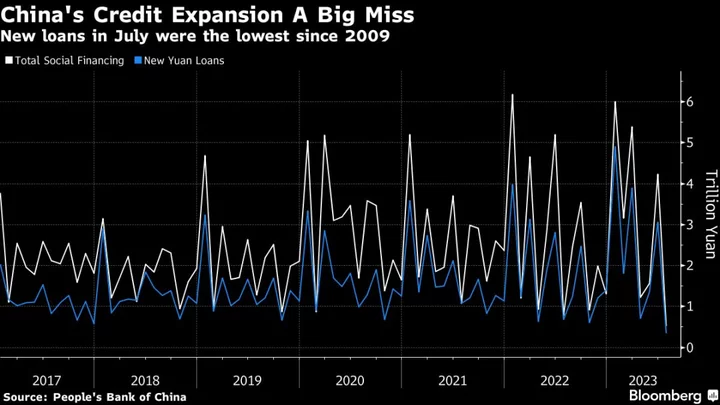

Chinese banks extended the smallest amount of monthly loans since 2009 in July, a further sign of weak demand in the world’s second-largest economy that raises the risk of prolonged deflation pressure.

New loans reached 345.9 billion yuan in July, the People’s Bank of China said Friday, less than half the 780 billion yuan economists had forecast in a Bloomberg survey. Aggregate financing, a broad measure of credit, was 528.2 billion yuan last month, also well below estimates.

“It is a big disappointment, proving the fragile status of the recovery in China,” said Kiyong Seong, lead Asia macro strategist at Societe Generale. The probability of further PBOC easing in the near term is notably rising, he said.

The plunge in loans is another sign of weak demand in China, and adds to a raft of negative data recently showing deflation in the economy, plunging exports and a slump in manufacturing activity. On top of that, the property market crisis is worsening, with fears mounting of another default of a major developer.

The offshore yuan extended a decline shortly after the data, dropping as much as 0.2% to 7.2558 per dollar, the weakest since July 7.

The gloomy economic news is adding pressure on policymakers to boost monetary and fiscal stimulus. However, the PBOC has been proceeding cautiously, held back by several factors, including a weak yuan and financial stability risks, given high debt levels in the economy.

Xing Zhaopeng, a senior China strategist at Australia & New Zealand Banking Group, said with the PBOC’s focus on stabilizing the currency, it likely can’t do much in the short term.

“It is hard to see credit growth turning around,” he said. “Deflationary risk will remain in place going forward.”

July is traditionally a weak month for financing activities, with banks not in a rush to meet their lending targets at the beginning of the quarter.

The PBOC’s data showed household mid- and long-term loans, a proxy for mortgages, contracted by 67.2 billion yuan in July, a sign that households continued to make early pre-payment of mortgages.

--With assistance from Wenjin Lv.

(Updates to add further detail. A previous version of the story was corrected to reflect new loans in billions of yuan.)