Chinese tech stocks are in a funk and even upbeat sales figures from the industry’s bellwethers can’t revive them.

Shares of Tencent Holdings Ltd. have fallen more than 2.5% in Hong Kong since China’s most valuable company announced its fastest revenue growth in over a year on Wednesday. Similarly, the nation’s Internet search leader Baidu Inc. has declined over 2% following a stronger-than-expected sales report on Tuesday.

The Hang Seng Tech Index has dropped more than 7% this year to trail the Nasdaq 100 gauge which is up over 26%, reflecting the broader malaise that’s afflicting Chinese equities. A slowing economic recovery with few signs of policy support and Beijing’s rift with Washington are undermining sentiment toward China’s assets.

“I don’t really see much upside in the short term,” said Dickie Wong, executive director of research at Kingston Securities Ltd. “On the earnings front, JD.com and Baidu actually beat my expectation while Tencent and Alibaba are in line. But with a weaker yuan, geopolitical risks from the upcoming G-7 meeting and unresolved auditing issues, the market is more likely to remain in range bound trading.”

Chinese tech stocks have succumbed to the pull of gravity after investors’ hopes for a swift rebound in growth failed to materialize. Official data released this week showed China’s industrial output, retail sales and fixed investment grew at a much slower pace than expected in April.

As a result, traders have been focusing more on bad news of late.

Case in point: Alibaba Group Holding Ltd. slumped as much as 5.9% in Hong Kong on Friday as traders zeroed in on the firm’s weak sales growth even after the company laid out IPO plans for its logistics and grocery arms to unlock the group’s long-term value.

During this earnings season, all the industry bellwethers seemed to have gotten a lid on costs — the new fixation for markets as once-phenomenal growth evaporated at the tail-end of the pandemic years. Investors are expecting more of the same when Kuaishou Technology and Xiaomi Corp. report next week.

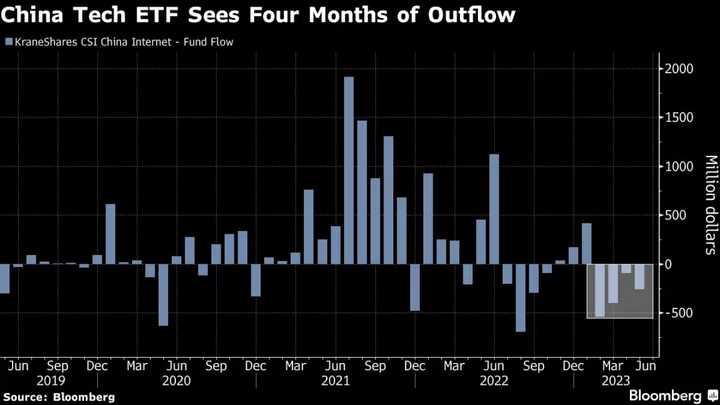

But that may not be enough to reverse the negative sentiment. Investors have pulled $256 million from the KraneShares CSI China Internet ETF this month, putting the vehicle on track for a fourth month of outflows, according to data compiled by Bloomberg.

Given all the uncertainties, tech shares are likely to remain in the doldrums for now.

“The results of Baidu, JD and Tencent have lifted the bar for people’s expectation on the net profit side,” said Willer Chen, a senior research analyst at Forsyth Barr Asia Ltd. For tech companies reporting next week, investors are expecting topline growth to be “pretty tepid” while they wait for the guidance, he added.

--With assistance from Edwin Chan and Jeanny Yu.