China stepped in to support the yuan for a third time this week, once again signaling a limit to its tolerance for weakness in the currency.

The People’s Bank of China set its daily reference rate for the managed currency at a stronger-than-expected level, as it did on Monday and Tuesday. The so-called fixing came in at 7.2208 per dollar, 311 pips stronger than the average estimate in a Bloomberg survey and the largest premium since November.

“The PBOC may need to show its intention of moderating the pace of a yuan depreciation with another stronger fixing today,” after traders pushed the currency weaker despite the central bank signals earlier this week, said Kiyong Seong, a strategist at Societe Generale. “Sporadic stronger adjustment to the fixing will prevail for a while though.”

The yuan has come under increasing pressure against the dollar amid mounting evidence that China’s economic recovery will be slower than anticipated and any stimulus modest. The currency fell to its lowest since November this week and is down close to 5% this year.

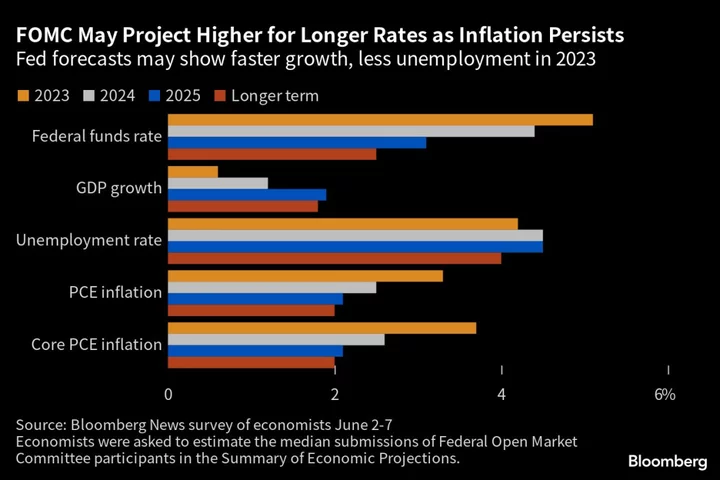

Policy divergence between the PBOC and developed-market central banks has also weighed, something highlighted again by hawkish comments from Federal Reserve Chair Jerome Powell on Wednesday. On top of the fixing, a few state-owned banks have also been active earlier in the week, selling dollars just before the yuan’s official close, according to traders.

The offshore yuan flipped to a gain of 0.1% at 7.2379 per dollar after the release. The daily fixing limits the onshore yuan’s moves by 2% on either side.

The current level of the yuan is making the PBOC uncomfortable, and the central bank may take more actions to guide market expectations, said Hong Hao, chief economist at Grow Investment Group. The currency will weaken to 7.3 within the next two months, he added.

--With assistance from Iris Ouyang.