China’s top leaders signaled more support for the troubled real estate sector alongside pledges to boost consumption and resolve local government debt, though fell short of announcing large-scale stimulus to support the slowing economic recovery.

The ruling Communist Party’s 24-member Politburo — its top decision-making body led by President Xi Jinping — promised “counter-cyclical” policy, according to a readout published Monday by the official Xinhua News Agency. That suggested more economic support as well as an “adjustment” of restrictions in the property sector. Real estate has been slumping for two years, partly due to a government clampdown on corporate and household leverage.

The meeting — during which leaders set the rest of the year’s economic policy agenda — did not include language indicating major fiscal or monetary loosening.

“Overall, the Politburo fell short of so-called ‘bazooka stimulus,’” said Kiyong Seong, lead Asia macro strategist at Societe Generale SA. “I don’t expect a sustained impact on the market unless there is a series of strong concrete steps.”

Financial markets showed limited enthusiasm for the measures. Futures on the Hang Seng China Enterprises Index climbed as much as 0.6% after the statement was released before paring those gains. The offshore yuan trimmed losses, it remained weaker on the day.

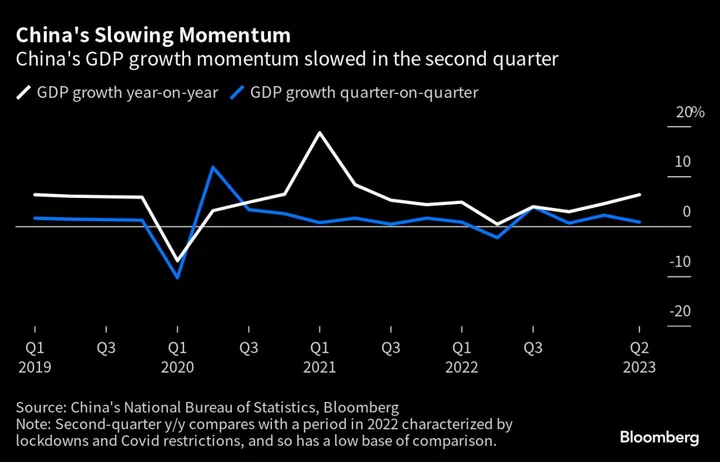

Investors have been waiting for support after official data showed the rebound’s momentum slowing in the second quarter. Economists have pointed to the property crunch and weak private sector confidence as the main challenges to China’s official economic growth target of about 5% this year.

The meeting included two key messages, according to Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd.

“One, it brings domestic demand ahead of industrial policy, suggesting stronger counter cyclical measures,” he said. “Two, it also stressed a big plan for local government debt disposal.”

Local government debt burdens — which have climbed because of the property market slump that reduced their income — have slowed government spending growth this year. The Politburo vowed to effectively deal with the risks of local government debt and “come up with and implement a series of new policies to reduce debt.”

The government is considering debt-swaps and loan restructuring, Bloomberg News has reported.

The Politburo’s language on property — which accounts for up to 20% of GDP once related sectors are added — was notably softer than in previous meetings. It omitted Xi’s signature slogan that “houses are for living, not for speculation” for the first time in a mid-year review of the economy since 2019.

Economists have tipped real estate as the sector in greatest need of aid, and there have been other indications that officials are making property a focus. Chinese authorities are considering easing home-buying restrictions in the nation’s tier 1 cities, Bloomberg News reported last week. That may include scrapping mortgage rules that require higher down payments and have more restrictive borrowing limits for homebuyers who have ever owned property before.

Officials said the demand for goods and services drives supply, marking a shift in emphasis from recent statements stressing industrial policy to upgrade China’s supply side.

Language on fiscal policy was largely unchanged after a tightening of China’s overall fiscal stance in the first half compared to last year. The Politburo called for faster issuance of local government bonds, which are limited by an annual quota.

The meeting did not hint that the quota would be expanded as it was last year when coronavirus lockdowns hit the economy, though. Instead, officials should make “good use” of existing policy space, the Politburo said.

Monetary policy language was also consistent with previous statements — though the Politburo hinted that the central bank will roll out more targeted liquidity to support lending to favored sectors. The yuan will be kept in a “basically stable” range, it added.

“The details are mostly in line with our and market expectations, which are low to begin with,” said Michelle Lam, greater China economist at Societe Generale SA. “Policymakers are focusing on long-term sustainability, and are adopting a measured approach to support near-term growth. It remains to be seen if new demand measures could be effective given poor sentiment.”

In the readout, the Politburo said the country’s long-term fundamentals remained strong. It vowed to increase general confidence in the economy, singling out investor confidence and capital markets.

“Economic operation is facing new difficulties and challenges, mainly due to insufficient domestic demand, difficulties in some enterprises’ operations, many hidden risks in key areas, and a complex and severe external environment,” the Politburo said.

The meeting also included a pledge to drive the healthy development of internet platform firms, as well as a vow to boost the consumption of cars and electronic products.

--With assistance from Emma Dong, Shikhar Balwani and Paul Dobson.

(Updates to include additional details.)