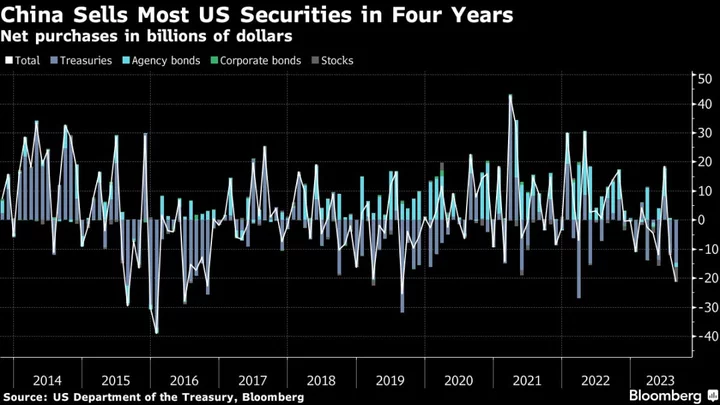

Chinese investors offloaded the most US bonds and stocks in four years in August, fueling speculation the authorities may have moved to beef up their war chest to defend a weakening yuan.

The bulk of the $21.2 billion of sales were in Treasuries and US equities, with funds in the Asian nation also cutting holdings of agency debt, according to data from the US Department of the Treasury released on Wednesday. In August, the onshore yuan tumbled to its lowest against the dollar since November, prompting Beijing to tell state-owned banks to step up intervention in the currency market.

“This could be to liquidate some bond holdings to obtain US dollar cash in case it is needed later to defend the yuan via intervention operations,” said Gareth Berry, a currency and rates strategist at Macquarie Group Ltd. in Singapore. “The same reason may go for why they sold stocks.”

Chinese investors sold a record $5.1 billion of US stocks in August, the data showed.

While Chinese funds have been selling down holdings in Treasuries this year, they had been buying more or less equivalent amounts of US agency bonds. As such, the net sale of both types of bonds in August will raise eyebrows for investors tracking demand for US debt.

US bonds have sold off heavily again this year, as stronger-than-expected labor and inflation data have triggered a hawkish response from Federal Reserve officials. A Bloomberg index of Treasuries is heading for a sixth straight month of losses, while US 2-year yields surged to the highest since 2006 this week.

China’s Falling Treasuries Holdings Mask Rotation to Agency Debt

Japanese investors have also been paring their holdings of US securities, with sales of corporate bonds hitting a record.

“I suspect that Japan investors bought US corporate bonds over the past two years to obtain a yield pick-up over Treasuries,” said Macquarie’s Berry. “Now that Treasury yields have risen so much, they can feel more comfortable rotating back the other way.”

--With assistance from Marcus Wong and Wenjin Lv.

(Updates throughout)