reduction of mortgage rates guided by the central bank. On the downside, the data also showed corporate bond financing falling sharply. This shows that sentiment is still weak — and more policy support is needed.

- David Qu, economist

Click here for the full report

Bank lending is usually stronger in September as institutions rush to extend loans at the end of each quarter to meet their lending targets and satisfy regulatory requirements. Last month’s data may also be bolstered by recent stimulus — including a move by the PBOC to release long-term liquidity into the financial system by cutting the reserve requirement ratio, which analysts said was intended to support banks to purchase government bonds.

The amount of outstanding government bonds was 12.2% higher than a year earlier, the strongest growth recorded since May, as provinces rushed to issue so-called “special purpose” bonds ahead of an October deadline. Those are are mainly used to pay for infrastructure spending.

Several measures to spur people to buy more homes — such as lowering down-payment requirements in cities took effect from September. The additional support for the economy came as China’s post-pandemic recovery has lost steam, with the property crisis weighing on demand and sentiment. Exports have been falling and the job market has been gloomy, especially for recent graduates.

Recent measures on interest rates — including cuts to existing mortgage rates — have achieved “remarkable” results and were received by the market “positively,” Zou Lan, head of the PBOC’s monetary policy department, told reporters at a Friday briefing. He added that those steps will continue to take effect, adding that the mortgage rate cuts “boosted the confidence and ability to invest and consume.”

There are signs, though, that stronger policy support so far has had limited results. Some sectors such as manufacturing are seeing a mild rebound, but home sales are still struggling and spending over the critical Golden Week holiday period was cooler than expected.

“The rebound in household medium and long-term lending offer some hope that property demand might be picking up in response to recent policy support,” said Adam Wolfe, China economist at Absolute Strategy Research. “But weak money supply growth and relatively soft corporate lending suggest the economy remains in a funk.”

To ensure the economy meets Beijing’s 2023 growth target of around 5%, policymakers are considering raising this year’s budget deficit and issuing at least 1 trillion yuan of additional sovereign debt for spending on infrastructure such as water conservancy projects, Bloomberg News has reported. That may push up the extension of credit in the coming months.

--With assistance from James Mayger and Tom Hancock.

(Updates throughout.)