China plans to take a page from Singapore’s social housing model to help end a multi-year property slump that’s hammered the nation’s consumer confidence and weighed on economic growth.

Beijing has in recent weeks named two “big projects” as the center of its housing policy: building social housing and renovating run-down inner city districts. The projects have top-level political backing and could soon have 1 trillion yuan ($138 billion) or more of central government support behind them.

Authorities are considering offering cheap central bank loans to key state-owned policy banks to fund the projects, Bloomberg reported this week. The amount under discussion — which could be increased through further leverage and other funding — amounts to the equivalent of about 10% of annual new home sales.

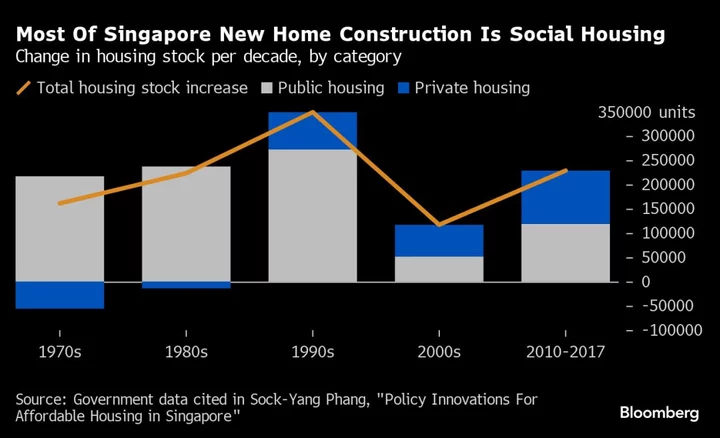

Singapore, while a mecca of private-sector business and financial activity, is renowned for a residential market that’s dominated by public housing. If China’s new plan works, officials might be able to both end a nearly three-year slump in property construction and meet President Xi Jinping’s aims to promote “common prosperity.”

“The plan is more of a longer-term structural adjustment in the property sector toward a Singaporean model,” said Betty Wang, senior economist at Australia & New Zealand Banking Group in Hong Kong. “I don’t think it’s just a short-term effort to boost property investment — instead, it’s about China’s 2035 common prosperity goals.”

Details of the social housing push are yet to be made fully public. China’s State Council handed instructions out last month in a classified “Document 14,” the Economic Observer newspaper reported. That called for a “new model” for the real estate sector, with 35 cities expected to test the program, according to the report.

What Bloomberg Intelligence Says ...

“The proposal is seen as China’s attempt at property reform, which could shift the balance between public versus private housing.”

— Kristy Hung and Lisa Zhou, real estate analysts

Click here to read the full report.

Analysts say the idea is to create a tightly regulated social housing market with limits on who can buy the homes and how they can be sold on to new owners. One way to ensure that would be to require them to be sold back to the government.

Alongside such a public housing market would be a freer commercial segment catering to wealthier households. That might even allow a return to speculation on property values — something Beijing has tried to clamp down on for years.

“We have argued that a reversal of the mantra of ‘houses are for living in, not for speculation’ would be a major positive for the economy,” Enodo Economics analysts wrote in a note this week. “Document 14 appears to suggest this may now be the case for the rich and the high-earners.”

Such a dual-market approach would allow “private housing to function as a store and generator of household wealth for the upper classes, while ensuring ample supply of affordable housing for those of more modest income,” they wrote.

Even China’s beleaguered developers may benefit: government money could be used to buy the housing projects that they can’t currently sell or are too cash-strapped to complete.

Document 14 called on cities with “a large inventory” of private housing to purchase or modify the unsold homes and turn them into public housing, according to local media reports.

But there are major obstacles to transforming China’s housing market. Previous government pushes to build social housing at scale have faltered on a lack of funding and corruption and private developers may remain too liquidity-strained to support a private market revival.

Meantime, big changes to a decades-old model for funding local governments would also be required. Reducing the role of private-sector housing would hurt the incomes of local governments that typically fund spending in part through land sales for private projects and taxes on commercial property sales.

Details of government funding for the projects are yet to be confirmed. Bloomberg reported the plan to use central bank funds has the backing of Vice Premier He Lifeng. That gives it serious weight: He is a close associate of Xi who was recently confirmed as the top official overseeing economic and financial policy.

Renovating urban villages in 35 cities could mean 150 million square meters of new housing started per year, Gavekal Dragonomics analyst Rosealea Yao said. That would help drive 10% growth in the area of newly-started property in 2024, reversing a 23% plunge so far this year.

Property developers could be hired to build the social projects, but their profit margins would be kept “moderate”, according to Chinese media reports. Returns could rise in the private segment of the market, where regulations to stop developers building too many luxury apartments could be dropped, according to Bloomberg Intelligence.

“If it works this time, the provision of affordable housing to lower-income Chinese would meet a central goal of Xi’s ‘common prosperity’ slogan,” Enodo economists wrote.