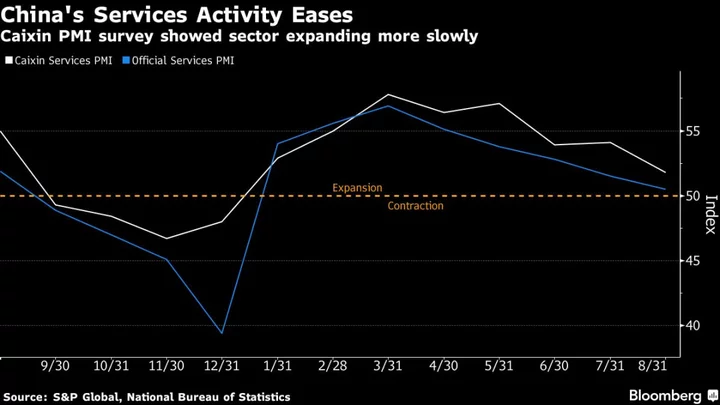

A private survey of China’s services sector showed activity expanded at the slowest rate this year in August, adding to concerns about whether a major engine for the economic recovery this year is losing traction.

The Caixin services purchasing managers’ index fell to 51.8 last month from 54.1 in July, Caixin and S&P Global said in a statement Tuesday. While the reading is still above the 50 line that separates expansion from contraction, it was the weakest pace since December.

The dropoff was mainly because of a softer increase in overall new work, with new business from abroad falling for the first time this year, according to a statement accompanying the survey.

A gauge of Chinese stocks in Hong Kong extended losses to as much as 1.4% after the data release, while a drop in CSI 300 Index deepened to 0.6% as of 9:55 a.m. local time.

The data came after official PMIs last week showed services activity easing significantly last month: the sub-index’s 50.5 reading was the weakest since December. The Caixin survey focuses on smaller firms compared to the official PMI, with the latter also having a larger sample size.

China’s economic recovery remains precarious. Recent surveys have showed some improvement for factories, triggering cautious optimism that government policies to support the manufacturing sector are taking root and helping those firms find a bottom to their slump.

But other indicators — including the official services data — show the recovery has not yet reached a turning point. The property downturn and subdued consumer spending continue to be drags.

--With assistance from Zhu Lin.