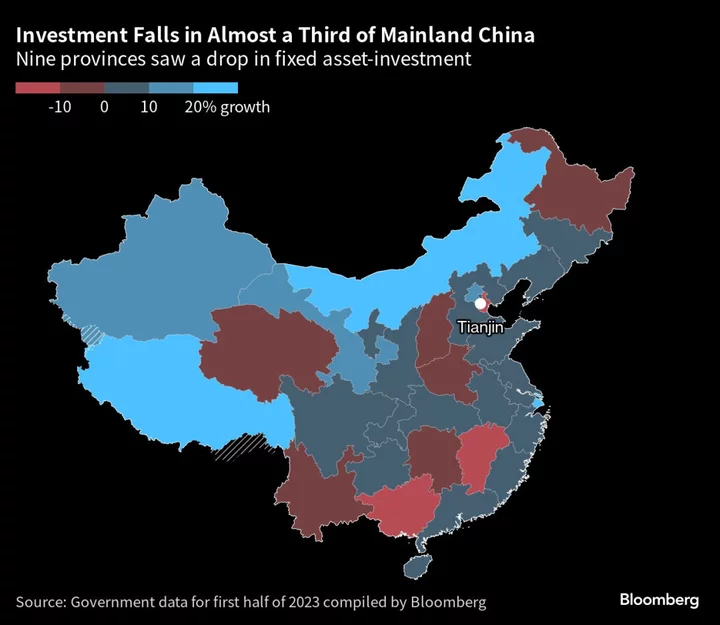

Almost a third of Chinese provinces recorded shrinking investment in the first half of the year, the most widespread decline for the same period since 2020, as financially-strained local governments and companies cut back on spending.

Some of the most debt-laden provinces, like Guangxi and Tianjin, had the biggest contraction in fixed-asset investment in the period, according to a Bloomberg News analysis of reports published by local governments.

The decline in investment is weighing on the economy’s recovery, which has lost momentum since China’s reopening surge in the first quarter. Weaker economic growth, in turn, will make it difficult for some provinces to service their debt, resulting in a further pullback in investment.

Along with Guangxi and Tianjin, Jiangxi province also reported a double-digit contraction in investment in the first half of the year, according to the data compiled by Bloomberg News. Another six provinces saw fixed-asset investment declining in the period, while six others reported slower growth than the nationwide rate of 3.8%. Investment in Fujian rose only 1.8% and 1.4% in Chongqing.

Debt Pressure

Local governments have pulled back on investment following a slump in land revenue, a key source of income in many provinces. In the first half of 2023, income from land sales dropped 21% from a year earlier, reducing revenue for the various government fund budgets by 17% and making it difficult for the Ministry of Finance to meet its income forecast for the year.

Guangxi and Tianjin were among the 10 provinces cited by Fitch Ratings where local government-related debt was most at risk of refinancing pressure. Tianjin’s debt was almost three times its income last year, according to data compiled by Bloomberg, while Guangxi’s was 144%. Yunnan and Guizhou, which were also highlighted on the Fitch list, had debt ratios of 172% and 164%, respectively.

The provincial data also showed weak economic growth in several places. Jiangxi’s economy expanded just 2.4% in the first six months compared to a year earlier, the slowest pace of all the provinces, while Guangxi grew 2.8%.

Shanghai’s 9.7% expansion was the fastest, although some of that was likely due to the low base of comparison with last year, when the city spent months under a lockdown, which crushed economic activity. Industrial output in Beijing and Heilongjiang shrank in the first half, while retail sales in Ningxia fell.

Read more: Everything China Is Doing to Juice Its Flagging Economy

The financial strain means provinces are curbing fiscal support when their economies need it the most. The main budget deficit in 19 provinces shrank in the first half of the year, while Shanghai was in surplus. However China’s top officials have vowed to do more to support growth and consumption in the economy, but have stopped short of providing direct fiscal support to consumers and companies to increase spending.

--With assistance from Kevin Kingsbury, Alice Huang, Tom Hancock and Jane Pong.