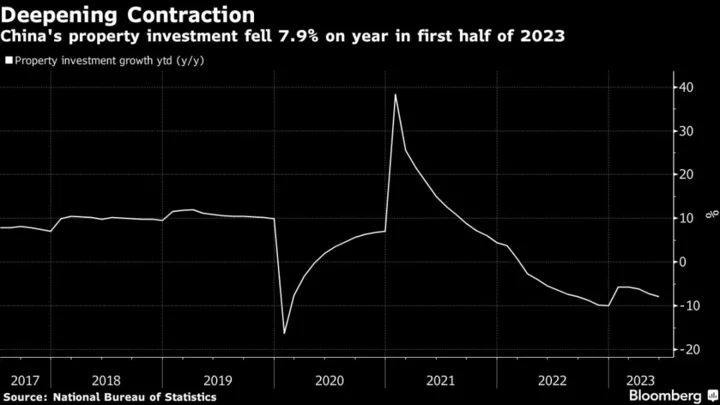

China’s property investment contracted at a steeper pace in the first half of the year, underlining the sector’s deepening downturn as policymakers pledge more support.

Investment in property development fell 7.9% in the first six months of 2023, compared with a 7.2% decline in January-May, data published Monday by the National Bureau of Statistics showed. Economists surveyed by Bloomberg had forecast a drop of 7.5%.

China’s real estate market has struggled recently after a brief first-quarter rebound. Home sales tumbled in June, snapping a four-month rebound. Housing prices dropped in the month for the first time this year.

The country’s two-year credit crisis among developers has shown no sign of easing. A defaulted builder recently failed to find a buyer for a heavily-discounted project, while fears have grown that even state-owned firms aren’t immune to the industry’s liquidity squeeze.

The property sector, including related industries, make up about a fifth of China’s gross domestic product. Investors see its turnaround as crucial to the recovery of the overall economy.

Slumping property investment was a main drag on GDP in the second quarter, which grew 6.3% from a year ago — weaker than economists’ forecast of a 7.1% expansion.

“Property is the key to resolving the various current problems,” said Jacqueline Rong, chief China economist at BNP Paribas SA, after Monday’s data release.

“The most urgent support needed for property is to stabilize the supply side,” she said. “Too many developers have been in trouble and there can’t be more large-scale defaults, otherwise housing development will come to a halt.”

The Communist Party’s Politburo — the top decision-making body led by President Xi Jinping — is expected to meet later this month to discuss economic policy. Rong called on policymakers to consider measures that would encourage commercial and policy lenders to offer new credit to developers, including support for their bond and equity financing.

“Only after developers are spared from the credit squeeze can they have resources to deliver on project construction and even acquire land for new projects,” she said.

Authorities last week extended loan relief to developers, and the People’s Bank of China has signaled that there may be more targeted support forthcoming — including what one central bank official called “tailored” policies for cities.

Goldman Sachs Group Inc. economists said the government may announce additional easing for the property market in the next few months — such as lowering the ratio for down payments or loosening purchasing curbs in top-tier cities.

“We believe the policy priority is to manage the multi-year slowdown rather than to engineer an upcycle,” economists including Yang Yuting wrote. “As such, we only assume an ‘L-shaped’ recovery in the property sector in coming years.”

(Updates with more details, BNP economist’s quotes.)