China’s strong third-quarter economic figures appear to have gotten a lift from official revisions and price adjustments, stirring skepticism among economists about just how strong the data really was.

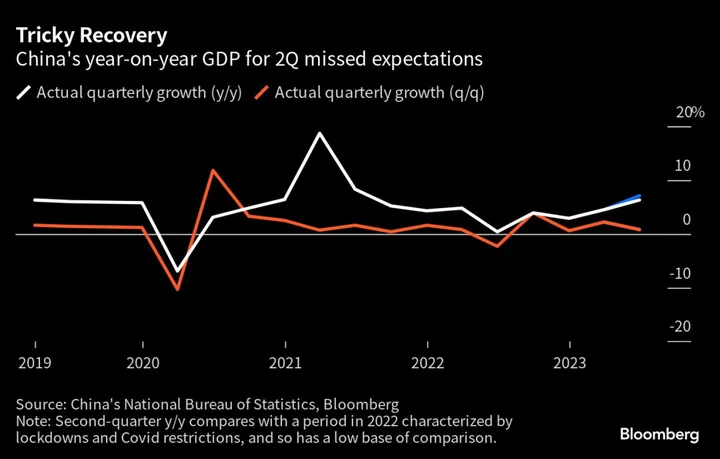

Both on-year and on-quarter growth rates for the July-to-September period significantly exceeded market expectations, leaving little doubt that the world’s second-largest economy is on track to hit an official growth target of about 5% for 2023. While other indicators in recent weeks have also shown greenshoots for the recovery, some economists stressed the new data should be met with caution.

“It now suddenly seems to be very easy for China to meet its 5% growth target for this year,” said Louis Kuijs, chief economist for Asia Pacific at S&P Global Ratings. “I need to make a caveat to that — there are some issues with the data.”

Kuijs pointed to concerns about how authorities estimate price deflation in the industrial sector. The government calculates those numbers by adopting figures from the producer price index — a method he called “very problematic at times like this.”

China’s factory-gate prices fell 3.1% on average in the first nine months of 2023 compared to last year, according to the National Bureau of Statistics. The statistics bureau doesn’t provide a number for the third quarter alone, though. Kuijs estimated the drop in the last three months was likely 3.3%.

‘Significant Overstatement’

“When the PPI falls, they are basically overstating real growth,” he said. “That’s quite a significant overstatement.”

Kuijs noted a discrepancy in nominal versus real growth in the industrial sector as well: While year on-year nominal value-added growth reached just 1.2%, real growth was much stronger at 4.6%, according to NBS data. The industrial sector makes up almost 40% of China’s overall GDP, he added.

A stabilization in year-on-year industrial output growth last month, meanwhile, “appears at odds” with a slowdown in the gauge’s month-on-month growth, Nomura Holdings Inc. economists led by Lu Ting in a Wednesday note. They compared the 4.5% on-year increase — the same as August — with slowing on-month growth rates, as well as declining on-month momentum as compared to September 2022.

Many countries — including the US — regularly revise historic GDP data, which sometimes leads to large changes. But the frequency of revisions by Chinese statistics agencies has drawn increasing attention over the last year.

In August, China downgraded the overall value of exports for 2022 and early this year, including its biggest single-month revision on record, which boosts trade data for the remainder of this year.

One eye-popping beat in the most recent set of figures from the NBS came in the growth rate as compared to the second quarter.

GDP in the three months ended September increased 1.3% compared to the April-to-June period, much higher than economists’ estimates of 0.9%. The on-quarter figure for the prior period, though, was revised down to 0.5% from the 0.8% pickup reported in July by the NBS, which also made revisions to several other prior quarters.

“When you read the rather strong third-quarter figures, you need to read them against the backdrop that the previous quarter’s growth rate is revised down,” said Miao Ouyang, greater China economist at BofA Global Research.

The NBS revisions also prompted Goldman Sachs Group Inc. economists to downgrade their projections for China’s 2023 growth to 5.3% from 5.4%, as each quarter has a different weighting in the calculation of full-year GDP.

The NBS did not immediately respond to a faxed request for comment about the revisions and price adjustments.

“Yes, the third quarter was probably better than the second quarter,” Kuijs from S&P Global Ratings said. “But we need to take into account that whenever people feel that the economy doesn’t feel as strong as the data, this is actually one of the key reasons.”

--With assistance from Tom Hancock.

(Updates with more context from Nomura economists.)