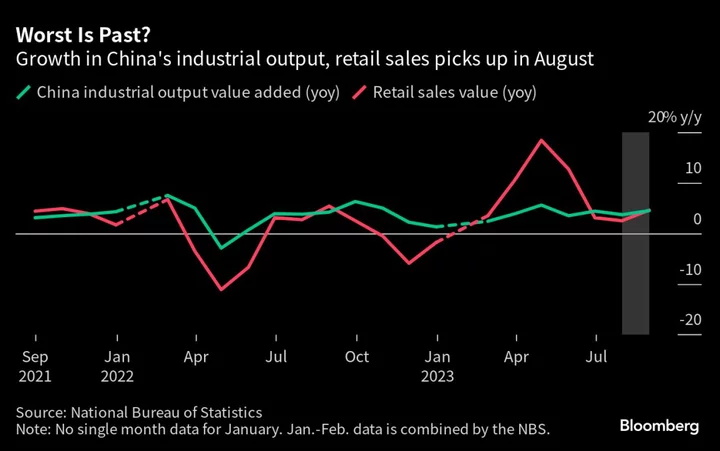

China’s economic activity gathered pace in August amid a summer travel boom and in the wake of a stimulus push, adding to cautious optimism that the worst of the downturn is passing.

Industrial production rose 4.5% from a year earlier while retail sales jumped 4.6%, the National Bureau of Statistics said Friday. Both figures significantly exceeded economists’ estimates and were above the gains recorded in July.

Fixed-asset investment grew 3.2% in the first eight months of the year from the same period in 2022, slower than in the January-to-July period as the property sector remained a drag. The urban jobless rate was 5.2% in August, slightly lower than the previous month.

“The main indicators marginally improved in August and the economy recovered,” the NBS said in a statement accompanying the data. “But we also need to see that there are still a lot of uncertainties and instabilities externally, and the domestic demand still appears insufficient.”

China has been trying to push past the worst of an economic slowdown this summer, with the government in recent weeks beefing up pro-growth measures. Authorities have unveiled plans to spur more spending on home goods, expedited the sale of bonds to fund infrastructure projects and eased curbs on home purchases in big cities.

The People’s Bank of China on Friday cut the amount of cash lenders must keep in reserve for the second time this year, in part to beef up the ability for banks to buy bonds and support government spending.

The PBOC also injected a net 191 billion yuan ($26.2 billion) via the medium-term lending facility into the interbank market on Friday while keeping the rate unchanged. The central bank is providing more short-term liquidity to meet demand for cash in the lead up to the nation’s Golden Week holiday starting later this month.

There have been other signs that some parts of the economy are stabilizing. Earlier indicators showed manufacturing inching toward expansion last month, while credit demand recovered and deflationary pressures eased slightly.

Still, an economic turnaround may take time given weak consumer confidence and a persistent real estate slump. Property investment slid 8.8% in the January-to-August period — deeper than the drop through the first seven months of the year.

Home sales in big cities surged after the government last month announced cuts to rates on existing mortgages and down payment ratios, but that bump quickly faded. Home prices dropped at a faster pace in August than in July, too.

And while consumers have been spending on services like travel and eating out, there is doubt about the sustainability of that spending. The job market outlook is also gloomy, adding to strains.