China’s economic recovery showed further signs of weakening in May, clouding the outlook for the rest of the year and fueling calls for more central bank stimulus.

While the majority of economists surveyed by Bloomberg still predict the People’s Bank of China will keep interest rates unchanged next week, a string of disappointing economic reports has led some analysts to call for stronger action.

Driving the speculation is also a move by China’s major banks including Bank of China and Industrial and Commercial Bank of China to drop their deposit rates. That would pave the way for them to lower lending rates while maintaining their profit margins.

“June is a key window of policy to stabilize economic growth,” Citic Securities Co. analysts led by Ming Ming wrote in a note. “That, combined with some recent activity and financial indicators as well as market sentiment, has led to a clear increase in the necessity for an interest rate cut.”

Citic expects the PBOC to reduce its one-year medium-term lending facility rate by 5-10 basis points on June 15, while Bloomberg Economics is predicting a 10 basis-point cut. Mizuho Securities Asia Ltd. and Nomura International (Hong Kong) Ltd. earlier this week forecast a 10 basis-point cut.

The government-linked Securities Times reported Thursday that the latest round of deposit rate cuts will enhance financial system stability by easing the profit margin pressure on banks, and “accumulate traction for a further decline in the loan prime rates.”

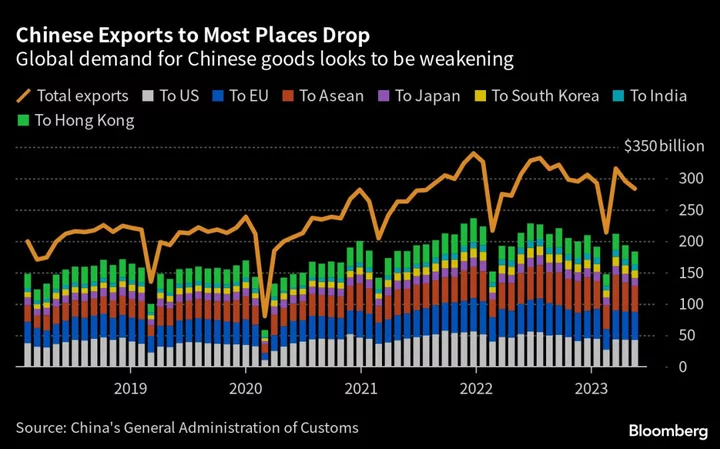

Trade figures on Wednesday were the latest to show the economy’s weakening outlook. Both exports and imports contracted in May from a year ago, a sign of subdued global and domestic demand. Data last week showed manufacturing activity contracted in May, while housing sales have slowed.

The move by China’s biggest state-owned banks to lower deposit rates would enable them to reduce lending rates while preserving their interest margins. The banks calculate their LPRs off the PBOC’s MLF rate, which is set every month. The loan rates have been kept unchanged since September, in line with the MLF rate.

What Bloomberg Economics Says...

China appears to be preparing to lower its policy rate as soon as next week. Authorities have asked big banks to trim their deposit rates, Bloomberg News reports. This would give them some room to reduce lending rates. We expect the People’s Bank of China to steer borrowing costs down with a cut in its one-year rate as soon as mid-June, followed by a reduction in the reserve requirement ratio in 3Q23 to free up more cash for banks to lend.

For the full report, click here

Chang Shu and David Qu

Lower deposit rates would also encourage consumers and businesses to spend rather than save. Recent data shows households are saving more and paying down their mortgages, rather than taking on more debt. Businesses are also unwilling to borrow because demand remains muted and their profits are falling.

Some economists argue that Beijing’s targeted support measures for sectors like property and manufacturing suggest broader stimulus steps, such as interest rate cuts, are off the table.

Some of those targeted steps include new support measures for the ailing housing market and tax breaks for high-end manufacturing companies, according to people familiar with the plans. The State Council, China’s cabinet, also pledged last week to extend tax exemptions on electric vehicle sales in order to spur spending.

“While economic data show the recovery is faltering, we do not think further policy easing will move the needle,” said Mitul Kotecha, head of emerging markets strategy at TD Securities. “We expect any monetary stimulus to be targeted” he said, adding there’s greater chance of a reduction in the reserve requirement ratio for banks than a cut to the MLF rate.

The government set a relatively conservative growth target of around 5% for the year — which most economists expect will be achieved even with the recent slump in activity — suggesting major stimulus steps aren’t necessary.

Ken Cheung, chief Asian FX strategist at Mizuho Bank, suggested the deposit rate cut was intended to improve profit margins for banks and any MLF rate cut would offset that effort as it will push lenders to lower their lending rates.

Rising US interest rates may also influence China’s decision to cut interest rates. The Federal Reserve has been raising its policy rate since March 2022, with chair Jerome Powell recently indicating officials aren’t yet done tightening, even though they want to take a break to assess the outlook.

The widening rate gap between the US and China has fueled weakness in the yuan, which is down 3.2% against the dollar this year, among the worst performers in Asia. The currency slid past the key level of 7 to the dollar last month.

--With assistance from Chester Yung.

(Updates with state media report on loan rates.)