China’s economy is at risk of being caught in a confidence trap as the post-Covid recovery loses steam, presenting Beijing with a problem that can’t easily be solved with traditional tools such as interest rate cuts and infrastructure stimulus.

Evidence of low business and consumer confidence was everywhere in this week’s official data, which showed economic activity losing momentum in April. Private firms barely increased investment, while households curbed their spending on goods like appliances.

That raises the prospect of a vicious cycle as firms and households hold back on spending, slowing the pace of the recovery, which in turn lowers confidence even further, said Michael Hirson, China economist at 22V Research LLC and a former US Treasury attache in Beijing. Citigroup Inc. economists described China as being “on the brink of a confidence trap.”

The poor economic data this week and concerns about the outlook have weighed on China’s currency, which weakened past the key level of 7 to the dollar on Wednesday. The nation’s benchmark stock gauges are also trailing their major Asian peers this quarter, while sovereign bonds have rallied on expectations of more central bank easing.

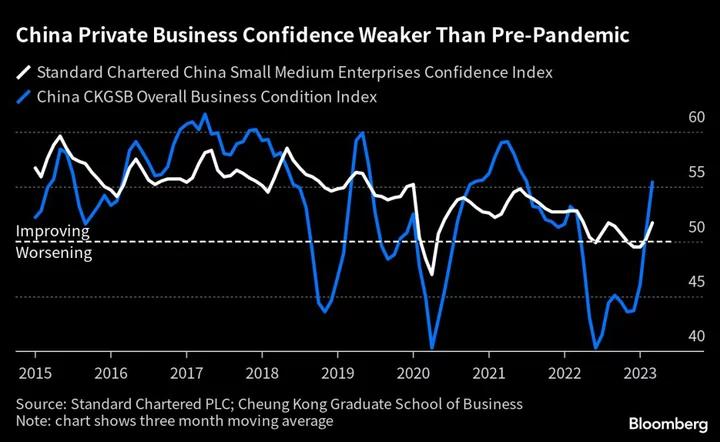

Two independent surveys show that while private sector confidence has improved since last year’s lengthy coronavirus lockdowns, it has yet to regain its pre-pandemic momentum. The Cheung Kong Graduate School of Business’ survey, which covers relatively successful private firms, is faring better than an index of small and medium enterprises by Standard Chartered Plc.

A high-frequency survey of Chinese consumer sentiment by Morning Consult shows that while confidence surged earlier in the year, it peaked earlier than in previous recoveries and “now appears to be waning,” said Jesse Wheeler, an economist at the US consultancy.

The Citi economists blamed the low confidence on the scarring effect from China’s stringent pandemic rules and the chaotic end to the Covid Zero policy late last year. Another reason was the “policy excesses” in the last few years, when Beijing hit sectors such as property, technology and education with rapid regulatory changes.

China’s leadership is aware of the problem, with the ruling party’s Politburo last month referencing low confidence as a challenge to the economy. The top officials upped their rhetorical support for private businesses, especially for the tech sector, and vowed to boost household income growth.

Confidence-Boosting Policy

But concrete confidence-boosting policy initiatives have been small-scale. China’s internet regulator began a campaign last month to tackle online criticism of the private sector and entrepreneurs as a way to improve the business environment. Local governments are making high profile endorsements of private businesses, such as a partnership between the city of Hangzhou and Alibaba Group Holding Ltd., which is based there.

Businesses appear to want more. “Entrepreneurs seem to be putting the burden of proof on new premier Li Qiang to demonstrate that the environment is really improving,” Hirson said.

Li visited a number of manufacturing companies on a trip this week to the eastern province of Shandong, reiterating that the key to ensuring a sustainable economic recovery is to “enhance the confidence in development,” the official Xinhua News Agency reported. He said China will take more measures to attract foreign investment and stabilize its share in the international market.

“We must do more things of certainty to offset the impact of various uncertainties,” he said at a meeting with local officials and business representatives. “We must make the greatest effort to strive for the best outcomes.”

Foreign firms are facing additional hurdles too. A recent American business chamber survey shows increasing pessimism about US-China ties as political tensions and competition in the tech sector escalate. High-profile investigations against foreign businesses like Bain & Co. and Mintz Group have also added to concerns.

Traditional government policies to boost the economy — state-led infrastructure investment and bank lending — will be less effective while confidence is weak.

“Unlike previous cycles, we see no easy fix this time,” Nomura Holdings Inc. economists led by Lu Ting wrote in a note. “The real barrier to sustaining the growth recovery is a lack of confidence.”

To be sure, for some economists the confidence issue is mainly a matter of time. The strong recovery in services spending should feed through to the labor market, boosting incomes, said Adam Wolfe, China economist at Absolute Strategy Research.

“I do think consumer confidence will gradually improve,” he said.

The data on private investment may also be less concerning than it appears, as it’s overwhelmingly driven by a decline in the property sector, where private companies have generally been dominant. Growth of investment in manufacturing, which is also private-sector dominated, has held up better.

Beijing’s reluctance to provide households with direct income support will make it “difficult to restore confidence,” said Houze Song, an economist at US think tank MacroPolo. A more feasible option would be cuts to employers’ required payments into staff social security accounts, which could encourage hiring, he said.

--With assistance from Jill Disis and Fran Wang.

(Updates with comments from Chinese premier)