China’s manufacturing activity contracted for a second straight month in May, providing more evidence the post-Covid recovery in the world’s second-largest economy has slowed.

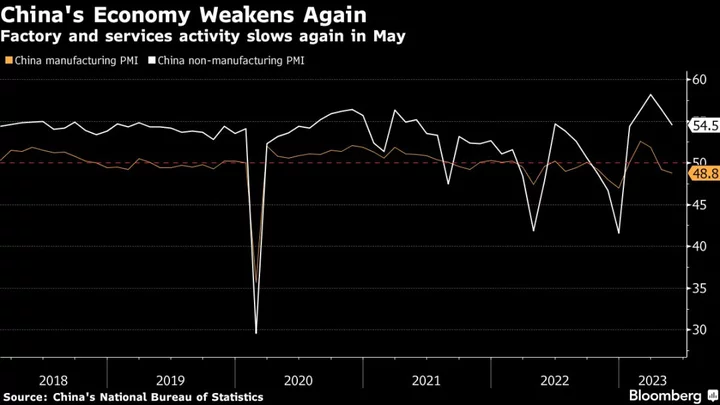

The official manufacturing purchasing managers’ index fell to 48.8, the lowest reading since December 2022, the National Bureau of Statistics said Wednesday. The figure was lower than the median estimate of 49.5 in a Bloomberg survey of economists. A reading below 50 signals contraction from the previous month and anything above that points to expansion.

A non-manufacturing gauge of activity in the services and construction sectors slid to 54.5 from 56.4 in the previous month, also weaker than expected.

The PMI figures confirm the economy’s recovery cooled in the second quarter after a burst of consumer activity early in the year. Exports remain weak, a rebound in the property market has faded and the government has slowed spending on infrastructure. Businesses are also being hit by falling profits and heightened tensions with the US and its allies.

Investors have dumped Chinese stocks as the growth outlook waned, with an index of shares traded in Hong Kong down about 20% since its Jan. 27 peak.

Economists have trimmed their growth forecasts for the year to 5.5%, which is higher than the government’s fairly conservative target of around 5%. While many expect the central bank could still ease policy this year — including cutting the reserve requirement ratio for banks or reducing interest rates — it’s unlikely to take major stimulus steps.

Beijing is likely to take targeted steps to boost the economy. Officials are considering new tax incentives worth hundreds of billions of yuan for high-end manufacturing companies, according to a person familiar with the discussions.