China’s economic activity likely improved in August, adding to a steady drip of clues that suggest the worst of this year’s downturn may be starting to pass.

The peak summer holiday season drove a boom in spending on travel and hotels, keeping one of the few bright spots for the economy humming. Manufacturers reported an expansion in new orders for the first time in five months. A rush to sell more special local bonds to fund infrastructure projects aided construction at a time when activity is otherwise being challenged by the ongoing real estate slump.

Official data due Friday will provide the most comprehensive view yet of whether the economy is close to a turnaround. Figures for retail sales and industrial production are expected to show year-on-year growth in August outstripping the previous month’s pace, while real estate may have remained a significant overhang.

The National Bureau of Statistics is expected to release August economic data Friday at 10 a.m. local time. Here’s what to watch:

Improved Production

Industrial output is projected to have grown 3.9% last month from a year ago, according to economists surveyed by Bloomberg, faster than July’s increase.

Recent data suggested the nation’s manufacturers are through the worst of their struggles. An official gauge of the sector in August edged closer to the 50 mark that would signal activity has stopped contracting. New orders placed at factories expanded for the first time since March. Meanwhile, the decline in China’s exports narrowed in a sign overseas demand may be stabilizing.

Beijing’s policies have become “visibly more supportive” in the last month following a July meeting of the ruling Communist Party’s top officials, wrote Macquarie Group Ltd. economists including Larry Hu in a Monday note. Those measures have included attempts to bolster specific sectors, including consumer goods manufacturing.

Summer Spending

Economists see retail sales growth accelerating to 3% in August from the prior year, above July’s pickup of 2.5%.

That’s likely the result of a busy summer travel season. Flights in China jumped 13.7% last month as compared to a similar time frame before the pandemic, according to VariFlight, an online platform tracking flight data.

Government measures to spur spending on cars also seem to be taking hold. Sales of passenger vehicles grew in August from a year earlier, the first increase in three months.

Consumers have been spending more on services, like travel and eating out, than household goods, although there are signs that growth is now moderating.

The urban unemployment rate also likely remained relatively high at 5.3% in August, and while consumer prices rose last month — reversing the deflation seen in July — they just barely did so, suggesting demand remains weak.

“With much of the pent-up travel demand released in the summer, we believe the economy might face new headwinds and has yet to stabilize,” Nomura Holdings Inc. economists led by Lu Ting wrote in a note this week. “Beijing may need to introduce more aggressive easing measures to ensure a real recovery.”

Investment Woes

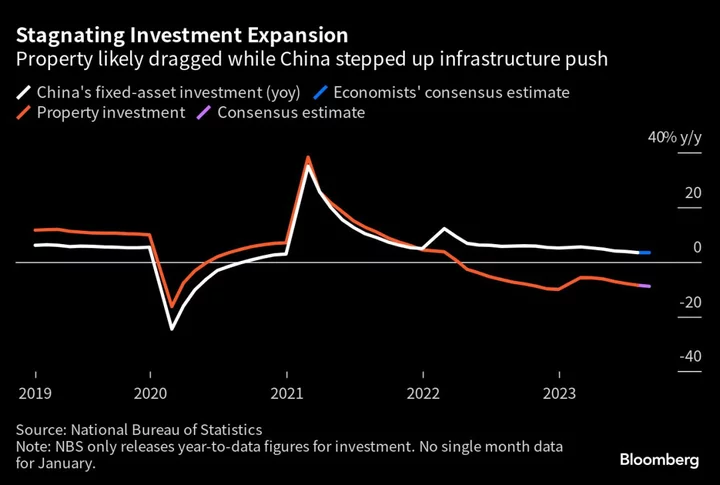

Fixed-asset investment likely expanded 3.3% through the first eight months of the year, slowing slightly from the 3.4% growth rate seen in January-to-July.

The figures probably got some help from infrastructure, as Chinese provinces ramped up the sale of special local bonds to fund such projects and boost economic activity. Beijing is giving those regional governments until the end of September to issue their remaining bond quota for the year.

Even so, the real estate sector’s woes still loom. Property investment likely shrank 8.9% in the January-to-August period, deepening from the 8.5% slump in the first seven months of 2023.

China eased property policies at the end of last month by cutting some mortgage rates and lowering down payment ratios for homebuyers, but consumers are still cautious. A spurt of home sales in big cities recorded immediately after those measures has since lost traction.

Holding Steady

Several economists see the need for the government to continue supporting the economy in the coming months if they hope to build momentum for the recovery.

Big actions probably won’t materialize on Friday, though, as policymakers wait to see how effective recent measures have been. The People’s Bank of China is expected to keep policy rates unchanged following last month’s surprise cut to the rate on the one-year policy loans, called the medium-term lending facility. The central bank has never adjusted that rate two months in a row since it began publishing it regularly in 2016.

To keep liquidity stable, the PBOC will likely roll over the 400 billion yuan ($54.9 billion) worth of maturing one-year policy loans and inject slightly more cash into the banking system.

There’s also room for more support on the fiscal side. Last year, authorities allowed for additional sales of special local bonds, a step they could repeat. Issuing an extra 500 billion yuan worth of bonds alongside what’s already budgeted could boost growth by 1.2 percentage points in the second half of the year, Bloomberg Economics estimates.

What Bloomberg Economics Says...

“In the broader picture, the fiscal boost will complement the stepped-up monetary stimulus in the form of policy rate cuts and lower mortgage rates. This should give a much-needed boost to sentiment, a critical element for any robust recovery. Shifting spending from infrastructure to more direct support for vulnerable households and small private firms could also provide a powerful boost to confidence.”

— Chang Shu and David Qu, economists

Read the full report here.

“Policymakers aren’t panicking over the state of the economy and are prepared for a drawn-out ‘tortuous’ recovery,” wrote Pantheon Macroeconomics Ltd. economists including Duncan Wrigley in a Monday note. “This means the policy approach will continue to be reactive and calibrated toward attaining a modest ‘about 5%’ GDP growth target.”

--With assistance from Yujing Liu and Ocean Hou.