China is setting out how it will prevent bottlenecks as it prepares for another record year of renewable power installations.

In recent weeks, national and local governments have announced a slew of proposals to prevent blackouts, support energy storage, bolster grid operator finances and create more flexible pricing. The payoff could be a more efficient power system that can absorb a bigger share of clean energy, according to BOCI Research Ltd.

Most residents and businesses in China pay electricity rates tied to government-set benchmarks, counter to the arguably more robust free market models that prevail in Europe and the US. But the latest moves are still important, if small, steps in the reforms that China has been discussing for over two decades, as it aims to build an integrated power trading market by 2025 that will let supply and demand play a bigger role in setting prices.

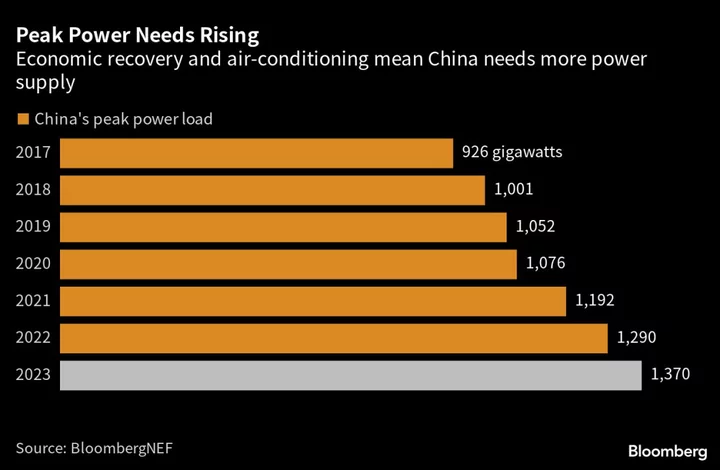

One of the problems plaguing China’s power system is that more instances of extreme heat and rising air-conditioning use are driving a surge in peak demand. The government has offered several responses, including a massive expansion of new coal-fired power plants, even though it knows they may only be operating at partial capacity.

Beijing is also working on the other side of the equation. Known as demand response, the idea is to find users who can quickly turn off the lights when demand is rising, saving electricity for others, usually in return for lower rates or other benefits.

The National Development and Reform Commission, China’s top planning agency, asked local governments last month to establish demand response plans that cover at least 3% to 5% of peak use, and more if the swings between peak and trough are particularly large. The city of Chongqing recently proposed a pricing model that would let residents pay less for electricity when demand is low and more during peak hours.

It won’t be cheap for China to reach its eventual goal of a post-carbon society. BloombergNEF estimates that spending will need to average $136 billion a year through 2050 to reach net zero emissions by then, compared with a $75 billion outlay last year. Power grid investment alone will cost $3.8 trillion by 2050 — or $2.5 trillion under a less policy-driven transition that puts economics first.

To that end, the government may be trying to help out its two massive state-owned utilities, State Grid Corp. of China and China Southern Grid Co. On May 15, the NDRC amended power transmission and distribution fees to allow grids to pass through certain costs for the first time. The change should help the operators boost revenue and be able to afford more investments in grid upgrades, analyst Tony Fei said in BOCI’s report.

Energy Storage

The NDRC has also set a fixed fee on capacity for 56 gigawatts of pumped hydropower energy storage projects that will take effect June 1. The charges are meant to keep the projects profitable even when they’re not being used, which could boost investor confidence and accelerate construction, according to BloombergNEF.

While energy storage is viewed as necessary to help balance out intermittent wind and solar generation, much of China’s current fleet of batteries paired with renewables projects is underutilized, operating on average only 6% of the time in 2021. That’s because power markets aren’t established in most places, so there’s no price signal for storage projects to buy when there’s excess power and sell when demand is high.

Some areas are experimenting with changing that. A pilot project in solar-rich Shandong province allows power prices to go negative, theoretically incentivizing energy storage projects to get paid to buy electricity.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Monday, June 5

- Caixin’s China services & composite PMIs, 09:45

Tuesday, June 6

- Nothing major scheduled

Wednesday, June 7

- China’s 1st batch of May trade data, including steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports. ~11:00

- China’s foreign reserves for May, including gold

- CCTD’s weekly online briefing on Chinese coal, 15:00

- Chongqing exchange hosts oil & gas summit, day 1

Thursday, June 8

- Chongqing exchange hosts oil & gas summit, day 2

Friday, June 9

- China’s inflation data for May, 09:30

- China to release May aggregate financing & money supply by June 15

- China’s monthly CASDE crop supply-demand report

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Chongqing exchange hosts oil & gas summit, day 3

On the Wire

Thermal coal stockpiles at China’s ports are at the highest levels since April 2020 as companies import the power-plant fuel to meet summer demand.