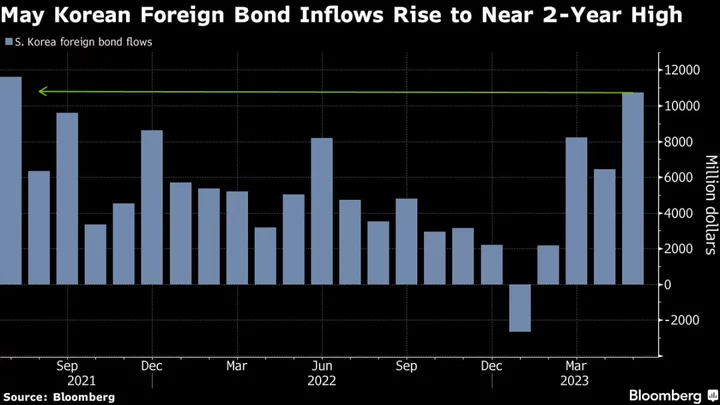

Foreigners bought the most South Korean bonds in two years as wagers on the central bank turning dovish increased with a deteriorating economic outlook for its largest trading partner.

Global funds bought $11 billion of Korean debt in May, the most since July 2021, according to data compiled by Bloomberg. Favorable won currency swaps, which boost returns for foreigners, are also supporting the notes.

A spate of weak data from China is leading to concerns of slowing growth for Asia’s biggest economy, and its knock-on impact on nations including South Korea. The Bank of Korea has already halted interest-rate increases, with analysts predicting a cut later this year as the country narrowly skirted a recession in the first quarter.

“With no definite signs of China’s PMI rebounding, Korean exports to the country are expected to remain weighed,” said Paik Yoon-min, fixed-income analyst at Kyobo Securities. “The dominant view is that Korea’s growth recovery will be delayed, and that’s likely driving demand for Korean bonds.”

China’s economic recovery weakened in May, raising fresh fears about the growth outlook. Manufacturing activity contracted at a worse pace than in April, while services expansion eased, official data showed Wednesday, suggesting the post-Covid rebound had lost momentum.

Korean six-month one-day swaps fell as much as 17 basis points in May as dovish bets rose for the BOK, although they pared some losses in recent days.

Dollar-based investors in Korean bonds also continue to benefit from favorable cross-currency basis swaps. By offering their in-demand greenback for the won, they earn an extra 80 basis points on their investments, increasing the returns on a five-year sovereign note to 4.8%. That compares with the average yield of around 3.60% for a similar-maturity Treasury in May.

“There could be more foreign inflows,” said Kiyong Seong, lead Asia macro strategist at Societe Generale Hong Kong Branch. “At this juncture, higher Korea rates and an apparent central bank pivot may also look attractive to investors, though we believe this could be a temporary trend,” he added.